Takeaways

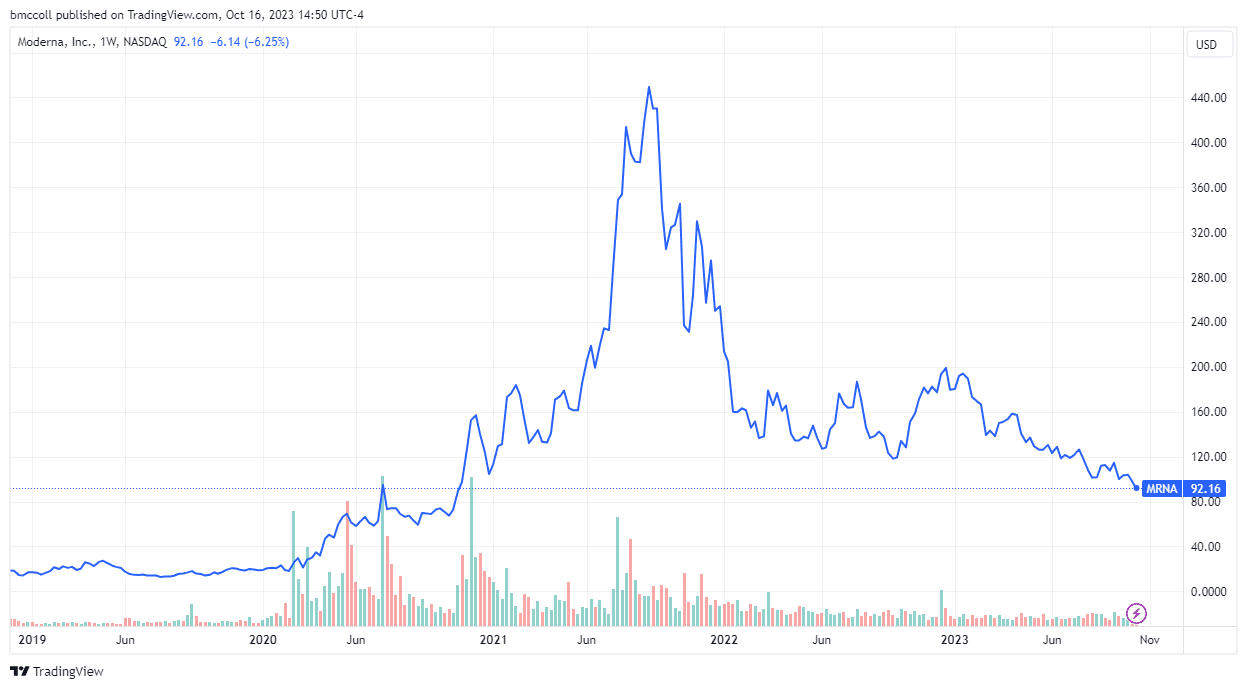

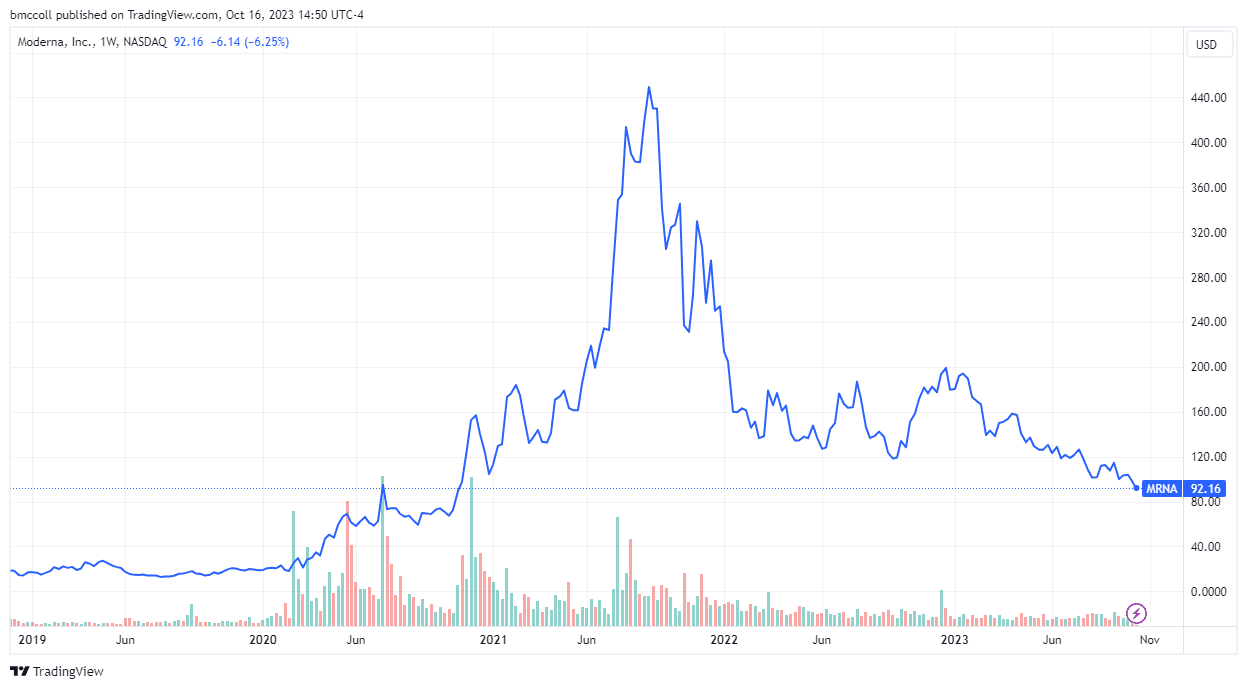

- Moderna shares fell to their lowest level in almost three years as the biotech company reiterated its full-year forecast but warned it could not yet predict vaccine demand against COVID-19.

- Moderna said it is too early in the U.S. vaccination season to determine what demand for the vaccines will be.

- The update came after rival Pfizer cut its outlook due to lack of demand for COVID-19 products.

Moderna (MRNA) was the worst performing stock in the S&P 500 on Monday, as shares lost more than 6% after the biotech company said it “remains comfortable” with its guidance for the full year, but cautioned that it could not yet predict exact demand for its COVID-19 vaccines. The comments come after rival Pfizer (PFE) cut its full-year outlook “solely because of COVID products.”

Moderna said in a regulatory filing that it expects sales of between $6 billion and $8 billion for 2023, reiterating what it announced in releasing its second-quarter results in august. The company previously estimated that if the U.S. vaccine market is about 50 million doses, it should be in the lower half of that revenue range, and if that number grows to 100 million doses, it should be in the lower half. upper half.

Moderna explained that it is “still too early in the U.S. vaccination season to accurately predict where vaccination rates will reach for the full year.”

The Company expects that ;it “improved visibility on the expected size of the US market” at the end of the month, and will provide an update during its earnings conference call on November 2.

Moderna shares fell to their lowest level in almost three years after the news. Pfizer shares, however, rose after Jefferies upgraded the stock, identifying it as an opportunity.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com