- U.S. IPO market reopens after the worst of the pandemic, before the elections of the uncertainty

- Number of Ipos to price in 2020, a decrease of 34% from the same period last year

- Warner Music Group is the largest IPO so far in 2020

Yesterday shares in Vancouver, Washington, ZoomInfo Technologies (not to be confused with the video conferencing platform) has increased more than 60% on their first day of trading on the Nasdaq index. The first tech IPO since the COVID-19 epidemic has been a resounding success with the firm collecting $ 934 million dollars. It is almost the double of what he was in search of stimulus in November, when he first announced plans. The company has priced its ipo at $21, above its $19 to $20 target range, and shares closed at$34.

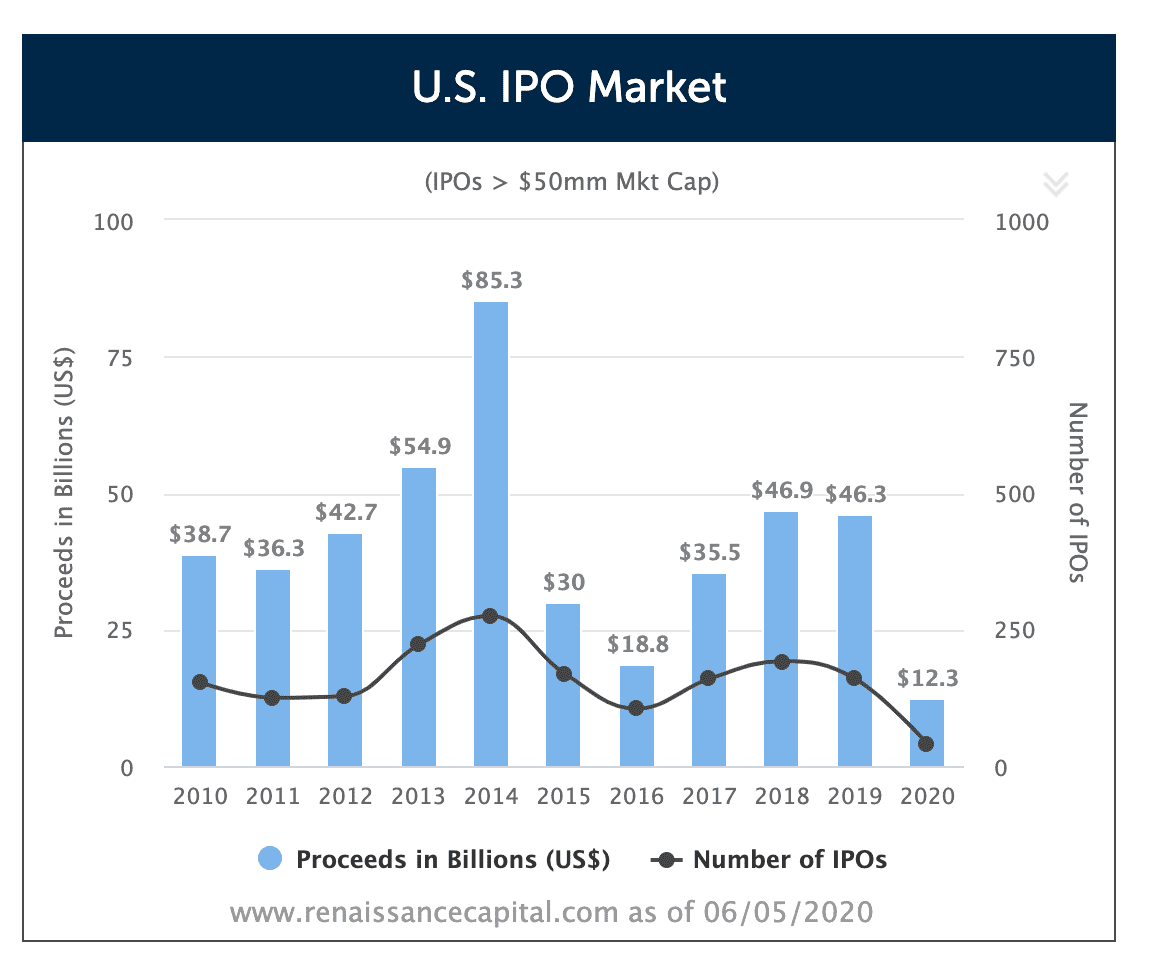

On Thursday, there were 40 Ipos in price (more than $ 50 million of market capitalization) in the UNITED states this year, according to Renaissance Capital. It is 34% lower than the same date last year. The Total funds raised are $ 12.3 billion, half of what it was last year at this time. (see the chart below), The pandemic has derailed many companies ‘ plans to make public the approach of the election, the uncertainty that is expected later this year.

Source: Renaissance Capital.

We are not yet rid of the new coronavirus, the UNITED states is to see widespread unrest, and unemployment is on the rise, but investors are still hungry for yield. We have seen the huge demand for the professionals of the debt after the Fed announced its stimulus measures in mid-March. This week, we are also witnesses of the UNITED states of the initial public offering market recover in a big way. Newly public U.S. listed companies, such as Uber, Spotify, Soft, Video Zoom, and Moderna, are also beating the broader market this year. The POPE of the Renaissance of the Index is up nearly 25% this year.

“You are going to see a wave of ipos on the market that are larger rather than smaller due to the volatility of the markets, investors want more liquidity. This is not a market where the marginal, the smaller of the IPO will be done,” said Neil Kell, president of global capital markets for Bank of America, according to the Financial Times report.

Earlier this week, Warner Music Group, which has delayed its plans in March, the price of its ipo to$ 25. It was at the upper end of the target range, and shares rose 8% in their debut after the company raised $1.9 billion. Electric truck maker Nikola debut yesterday just made his 38-year-old founder a multibillionaire. Today Shift4 Payments begin trading on the NYSE, after having priced its ipo at $23 per share, above its range and raised $345 million dollars. Remote health care service provider Amwell, which has seen virtual tours increase of 1000% since the beginning of the crisis, has filed confidentially to go public, according to CNBC. Online used-car seller Vroom, who is yet to make profits, said on Tuesday that it is seeking to raise up to $ 318.8 million in the next week.

Even some Chinese companies are eager to get in on the action despite signs that the UNITED states is the tightening of the rules of audit. Walmart & JD.com backed online grocery firm of Dada Nexus will make its stock market debut today. Bloomberg reports, he has raised $336 million and sold 21 million shares, more than he had originally planned, at $16 each.

Source: investopedia.com