Takeaways

- Nokia completed a difficult quarter in which profits fell almost 70% as customers signed up for fewer subscriptions.

- Nokia's revenue fell by 20% % compared to last year's quarter, at 4.98 billion euros ($5.27 billion), and well below estimates of 5.67 billion euros ( $6 billion).

- Nokia customers in North America reduced spending amid higher interest rates, while enterprise customers prioritized cash flow cash flow and reduced their inventory.

- Cost cuts for Nokia, including a new round of layoffs, could help it become a leaner company, while a global 5G rollout could deliver revenue growth in quarters to come. come.

Nokia (NOK) reported a nearly 70% drop in profit in the latest quarter as customers took out fewer subscriptions amid a tough economy and rising interest rates.

The company reported a net profit of 133 million euros ($140.86 billion), down 69% from the same quarter last year. Revenue fell 20% from the corresponding quarter last year to 4.98 billion euros ($5.27 billion), well below estimates. 5.67 billion euros ($6 billion).

The weaker-than-expected result was largely explained by a 24% sales decline in mobile networks, Nokia's largest segment by revenue, customers in North America having reduced spending due to rising interest rates, while corporate clients prioritized cash flow. and reduced their stocks.

In a video call, President and CEO Pekka Lundmark cited “a weakened macroeconomic environment” and the impact of rising interest rates on business customer spending as obstacles to during the last quarter, but said operating margins held up “reasonably well” thanks to cost controls. measures.

Higher interest rates make it more expensive for customers to take out loans to pay for mobile subscriptions and internet services, or to sign up for new services, which affects all telecommunications companies. income.

Nokia is not the only telecommunications company feeling economic uncertainty. Swedish telecom rival Ericsson (ERIC) posted a loss of 30.5 billion crowns ($2.78 billion) in its fiscal third quarter, while gross margins fell 3 percentage points compared to the same quarter last year. The company said uncertainty affecting its mobile networks could persist into next year, especially as demand in North America fell compared to last year.

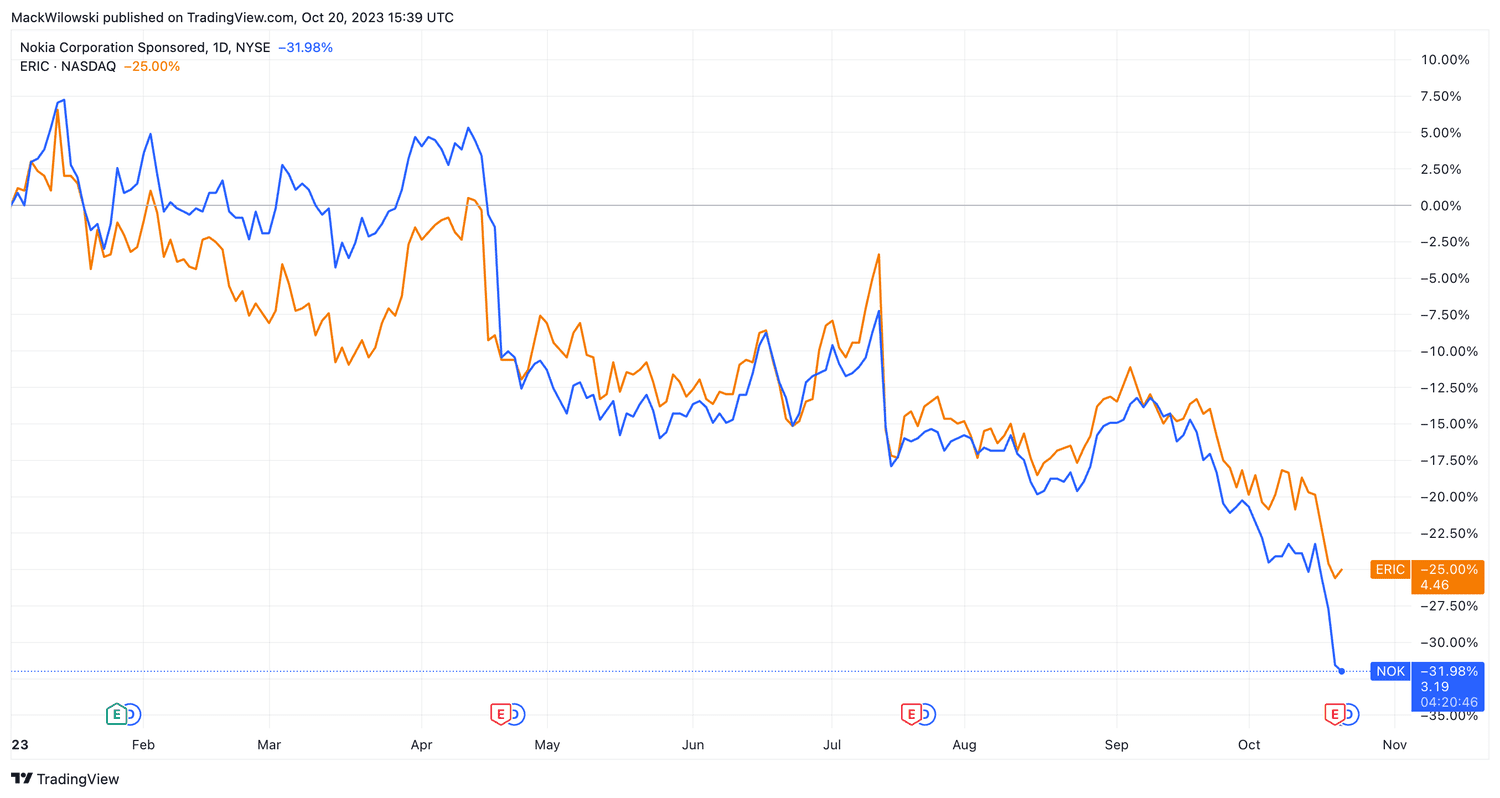

Nokia shares have fallen more than 10% since the start of the week. They have lost almost a third of their value so far this year, while those of rival Ericsson have fallen by a quarter.

TradingView

Cost reductions , Global 5G Deployment Could Benefit Nokia

In its efforts to reduce costs and become a leaner company, Nokia announced it would cut up to 14,000 jobs, compared to the current 86,000. It's part of a wider cost-cutting plan aimed at saving up to 1.2 billion euros ($1.27 billion) by 2026.

Nokia could also benefit from the deployment of 5G in India, where net sales more than doubled compared to last year. Lundmark said the ongoing global 5G rollout, which is “still only about 25% complete, excluding China,” remains a fundamental business driver and could increase revenue in the quarters to come. come.

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com