Key Takeaways

- The adjusted EPS was $ 1.46 vs the $1.38 analysts were expecting.

- The products have also been higher than expected.

- Microsoft intelligent cloud-based revenues were slightly higher than expected.

- The YEAR 2020 was the first time that the Smart Cloud segment was the largest revenue.

What Happened

Microsoft has said that its Q4 FY 2020, divided on 22 July 2020 and has exceeded the expectations of analysts on both adjusted earnings and sales. Its earnings according to generally accepted accounting principles (GAAP) have been slightly worse, as they have included a $ 450 million charge for the closure of all the Microsoft retail store locations due to COVID-19. Microsoft was pivoting to focus more on cloud services, including its Azure cloud platform, and that seems to have borne fruit. Cloud services revenue slightly exceeded analysts ‘ expectations and, in particular, has been the most important segment of the company by revenue for the YEAR 2020.

(Below, Investopedia’s original earnings preview, published on July 21, 2020)

What to Look for

Microsoft Corp (MSFT) stock has been a remarkable example in the middle of the spread COVID-19 crisis, from about 35% in 2020 and considerably superior to the overall market. Much of this good performance comes, as millions of home consumers and businesses in the world have strongly stimulated the demand for Microsoft products such as software, video games, and cloud services, in particular its Azure cloud computing platform.

Investors are likely to closely monitor the performance of the company to rapid growth in Intelligent Cloud segment when Microsoft reports earnings on July 22 for the Q4 of FISCAL 2020. Microsoft fiscal year ends in June. The good news is that analysts expect the higher revenues from cloud computing services and the scale of the business, but it is much slower than in recent quarters. The bad news is that analysts expect virtually no growth in the adjusted earnings per share (EPS).

