Takeaways

- Micron Technology Inc. raised its revenue and profit forecasts for the current quarter due to improving chip demand and prices.

- A recovery in the chip market would result by an increase in revenue for Micron, but also by an increase in costs, as the company increases its operating expenses.

- Micron shares fell more than 2% midday Tuesday, despite improved guidance.

Shares of Micron Technology Inc. (MU) fell more than 2% on Tuesday after the chipmaker raised its revenue and profit forecasts for the current quarter, citing “a better balance of supply and demand and improved prices.

Micron said it now expects sales for the quarter ending Thursday to total about $4.7 billion, up from a previous estimate of between $4.2 billion and $4.6 billion. . Higher revenue is expected to be slightly offset by higher costs, with operating expenses forecast at $990 million, up from $885 million to $915 million.

Gross margin is expected to be -0.5% to break even, better than the -6% to -2% range previously expected. Finally, the company's loss per share estimate ($1 to $1.14) was revised downward to $1 per share. Micron has struggled due to a slowdown in chip demand, and while that's an improvement, the new guidance may not have helped. been sufficient for investors.

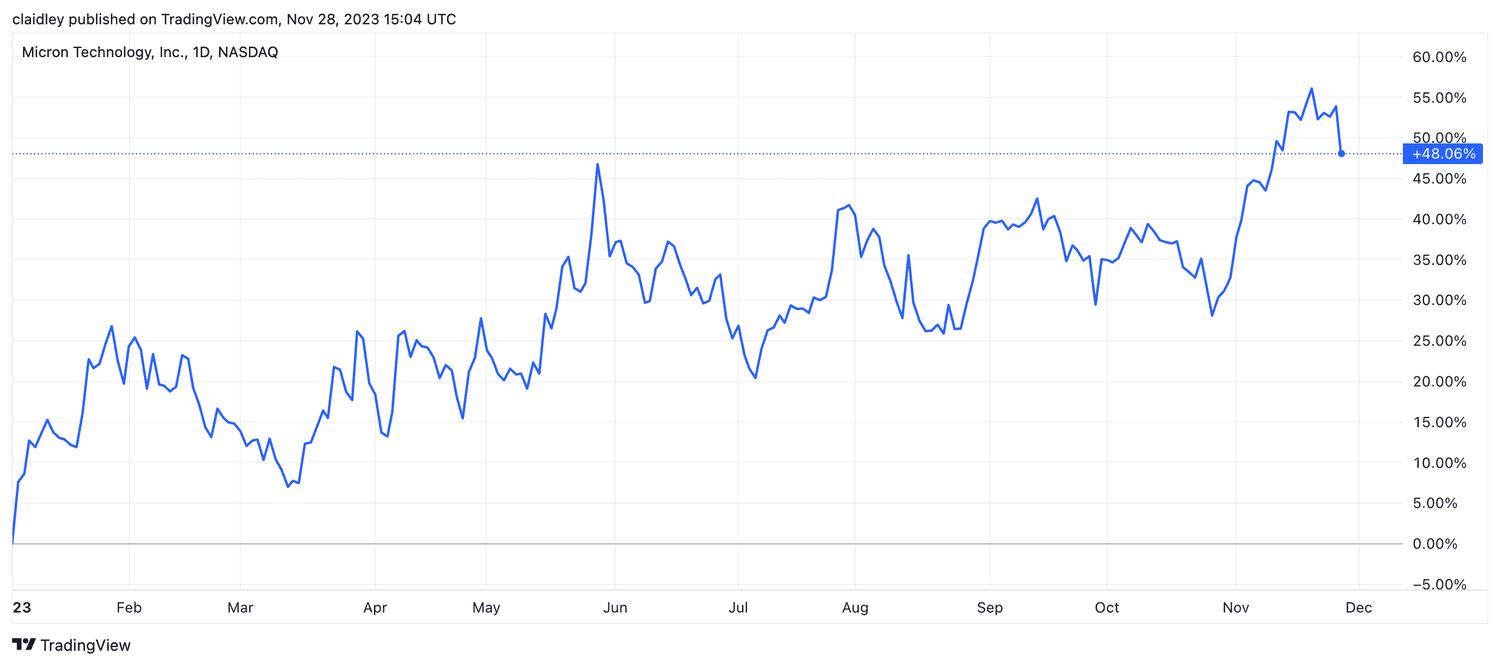

Micron shares fell up 4% at the start of the session on Tuesday, even though they were still up almost 50% since the start of the year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com