Dow component Mcdonald’s Corporation (MCD) is showing signs of weakness after a six-week bounce in the resistance and could sell in the coming sessions, provide timely, short sales qualified for the actors in the market. Better yet, the lack of progress over the March three-year low was hardly touched depressed accumulation of readings, increasing the chances that the decline traces back a good part of the rebound, the potential to reach a test of this profound level of support.

The recovery of the wave in April blocked a 50-day exponential moving average (EMA), the resistance in the mid$180, which was broken on heavy volume in February. The increase also failed to reach the 200-day EMA resistance in the mid$190, broken in the course of the same progeny. Taken together, it is possible that Mickey D’s stock is entered in a secular decline that will eventually break in the first quarter low, and achieve more support near $100.

The food service industry headwinds have been well documented, with the sars coronavirus pandemic of force closure or take-out alternatives around the world. States and countries are slowing the recovery in dine-in services, but the social distance requirements of capacity reduction and the sale, affecting the years of profit growth. In addition, Mcdonald’s has to deal with complex real estate, with 85% of restaurants owned by franchisees through mandatory lease-back arrangements.

It is a two-edged sword, with the company enjoying a large portfolio of real estate that adds to the income in the good times. However, these are not the good times, the real estate prices could slump badly in the next year or two, with millions of people without work and unable to pay their bills. In turn, the franchisees may be stuck in the lease expensive properties that are losing value at the same time, the restaurant industry is trying to recover.

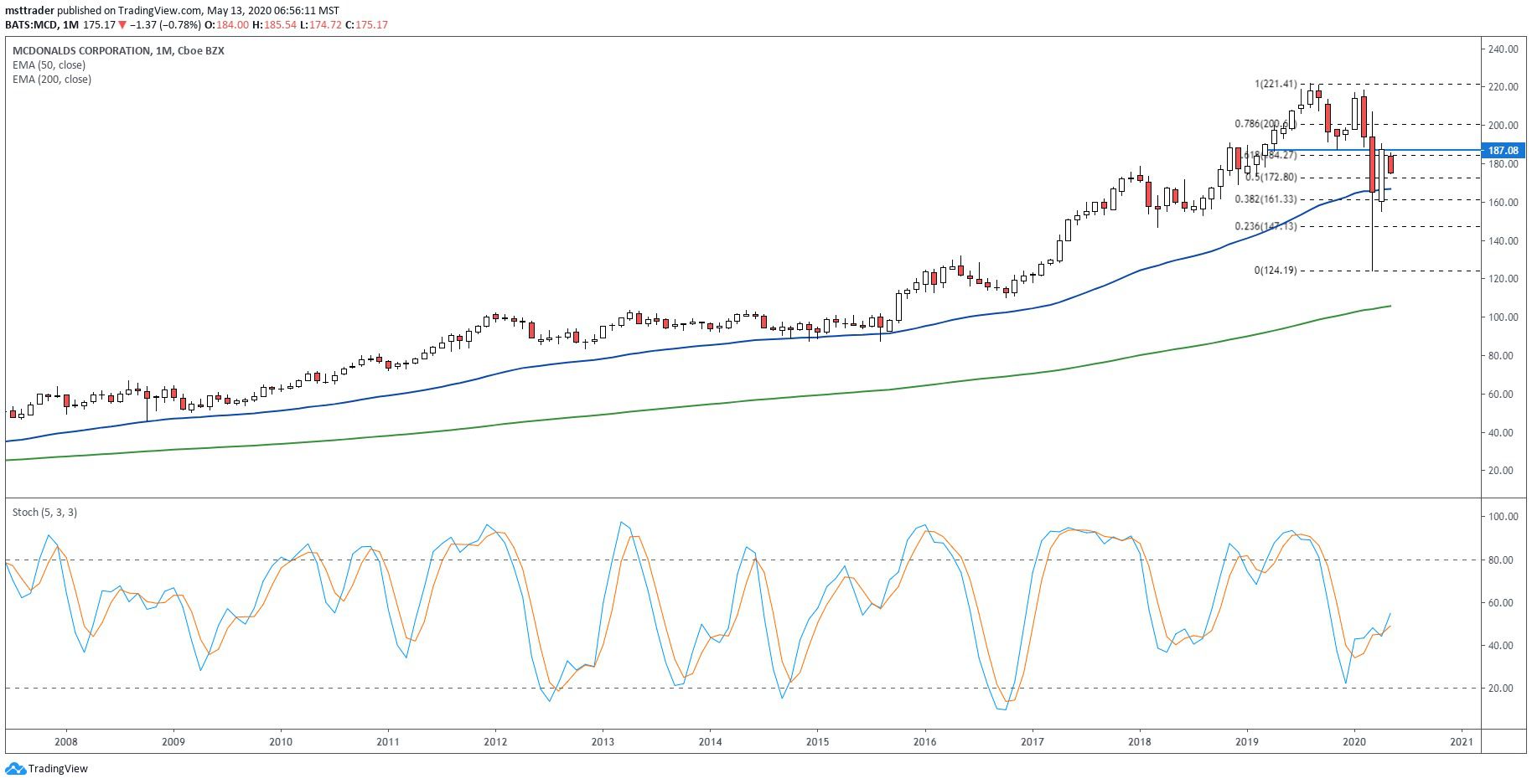

MCD Long Term Chart (2010 – 2020)

TradingView.Com

The stock broke out to new highs in 2010, entering into a strong uptrend that has stalled just above $100 in 2012. Several rally attempts have failed in the second half of 2015, when the all-day breakfast initiative has caught fire, that gives an escape, which sparked buying interest. Bullish price action carved a graceful series of higher highs and higher lows in 2019, culminating in August’s all-time high of $221.93.

A decline in November was bought, to the front of a slow upward movement that accelerated in the beginning of 2020. However, the rally resumed with a drop top, completing a double top breakdown in February. The subsequent fall of the cut, through the support of the 2018 and 2019 the bottom before ending at $124, the lowest since the month of February 2017. The monthly stochastic oscillator raised in a buying cycle right before peaking in January and kept rising status in the course of the 94 points of sale by highlighting the opposite nature of the current share price.

MCD Short-Term Chart (2017 – 2020)

TradingView.Com

The decline stretched if the .618 Fibonacci retracement of the 2012 to 2019 uptrend and has bounced back, reaching the .618 sell-off of retracement and 50-day EMA during the first week of April. This level also closely aligned with resistance at the double top breakdown and .236 retracement of the upward trend. The stock has fallen to a four-week low, but don’t look for a strong sell signal until it breaks the 15 April, the bottom and tries to fill the April 6, gap.

The balance volume (OBV), the accumulation-distribution indicator topped in April 2018, and tested this level when the price posted August 2019 the all-time high. The effort failed, but the buying pressure cleared the fence in January 2020, setting the stage for even more gains. However, the potential buyers are then directed to the outputs, the outbreak of the second failure in two years. OBV is now drifting lower and could test the 2019 and 2020, the hollow in the coming weeks.

The Bottom Line

Mcdonald’s stock could resume its downtrend at any time, by rewarding well-timed short sales.

Disclosure: The author held no positions in the aforementioned securities at the time of publication.

Source: investopedia.com