Lucid Group (LCID) shares surged by more than 9% in early trading Monday after the electric vehicle (EV) maker announced a technology partnership with Aston Martin.

KEY POINTS

- Lucid has entered into a technology partnership with Aston Martin worth $450 million.

- Shares of Lucid jumped more than 9% in early trading Monday after news broke. .

- The deal is the first of its kind for Lucid, allowing it to diversify its revenue streams.

In a deal worth $450 million, Lucid has entered into a long-term strategic partnership to integrate and supply high-tech drivetrain and battery systems to the iconic British automaker. As part of the deal, Aston Martin will give Lucid a 3.7% stake in staged cash payments in return for access to the technology.

Why is this agreement important to Lucid?

This agreement is the first of its kind for Lucid, allowing it to act as a supplier and diversify its revenue streams.

Thanks to him, American society will fuel future Aston Martin battery electric vehicles while providing technical support. In addition to Lucid's proprietary electric powertrain and battery technology, Aston Martin will receive its ultra-high performance dual-motor drive unit and revolutionary Wunderbox.

Earlier this year, Lucid cut its workforce by 18%, as part of a cost-cutting restructuring, affecting 1,300 employees. The plan, which is expected to be completed by the end of this quarter, is expected to result in $24 million to $30 million in charges related to employee transition, severance, benefits and base-based compensation. of actions.

Lucid ended the first quarter of 2023 with more of $3.4 billion in cash, cash equivalents and investments, and total liquidity of approximately $4.1 billion, which should provide ample liquidity through at least the second quarter of 2024.

Lucid and Aston Martin have a joint shareholder in the Saudi Arabian Public Investment Fund (FIP). PIF has invested approximately $3.6 billion in Lucid since 2018, including $915 million through a private placement in Q4 2022.

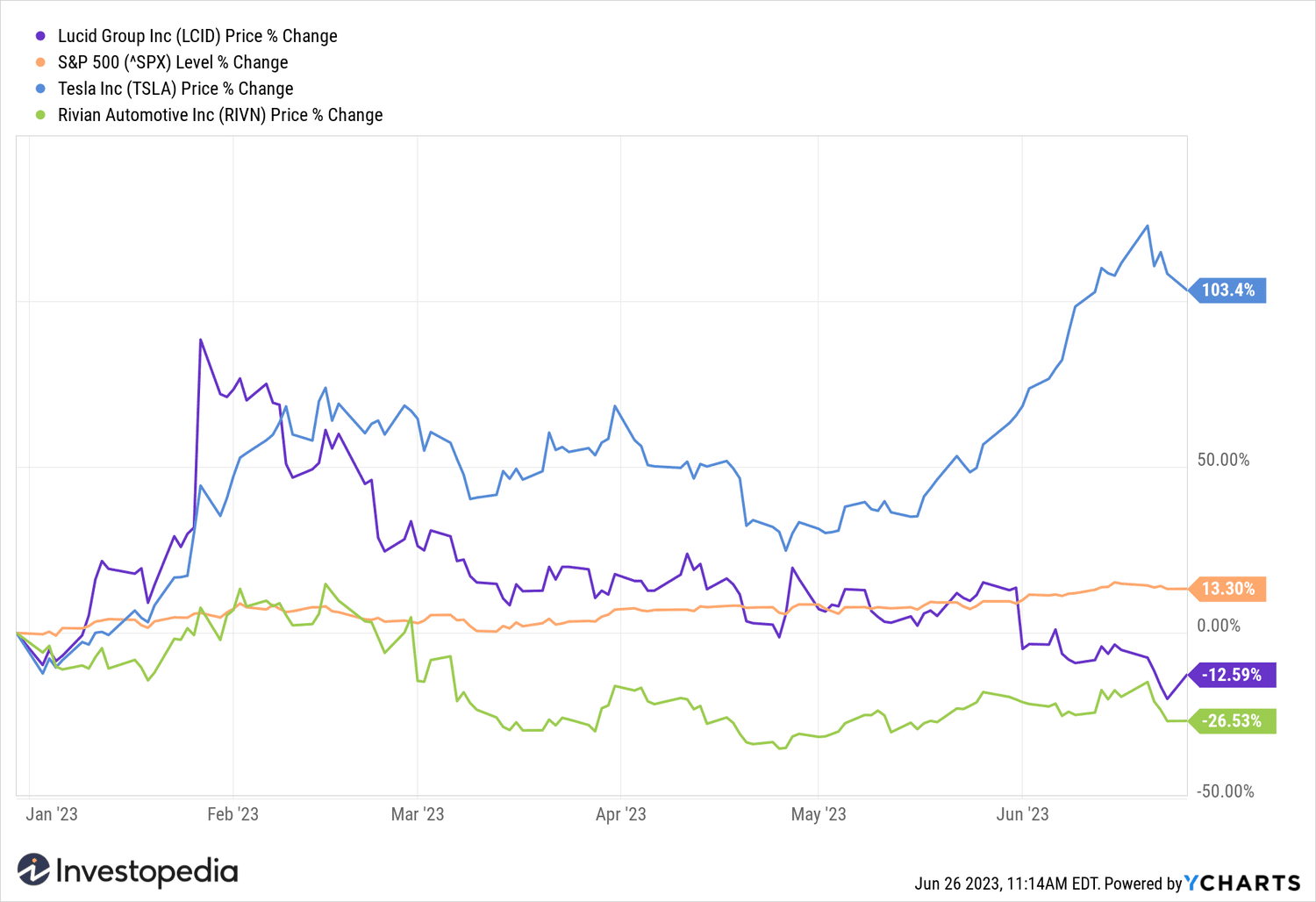

YCharts

Do you have any news tip for news reporters? 39; Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com