Dow component Microsoft (MSFT) reports earnings Wednesday after the closing bell, with Wall Street analysts expecting an earnings per share (EPS) of $1.38 in the fourth quarter of 2020 sales of $36.55 billion. The stock rose 1% after Microsoft beat top and bottom line third-quarter estimates in April, and then added to gains in the July all-time high at $216.38. It is consolidating near this level of price in advance of the compensation, of the new, in a perfect position to get out in response to the strong metric.

Key Takeaways

- Microsoft stock has registered higher yields during the last four years.

- The profits were resilient despite the pandemic of contrary winds.

- Technical readings warn that the stock is overbought and overdue for a correction.

The pandemic has hardly touched Mr. Soffee, which is now the second strongest component in the Dow Jones Industrial average, just behind Apple Inc. (AAPL). Microsoft has beat earnings estimates nearly every quarter, and ranks among the elite of major tech stocks after three years of good returns. Stifel analyst Brad Reback has just been added to a lot of optimism as to the section in the report, noting, “we expect healthy upside in the EPS/revenue that we believe Microsoft properties (Azure/Office365/games) are net short-term and long-term beneficiaries of the pandemic.”

The price-earnings ratio (P/E ratio) is the ratio of the valuation of an enterprise that measures its current share price compared to its per-share earnings (EPS). The P/E ratio is also sometimes known as price multiple or earnings multiple.

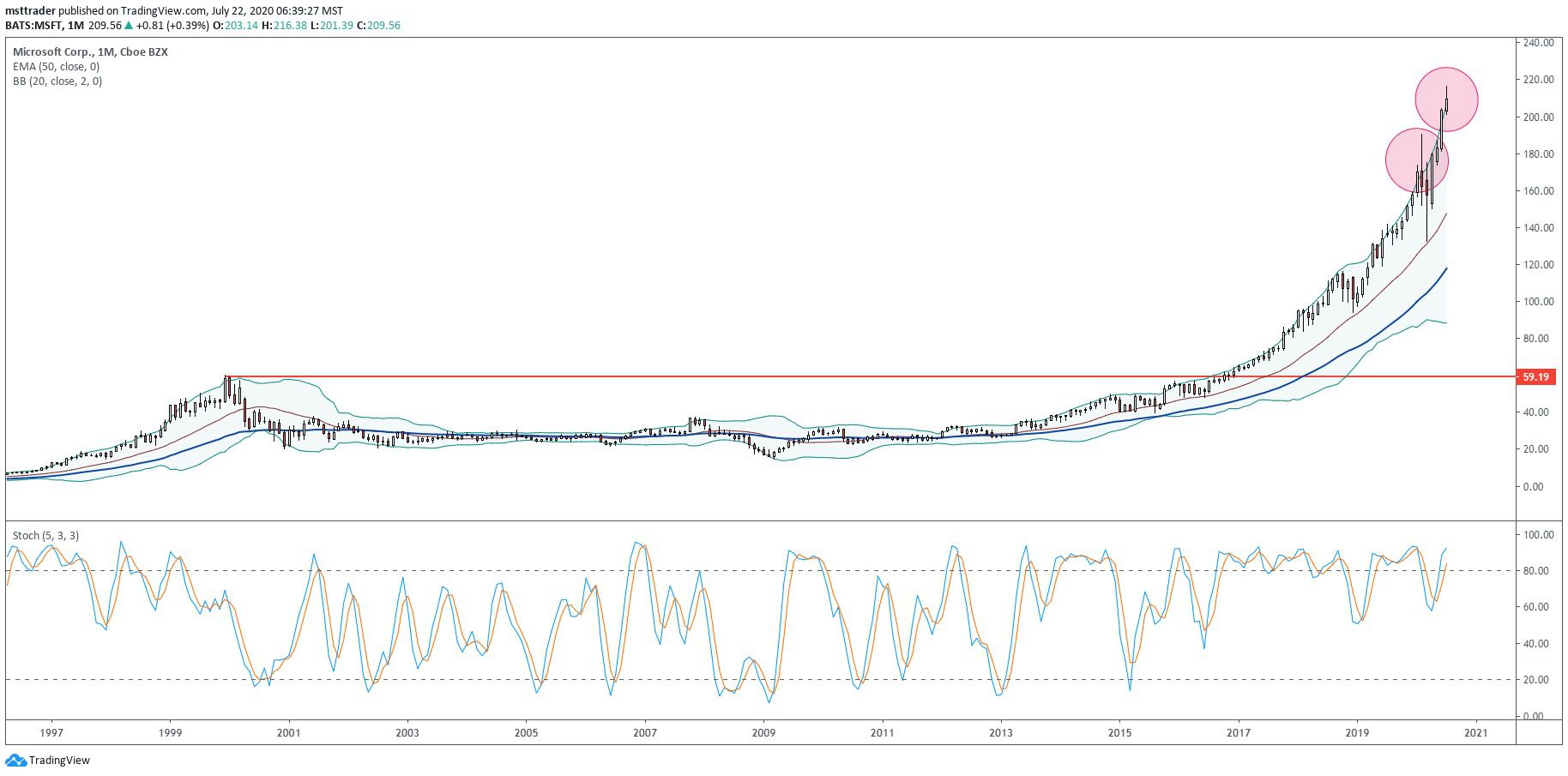

Microsoft’s Long-Term Chart (1999 – 2020)

TradingView.com

The stock ended on a strong up trend to a split adjusted $59.97 in December 1999, which represents a top that was not in question, for the next 16 years, in advance of a strong downward trend which first found support in the upper part of adolescence. It has under-performed during the mid-decade bull market, the trim in the middle of$30 in 2007, before a major decline that has posted a 10-year low during the economic collapse. It then took four years for the stock to a full 100% retracement to the high of 2007.

Stable upside-down in 2016 dropped three points below the 1999 peak, in front of a historical derivation following the presidential election. That marked the beginning of market leadership, with a channeled and sustained increase in by large institutional sponsorship. The rally took a break in October 2018, and again in early 2019, making rapid progress in February 2020 high at $190.70. He then rode on the world’s markets, hanging tough in a seven-month low in March.

Microsoft Outlook In The Short Term

A powerful recovery of the wave in the second quarter of the impasse just three points in the month of February to a high in May before a June breakout that has attracted a steady interest from buyers. The stock has added another 25 points in July, the all-time high, and relaxed in a holding pattern ahead of this evening of confessional. Microsoft is in the process of negotiation on seven points by virtue of this summit, in a quiet area of the session and could easily get out of a reaction to a strong state.

However, the 20-month Bollinger Band® is the signaling of the need for caution after hugging the top band of the past 15 months. More specifically, the July price bar has reached 100% outside the upper band, the setting out of an area of overbought technical reading, which raises the odds for an intermediate correction. It is difficult to tell from the current view, but the share price has generated a signal that is identical in February, just before a reversal carved along the top of the shade and a 58-point decline in the center of the strip.

A Bollinger Band® is a technical analysis tool defined by a set of trend lines plotted two standard deviations (positively and negatively) away from a simple moving average (SMA) of the price of a title, but accurate measurements can be adjusted to the preferences of the user.

The Bottom Line

Microsoft is firing on all cylinders for lifting, in the second location in Dow component of the performance, but the stock is now extremely overbought and in need of a consolidation or correction. Even if, this evening, the benefit of the release could easily trigger a strong, if short-term, “buy-the-news” reaction.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com