Microsoft (MSFT) the second most profitable American company , might say, cloud growth fell to its slowest pace in five years in the last quarter, the counterpoint of the bleak economy to Big Tech's flashy new products.

Key Points to Remember

- Microsoft is set to report its second straight year-over-year earnings decline.

- Investors will be eyeing the Intelligent Cloud performance and ChatGPT outlook.

- CEO Satya Nadella promised more detailed plans in this release.

The Redmond, Wash.-based company is expected to post earnings of $16.7 billion, or 2.24 cents per share, unchanged from the year-ago quarter, according to estimates compiled by Visible Alpha. Revenue is expected to grow 3% year-over-year to $51.1 billion. The company will release its financial results for the third quarter of its fiscal 2023 after markets close on Tuesday, April 25.

Investors will focus on the Intelligent Cloud segment, which has been Microsoft's largest in each of the past eight quarters. Cloud revenue is expected to grow at its slowest pace in five years, rising 15% to $21.9 billion. Global spending on cloud services is expected to hit a record $592 billion in 2023, a 21% increase over last year, according to research firm Gartner.

Microsoft's cloud business could be a bright spot as the company is expected to post double-digit revenue declines in its personal computing segment, which consists of Windows products and devices like the Surface tablet and Xbox game console.

Microsoft CEO Satya Nadella is expected to face questions about the future of Microsoft's artificial intelligence tools and the impact of cost-cutting measures. Nadella is likely to base much of the company's outlook on the AI push.

“The next great wave of computing is being born, as Microsoft Cloud transforms the world's most advanced AI models into a new computing platform,” he said in the publications of the results of the last quarter.

Microsoft extended its partnership with ChatGPT creator OpenAI in January, investing $10 billion in the startup which has been valued at $29 billion. Microsoft's AI-enhanced search engine Bing surpassed 100 million daily active users for the first time in March. Despite the buzz, analysts expect search and advertising revenue to grow just 4% in the last quarter, down from 22% growth in the same period a year ago. one year old.

Microsoft Key Metrics Q3 FY2023 (estimated) Q3 FY2022 Q3 FY2021 Diluted earnings per share ($) 2.24 2.22 2.03 Revenue ($B) 51.1 49.4 41.7 Cloud revenue annual growth (% ) 14.8 26 23.1

Nadella will also provide updates on the layoffs announced in Microsoft's latest earnings update when the company reported its first decline in adjusted earnings in eight years. Operating expenses are expected to increase 10% from 18% in the prior quarter.

