MicroStrategy Incorporated (MSTR) shares rose more than 10% during Tuesday’s session after the company has used half of its $ 500 million in cash to purchase 21,454 bitcoins, and has announced plans for a modification of the Dutch auction for the repurchase of its own shares with the other half.

The management of the corporation believes that Bitcoin is a reliable store of value and as an attractive investment asset over the long term, the appreciation potential of the holding of the cash. In particular, the team believes that the cryptocurrency is a good hedge against inflation and the prospect of earning a higher return than other investments.

Disclose the plans of $ 500 million in cash, the company announced that it intends to manage the business of $ 50 million in cash from operations and use excess cash in a similar manner on an ongoing basis by the purchase of MicroStrategy stock, and investing in “other investments”.

During the second quarter, MicroStrategy’s revenue fell 6.1% to $110.58 million, missing consensus estimates by $ 1.64 million, and GAAP earnings per share came in at 35 cents, missing consensus estimates of five cents per share. The society is a much looked at the cash position declined 4.7% during the quarter to $539.2 million of dollars after it bought back about 350,000 shares in the first quarter.

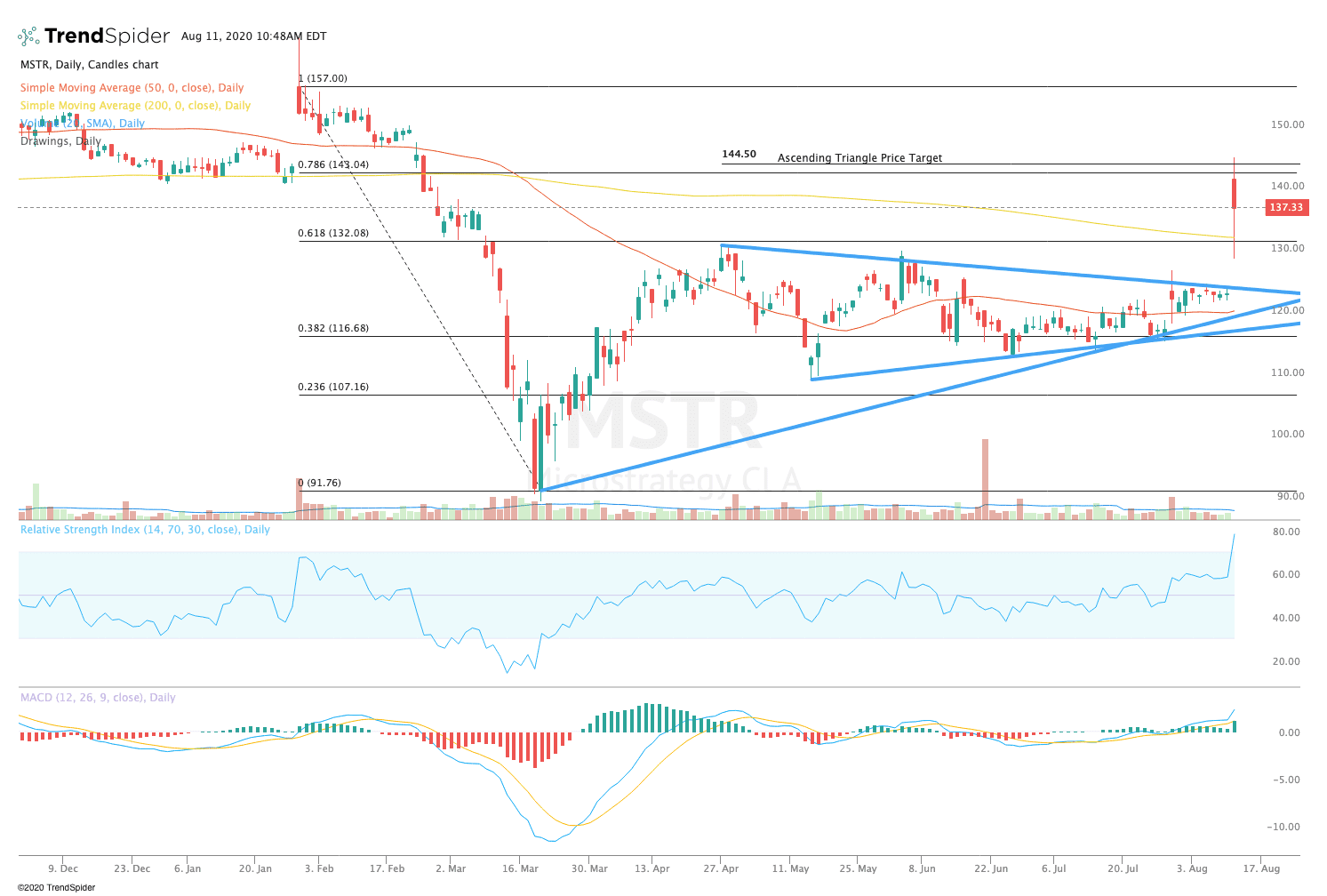

From a technical point of view, MicroStrategy stock broke out of its 200-day moving average to the high made earlier this year. The relative strength index (RSI) is placed in the overbought territory with a reading of 78.49, but the moving average convergence divergence (MACD) in histogram MACD experienced a bullish recovery. These indicators suggest that the stock could see some short-term consolidation before extending its rally higher in the coming sessions.

Traders should watch for consolidation among the ascending triangle price target of $144.50, and the 200-day moving average of $132.97 in the coming sessions. If the stock breaks out from these levels, traders should watch for a move to retest highs of $165.00. If the stock breaks down, operators could see a move lower to retest trendline support near $125.00. Of course, the passage in Bitcoin suggests that the crypto of the asset prices could influence the evaluation.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com