Micron Technology, Inc. (MU) has underperformed the PHLX semiconductor Index (SOX) and industry names through mid-August, so as not to reach the February high. Micron stock has broken a major support at the 200-day exponential moving average (EMA) for the second time this year and may already be entering the first summit of the downward trend since 2016. The first decline target is found at a few points above March 15-month low near $30, which now marks a line in the sand that the bulls need to defend at all costs.

Key Takeaways

- Micron stock can be entered long-term downward trend in 2018.

- The stock just broke the 200-day EMA for the second time this year, indicating that the bears are in control of price action.

- The new selling wave may eventually reach the mid-to-low $30s.

The company warned that the fourth quarter of 2020 the results will be lower than the “thought” to a KeyBanc investment conference this week. Who denies June 29 guidance for earnings per share (EPS) of $0.95 to $1.15 and revenues of $ 5.75 billion to $6.25 billion. Deutsche Bank has sounded the alarm, immediately after the comments, the demotion Micron stock to “Buy” to “hold.” Worse still, analyst Sidney Ho do not expect the supply and demand for memory chips to improve until the second quarter of 2021 at the earliest.

The stock has not posted a new all-time high since May of 2018. A resumption of the wave in February 2020 stalled within three points of the front edge, the carving of a bottom of the inside of a massive topping or consolidation pattern between the upper $20s and low $60s. A large-scale fall may now complete the bearish price structure, in line with Micron’s long-term tendency for vertical expansion and recession cycles.

Earnings per share (EPS) are calculated as a company’s profit divided by the number of outstanding shares of common stock. The resulting number is used as an indicator of the profitability of a company. It is common for a company to report adjusted EPS exceptional items and the potential share dilution.

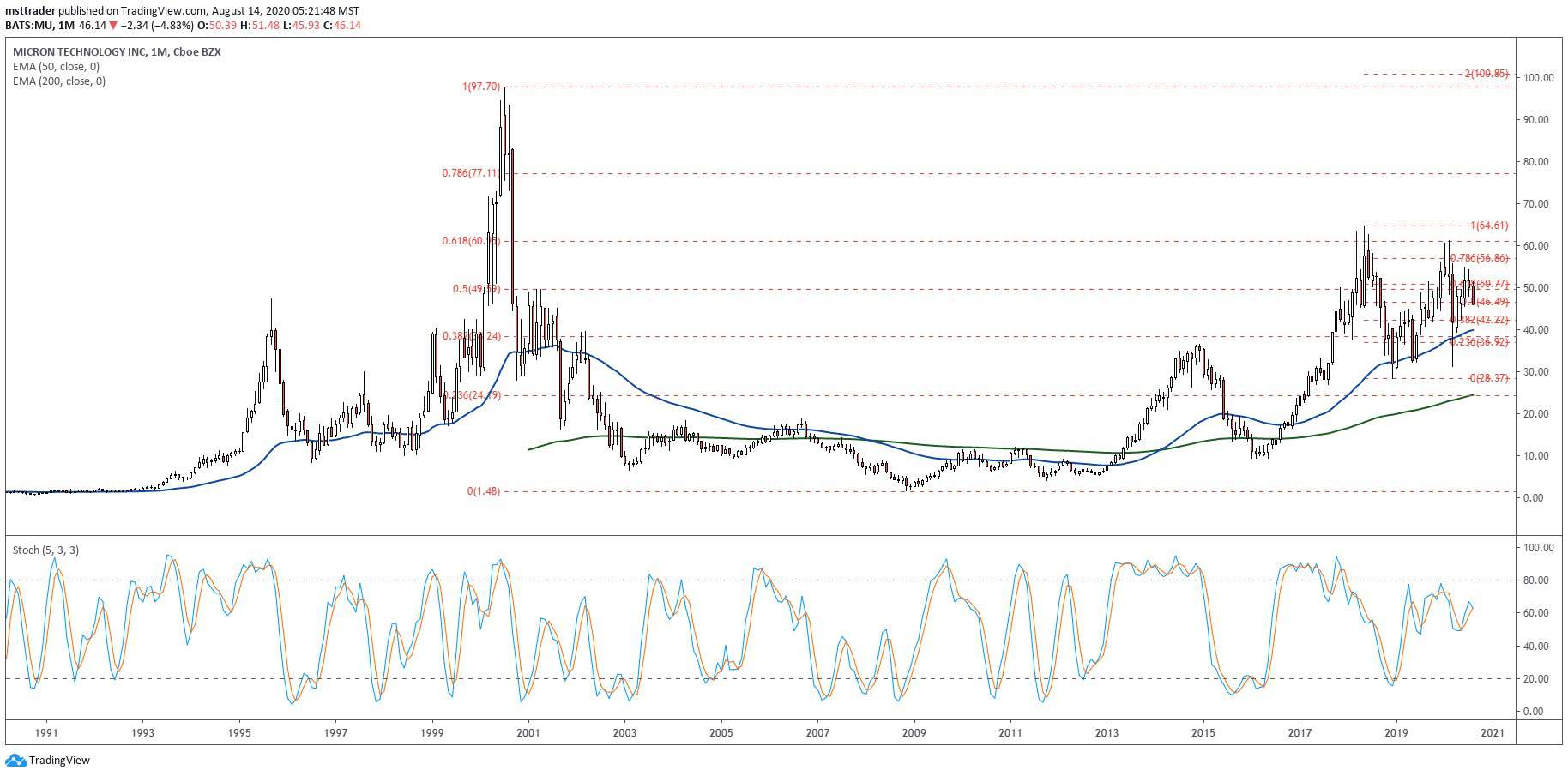

Micron Technology’s Long-Term Chart (1990 – 2020)

TradingView.com

Micron stock charged higher in the 1990s, stalling in the upper part of $40 in 1995. It has broke above this level in 2000, the publication of all time at $97.50 in July. As a corollary, the recession, which has found support in the single digits in 2003, while a recovery of the wave in 2006 reserved for minor returns. It has broken its support at the low during the economic collapse of 2008, reaching a bottom level in 16 years that finally resulted in the long-term downward trend.

The upward trend in the new decade carved on three broad rally waves in the 2018 high at the .618 Fibonacci sale retracement level. The stock has declined by more than 30 points in December, the tests 2017 evasion of support in the mid$30. It has hit this price level, again, in March 2020, highlighting the importance of this floor in the next few months. The general trend has now carved a lower high and a higher low, forming the outline of a possible triangle pattern.

A triangle is a chart pattern represented by drawing trend lines along a convergence of price range that evokes a pause in the trend.

Micron Technology Short-Term Chart (2018 – 2020)

TradingView.com

The rebound in the second quarter of 2020 reversed at the .786 Fibonacci sale retracement level, as well as 2018 to 2020 recovery wave. This highlights the symmetry, which could indicate a major change in the trend. A July test and strengthened the resistance and fell to the 200-day EMA for the fourth time in two months before breaking down on Thursday, in response to the decrease of the orientation. The drop in momentum could resume from here, the removal of the stock to $40.

The balance volume (OBV), the accumulation-distribution indicator of the health of the buying pressure mounted 2018 the resistance in July, publication of all time. However, OBV has now rolled over and seems to be ready to test new support, with a disposition to advance the price of the put off a bearish signal for the shareholders to take defensive measures and of short sellers to consider new entries. The decline could accelerate if this occurs, the abandonment of the stock in the shallow waters of the trendline near$33.

The Bottom Line

Micron Technology stock has broken the 200-day EMA for the second time this year and could sell in the middle of less than $30.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com