Takeaways

- Micron reported better-than-expected revenue and profit for the quarter ended Aug. 31, but issued weaker-than-expected guidance for the current quarter.

- Memory chip prices have fallen sharply since the start of last year, while demand for the company's memory chips among PC and smartphone makers remains subdued.

- Management is confident of a recovery in the sector next year, especially as price declines slow.

Shares of Micron Technology (MU) fell more than 3% in early trading Thursday after the company issued weaker-than-expected guidance for the current quarter, despite better-than-expected revenue and earnings for the quarter. closed August 31.

The figure of Business for the quarter ended August came in at just over $4 billion, above expectations of $3.93 billion. The company posted a net loss of $1.43 billion, or about $1.31 per share, almost 10% less than analysts expected.

Meanwhile, Micron has issued guidelines below for analysts. expectations. The company forecast an unadjusted loss of $1.07 per share for the current quarter, while analysts surveyed by Refinitiv had forecast 95 cents.

The disappointing forecast can be attributed to weaker-than-expected demand for the company's memory chips among its main customers, namely PC and smartphone makers like Hewlett-Packard (HPQ), Dell Technologies (DELL) and Apple (AAPL), as well as as data centers.

Memory chip prices have fallen in recent quarters, affecting companies like Micron and Samsung that specialize in manufacturing them. Prices peaked in late 2021 amid strong demand during the pandemic, but have fallen since the start of last year due to slowing industry demand, rising interest rates, lockdowns in China – one of the largest markets in the sector – and geopolitical risks. The industry is also struggling with excess inventory, as demand for semiconductors has declined after a record year in 2020 and 2021.

However, these price cuts have also slowed these recent months, which gives the company's management hope for a turnaround in the sector's situation.

While acknowledging a challenging 2023, Micron President and CEO Sanjay Mehrotra said recent performance “positions us well as a market recovery emerges in 2024, driven by growing demand.” and a disciplined offer.” Mehrotra predicts that industry-wide revenues will reach a record high in 2025 “as AI proliferates from the data center to the edge.”

In a report released Thursday, analysts at Wedbush Securities reaffirmed their “outperform” rating on Micron stock, driven by “improving memory fundamentals”; and a recovery in demand for the company's NAND flash memory chips. Analysts at Bank of America were slightly more pessimistic, giving investors a “neutral” rating. rating due to persistent inventory and cost pressures.