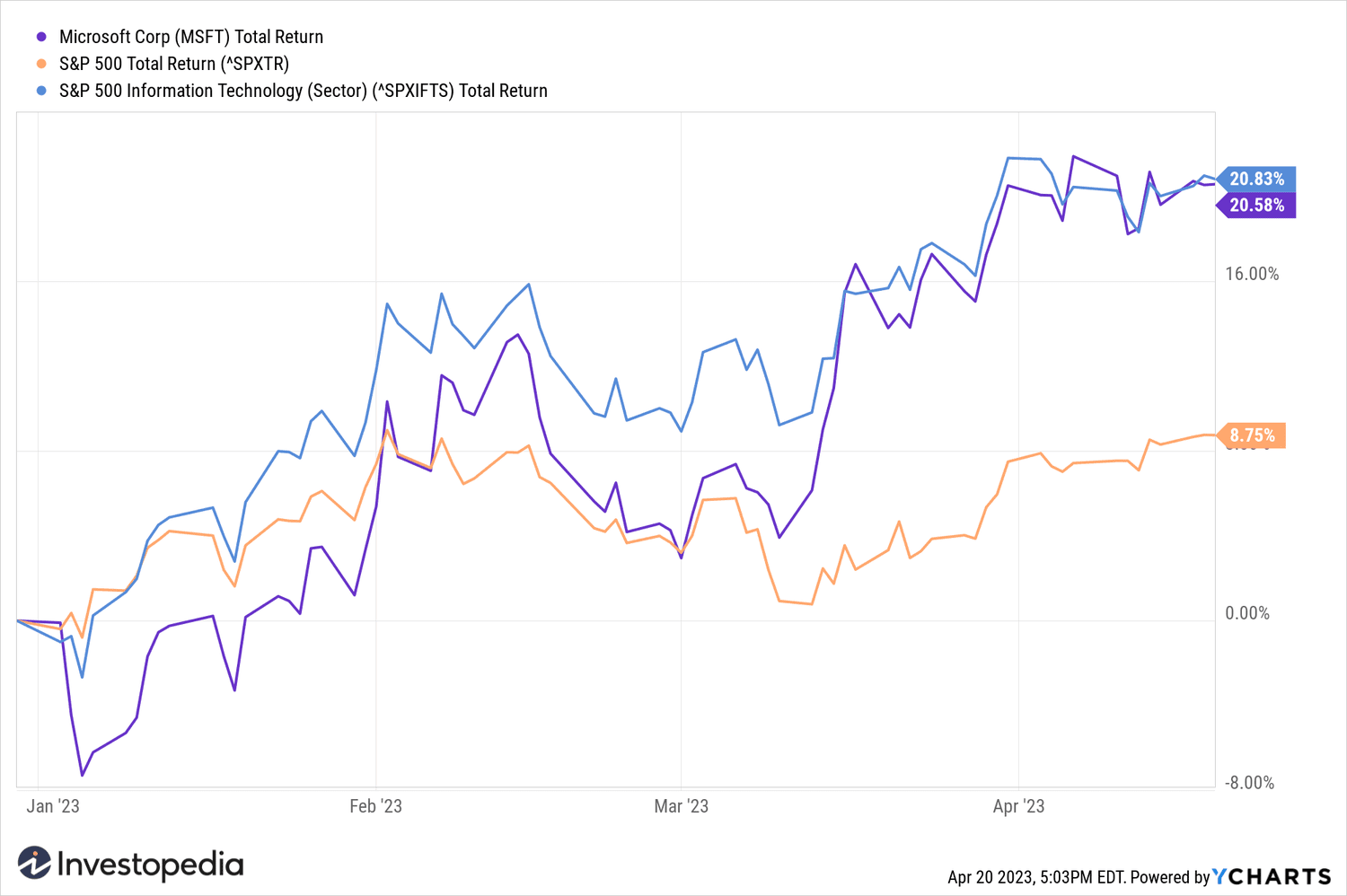

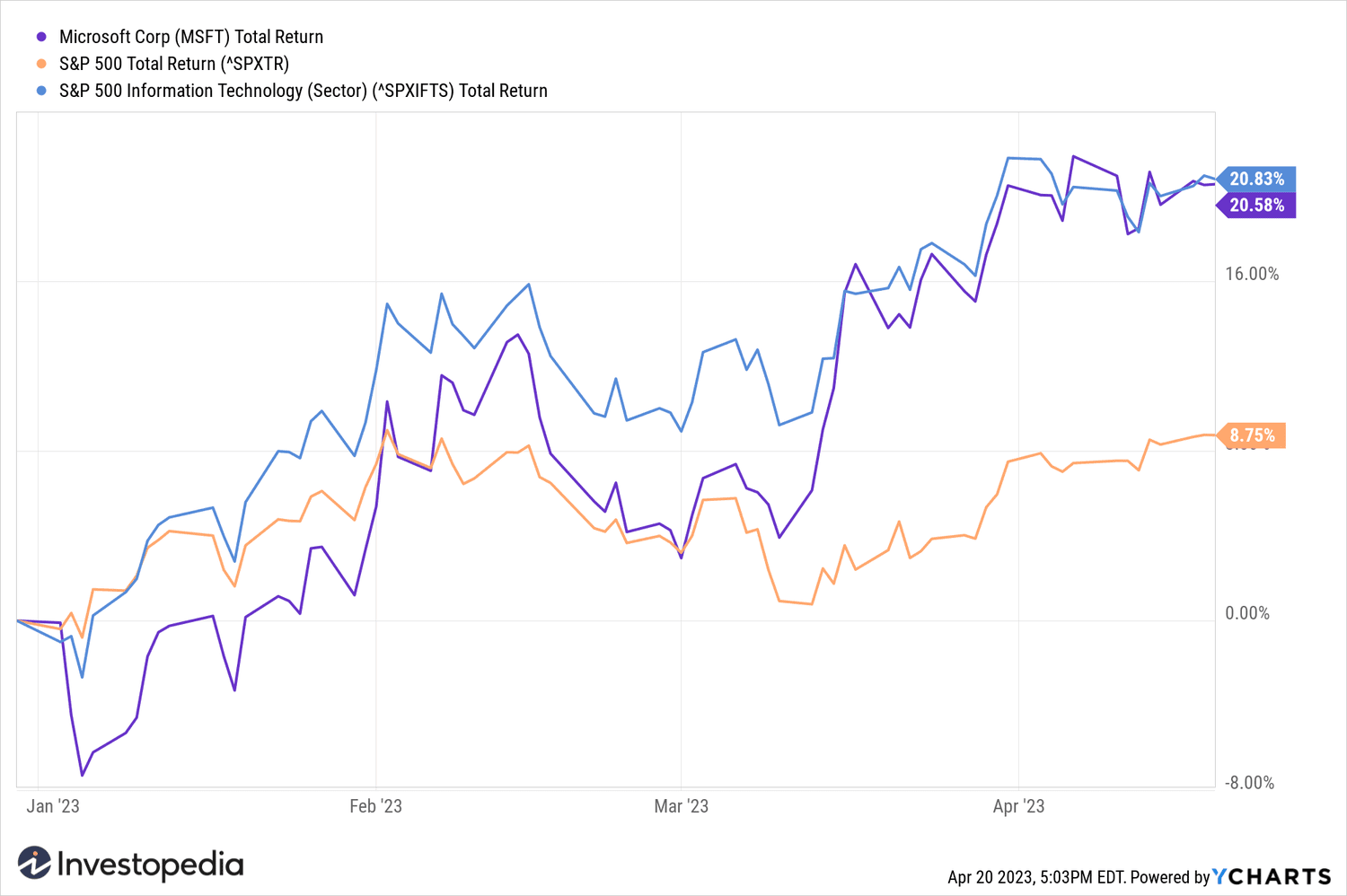

Microsoft Stock touched a 14-year high recently, up 20.40% on the year. The stock is slightly ahead of the S&P500 Information Technology Index, up 20.13% over this period in comparison.

Source: investopedia.com