Key takeaways

- Morgan Stanley posted record wealth management revenues and beat earnings and sales estimates.

- The bank benefited from higher interest rates as the Federal Reserve raised rates to fight inflation.

- Profits were driven down by severance pay for layoffs.

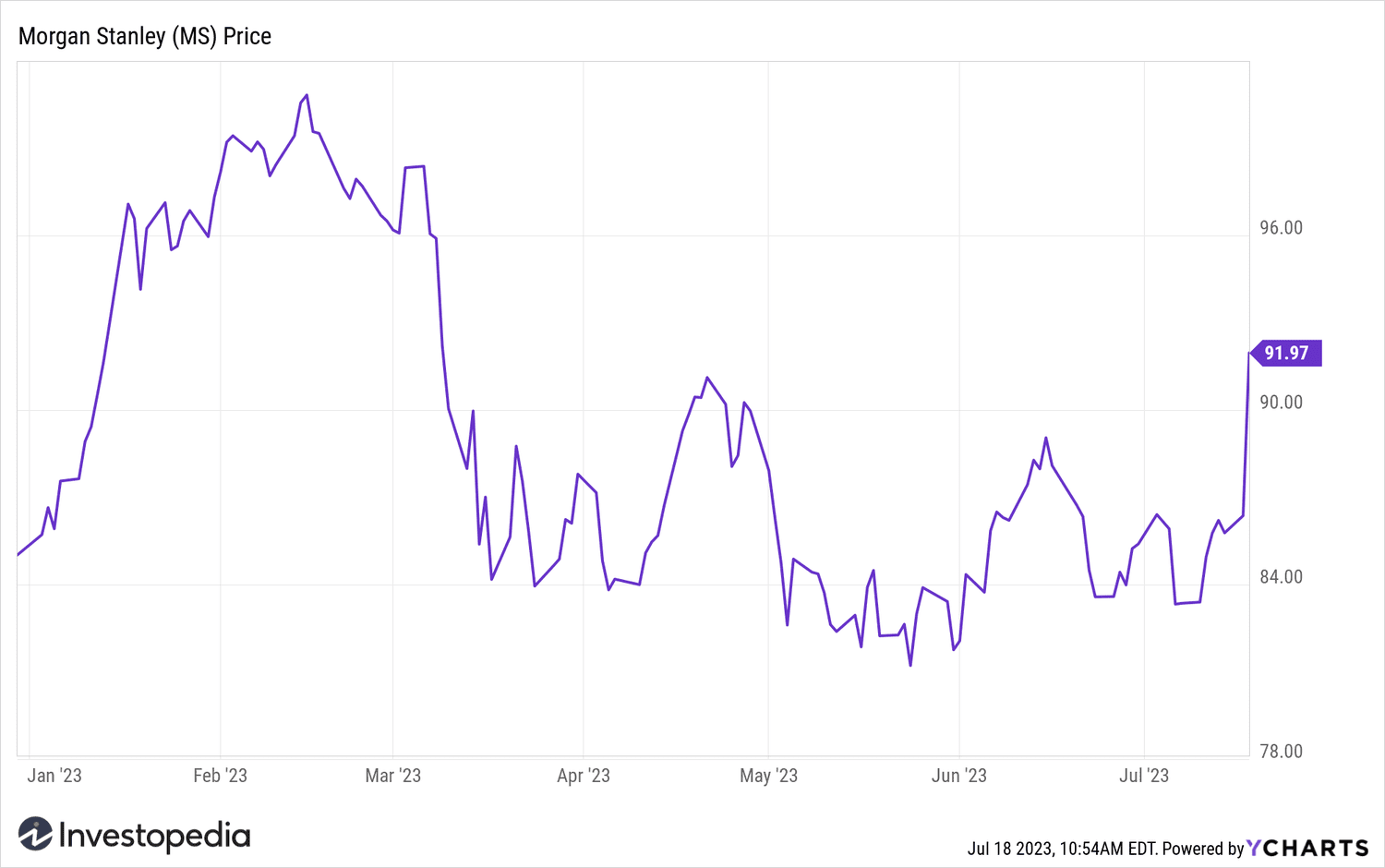

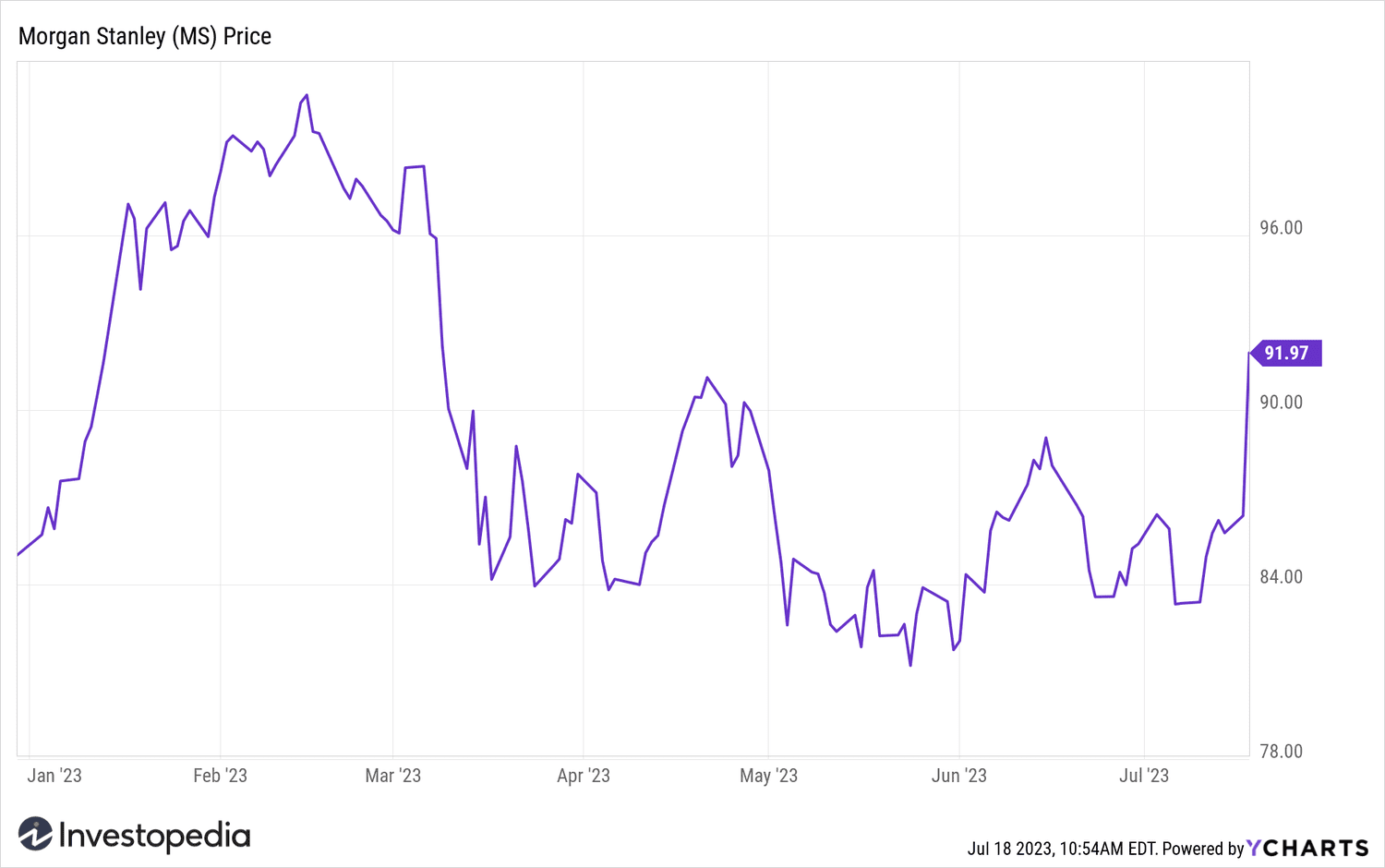

Morgan Stanley (MS) posted a 13% drop in profits due to lower trading volumes, but record wealth management revenue helped the bank post better-than-expected results. Shares soared more than 6% on Tuesday following the news.

Morgan Stanley said second-quarter earnings fell to $2.18 billion, or $1.24 per share. Earnings were impacted by a $308 million charge to pay severance benefits to some 3,000 employees laid off during the period. Sales rose 2.5% to $13.46 billion. Earnings per share (EPS) and sales were above analysts' estimates.

Wealth management revenue jumped 16% to $6.66 billion. The bank benefited from higher interest rates as the Federal Reserve raised rates to fight inflation. Net interest income jumped 23% to $2.16 billion. Transactional sales more than tripled from a year earlier to $869 million. In contrast, asset management revenues declined.

Investment banking revenue was little changed. Fixed income net income fell 31% and equity net income fell 14%.

CEO James Gorman said that Morgan Stanley “delivered strong results in a challenging market environment”. He said the quarter started with “macroeconomic uncertainties and subdued client activity” but ended on what he called a “more constructive tone.”

Morgan Stanley shares are were trading at four-month highs in the morning session.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com