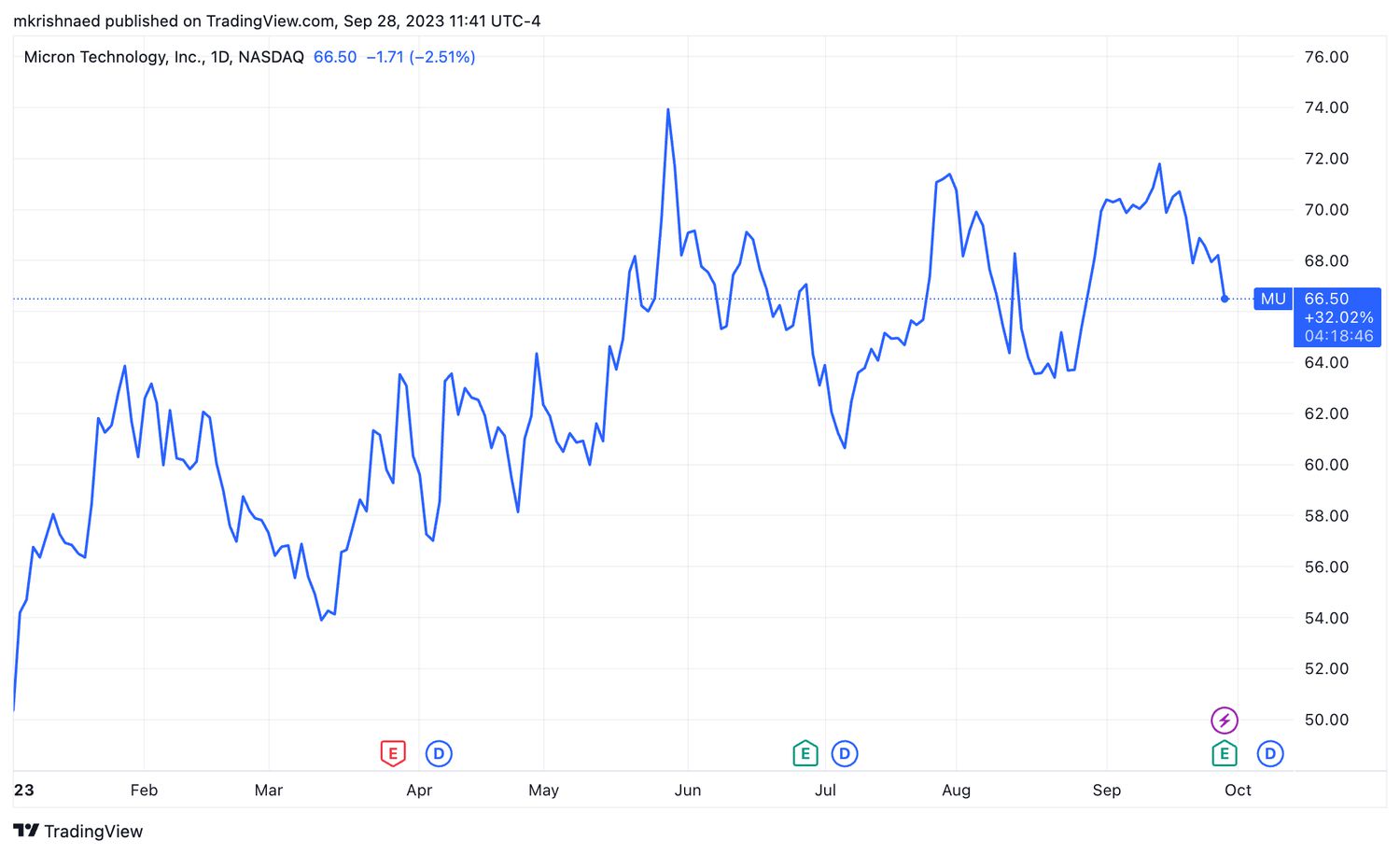

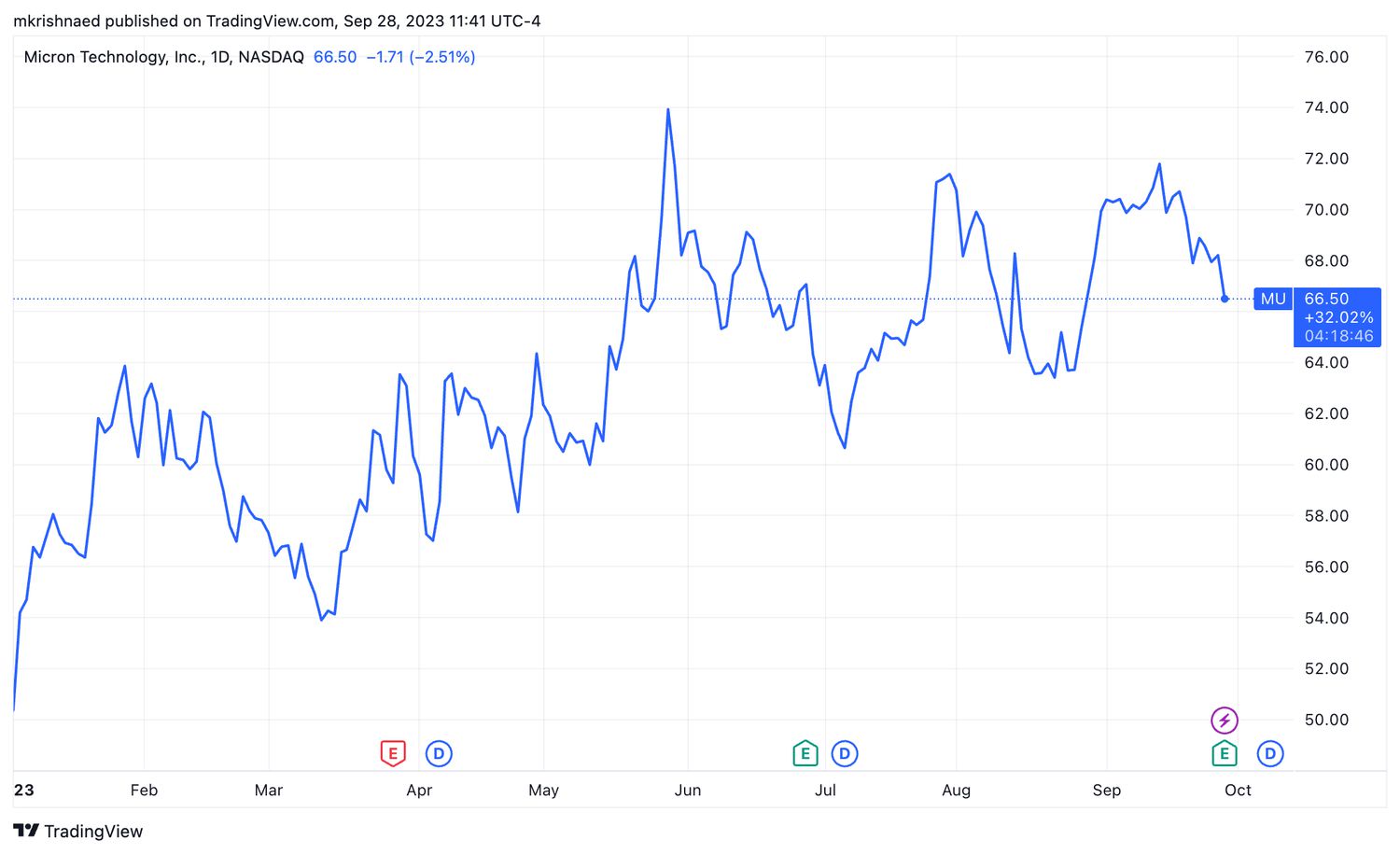

Despite Thursday's Decline , Micron shares were still up about 32% so far this year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com