Takeaways

- Domino's Pizza Inc. reported weaker-than-expected third-quarter revenue as customers fed up with inflation gave up ordering pizza.

- Sales of non-franchise Domino's American restaurants fell further. by 23% from last year, to $86.3 million.

- Despite the lack of revenue, Domino's net profit jumped 47% to 147 .7 million and beat consensus estimates by nearly 27%.

- U.S. consumers have cut back on discretionary spending this year amid persistently high inflation, turning to cheaper options and home-cooked meals.

Despite higher profits, Domino's Pizza Inc. (DPZ) reported weaker-than-expected revenue for its third quarter as inflation-weary consumers gave up ordering pizza.

The pizza chain reported revenue of $1.03 billion, down nearly 4% from last year, driven by lower same-store sales in the United States. -United States and supply chain revenues, derived from the sale of ingredients for making pizzas to its franchisees. Sales at company-owned U.S. restaurants fell more than 23% from last year to $86.3 million, driven by lower order volumes. Those of franchised establishments fared better, up 7% to reach $138.3 billion.

Weaker than expected domestic sales were offset by a strong international performance. International restaurant same-store sales increased 3.3% from last year, offsetting a 0.6% decline in the United States.

Despite the lack of income, Net income jumped 47% from last year to nearly $148 million as expenses fell more than revenues. Diluted earnings per share (EPS) jumped almost 50% to $4.18.

Globally, Domino' 39;s had eight fewer stores open than in the second quarter, largely reflecting the company's withdrawal from Russia. Outside the Russian market, the company has opened a network of 135 stores, the majority of which are outside the United States

Inflation and shipping costs bite consumers

U.S. consumers have cut back on discretionary spending this year amid continued high inflation and rising interest rates. When it comes to restaurant spending, consumers have turned to cheaper options or home-cooked meals.

Last month, Darden Restaurants (DRI) reported weaker-than-expected sales for its fine dining segment, despite overall better-than-expected profits. Large retailers like Target (TGT), Walmart (WMT) and Home Depot (HD) have also been affected by the slowdown in discretionary spending.

Higher delivery costs since the start of the #39;last year have also dissuaded consumers who like to have their pizza delivered. Last year, Domino's increased the prices of its popular 'Mix and Match'. combo to $6.99 instead of $5.99 for customers who ordered delivery, reflecting rising inflation and cost pressures.

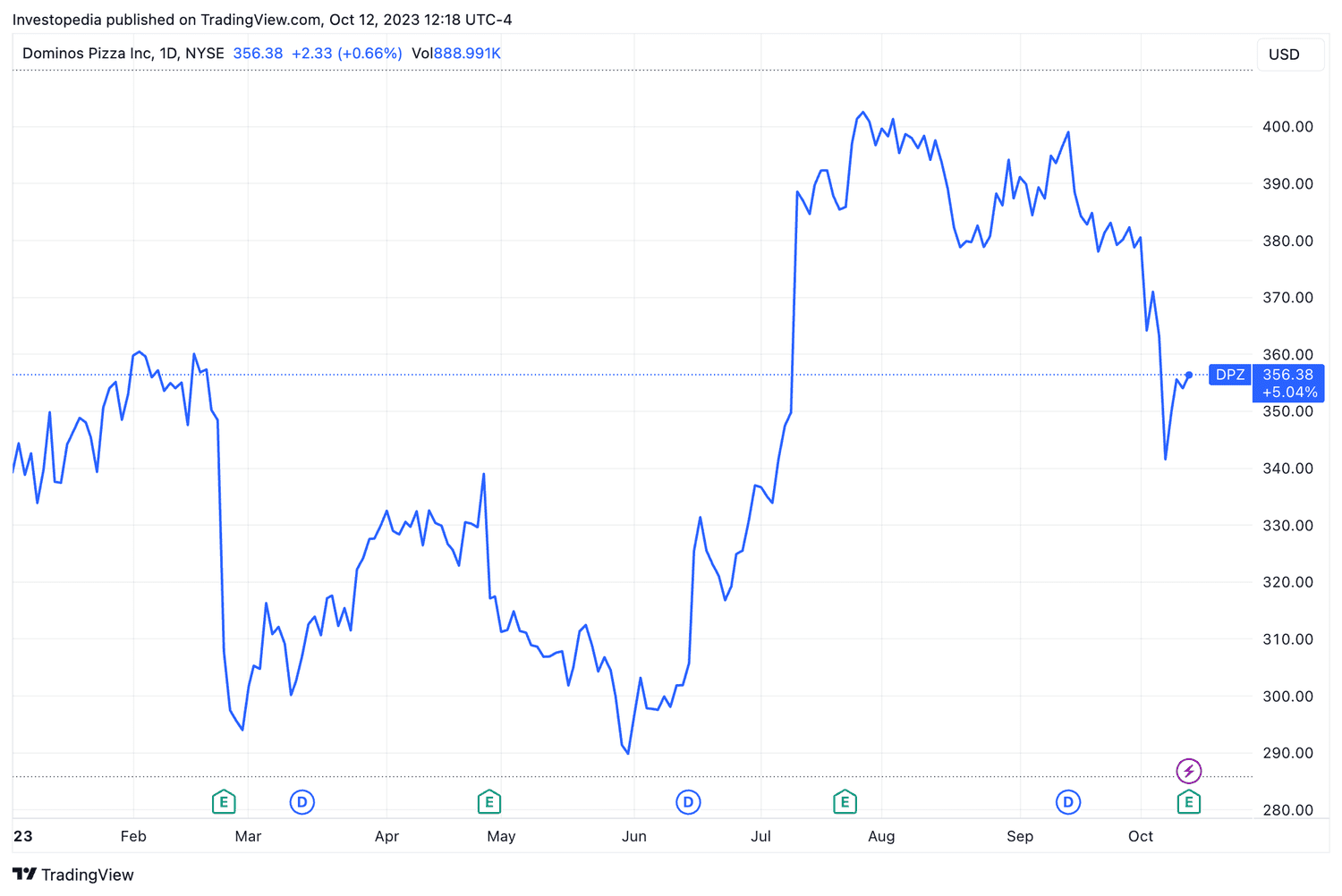

Domino's shares ; Pizza was down less than 1% on Friday.It's up more than 2% so far this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com