Trending Videos

Takeaways

- An investment group reportedly offered $5.8 billion to Macy's to take the department store chain private.

- The offer from Arkhouse Management and of Brigade Capital Management would price Macy's stock at $21, making it $21. 21% premium to Friday's closing price.

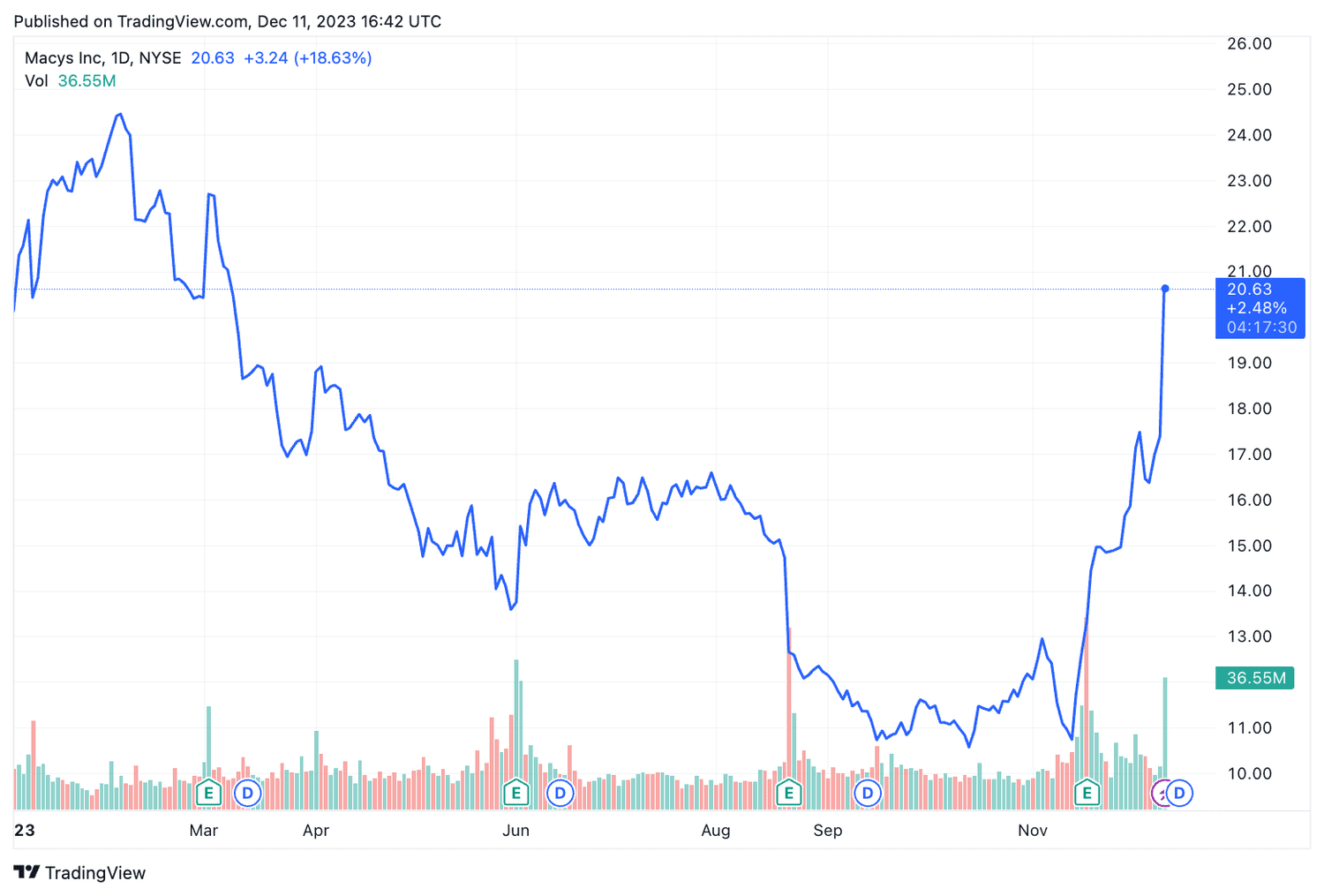

- Macy's shares soared on the news, but remained lower for 2023.

Shares of Macy's (M) soared more than 18% in early trading Monday following reports a group of investors is seeking to buy America's largest department store chain and take it private .

Arkhouse Management, which focuses on real estate investments, and global asset manager Brigade Capital Management have reportedly offered $5.8 billion for the iconic retailer. That works out to $21 per share, a premium of about 21% over Macy's closing price on Friday. A Wall Street Journal report also suggests that buyers could increase their offer based on due diligence.

Macy's has faced competition from online retailers, and last October its shares hit their lowest level in nearly three years. The company announced a three-year restructuring plan in June 2020 that included layoffs, store closures and $630 million per year in cost savings.

At the time, CEO Jeff Gennette noted that the retailer had been particularly hard hit by the COVID-19 pandemic and that Macy's “will be a smaller company for the foreseeable future, and our cost base will continue to reflect that as a result.” 'future “.

Last month, Macy's 39;s reported its third quarter sales fell 7% from a year earlier, with demand falling in its physical and online stores.

Macy's Stocks ; Shares were up 18.9% around 11:40 a.m. ET on the Monday following the news, putting them in positive territory for the year, with shares up 2.7% year to date. ;year.

investopedia.com