Meta Platforms (META) is the best performing title in the S&P 500 as the social media giant beat quarterly estimates in nearly every key financial metric and delivered strong guidance.

The parent company of Facebook, Instagram and WhatsApp announced that first-quarter revenue rose 2.6% to $28.6 billion. Analysts expected a decline. Earnings per share (EPS) of $2.20 also beat expectations. Daily active users (DAU) and average revenue per user (ARPU) were also better than expected.

CEO Mark Zuckerberg said the company is “getting more efficient so we can build better products faster and put ourselves in a stronger position to deliver on our long-term vision.” In January, Zuckerberg called 2023 “the year of efficiency” and Meta moved to cut costs, including cutting 21,000 jobs since November.

Zuckerberg joined Microsoft earlier this week to promote the success of its artificial intelligence (AI) reach. He cited “the progress we're making on our AI discovery engine” and Reels, Meta's social media video service, as key drivers for the company's growth.

Metaverse Losses

However, Meta's investment in the metaverse continued to bleed cash, with the company's Reality Labs unit posting an operating loss of $3.99 billion during the period. The company expects Reality Labs losses to increase this year.

Meta noted that it sees current-quarter sales of between $29.5 billion and $32 billion, beating estimates.

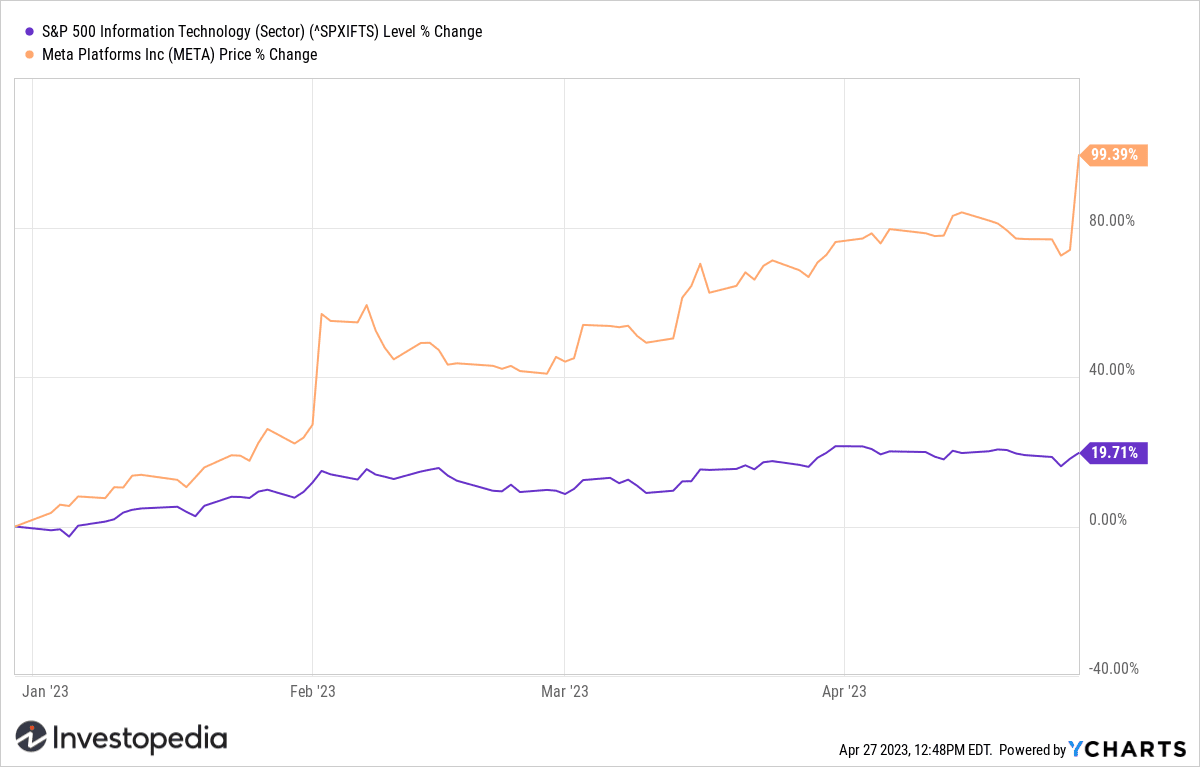

Shares of meta-platforms skyrocket 14% as of 1 p.m. New York time. They have nearly doubled so far this year, far outpacing a 20% gain in the broader S&P 500 information technology sector over the same period.

Y-Graphs

Source: investopedia.com