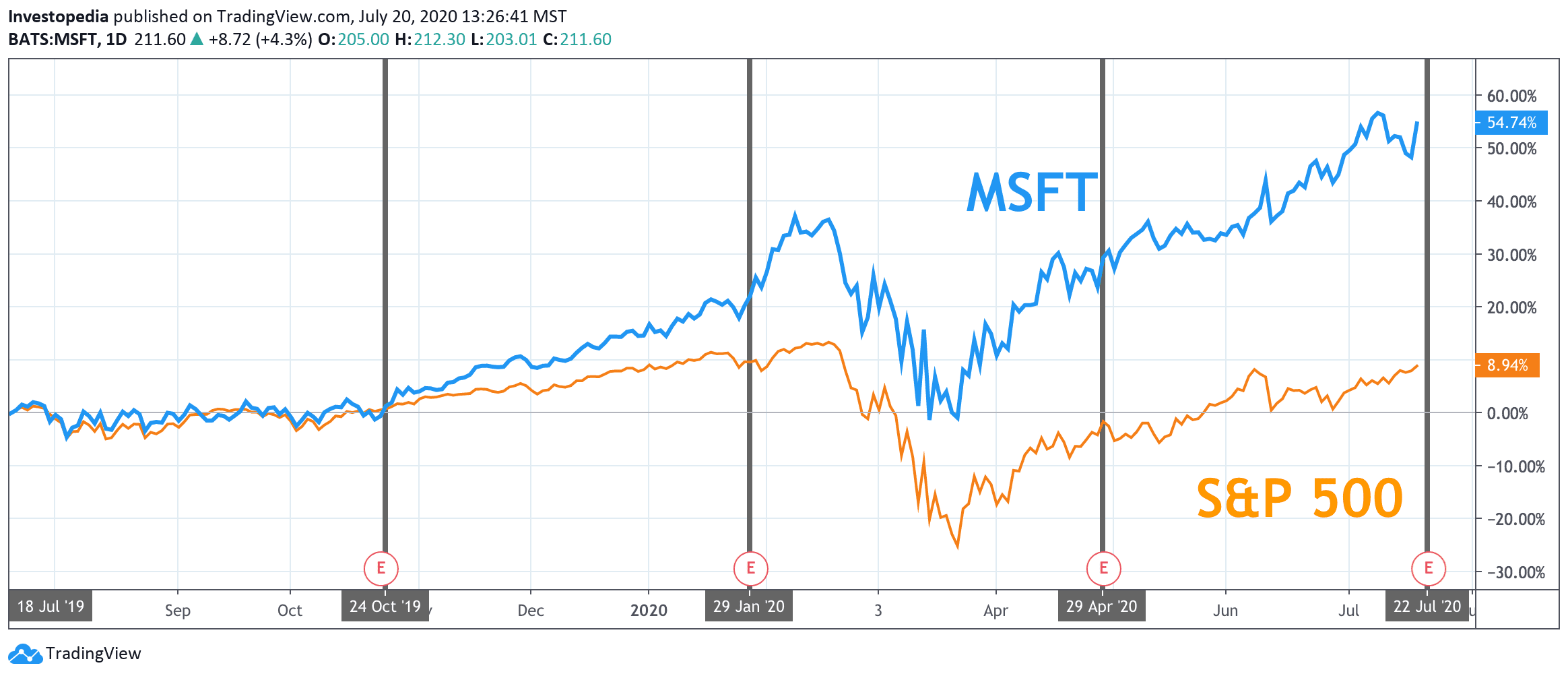

Although Microsoft stock fell in early 2020, with the broader market, the company has more than recovered those losses with a strong performance. In the last 12 months, Microsoft has posted a total return of 54.7%, which is six times larger than the 8.9% in the S&P 500 index.

Source: TradingView.

Microsoft outperformance over the last year comes amid a series of positive reports in recent quarters. In terms of turnover, the company has posted double-digit year-on-year (yoy) growth for the last 11 consecutive quarters. On the other hand, the analysts expect Q4 of FISCAL 2020 earnings slow sharply, to 8.1% year-on-year.

Microsoft has seen robust year-on-year growth of adjusted EPS over the past three years, the publication of 22.8% of growth in FISCAL 2017, 18.2% in FISCAL year 2018 and an increase of 22.3% in FISCAL 2019. The growth has been solid on a quarterly basis. Recently, Microsoft adjusted EPS increased by 37.2% and 23.2%, respectively, in Q2 and Q3 of FISCAL 2020.

That growth may end in the 4th quarter of FISCAL 2020. Analysts expect Microsoft to grow earnings per share by less than 1 percent, or 0.4% a share to$1.38.

Microsoft Key Measures

The estimate for the Q4 FY2020

Actual for Q4 FY2019

Actual for Q4 FY2018

Adjusted Earnings Per Share ($)

1.38

1.37

1.13

Revenue ($B)

36.5

33.7

30.1

Smart Cloud Revenues ($B)

13.1

11.4

9.6

Source: Visible Alpha

As mentioned, when Microsoft releases Q4 FY 2020 profits, investors will look at the performance of the Microsoft Intelligent Cloud segment as a barometer of the society of the solidity of the whole. Cloud services is one of the most rapid growth areas at Microsoft and in the technology sector. To accelerate sales growth, Microsoft has focused on key areas where it can stimulate the cloud of income. The company has been successful in the midst of stiff competition from market leader Amazon Inc.’s (AMZN) Amazon Web Services (AWS). Microsoft Azure ranked second.

Microsoft Intelligent Cloud segment has increased in each of the last 13 consecutive quarters, with sales more than doubled, from $ 6.1 billion in Q1 of FISCAL 2017 to $ 12.3 billion in Q3 of FISCAL 2020. The growth in this sector has exceeded 26% year-on-year in each of the previous three quarters. While analysts expect strong growth in the 4th quarter of the YEAR 2020, the growth to downshift sharply to 14.8%, about half the pace of the previous three quarters. While Intelligent Cloud-based revenue by doing a larger share of Microsoft is the corporation’s income, it is difficult to know if this will be enough to strengthen the long-term benefits.

Source: investopedia.com