Lucid Group Inc. (LCID) shares fell nearly 12% on Wednesday after the luxury electric vehicle (EV) maker reported second-quarter deliveries well below expectations.

Key Takeaways

- Lucid's Electric Vehicle (EV) Deliveries in Second quarter were little changed from the first quarter, with analyst estimates missing.

- Production of Lucid's Air sedan fell from the prior quarter.

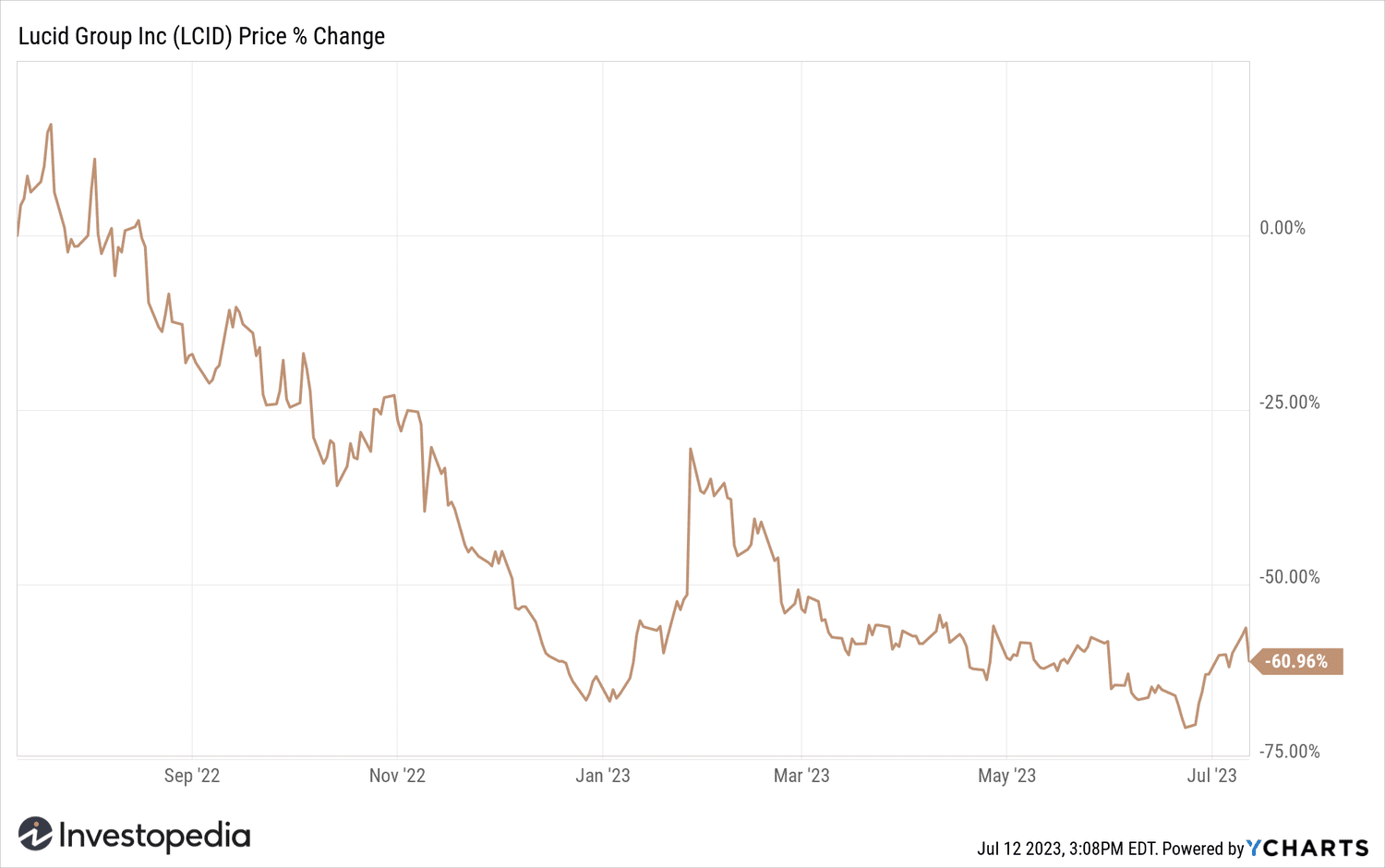

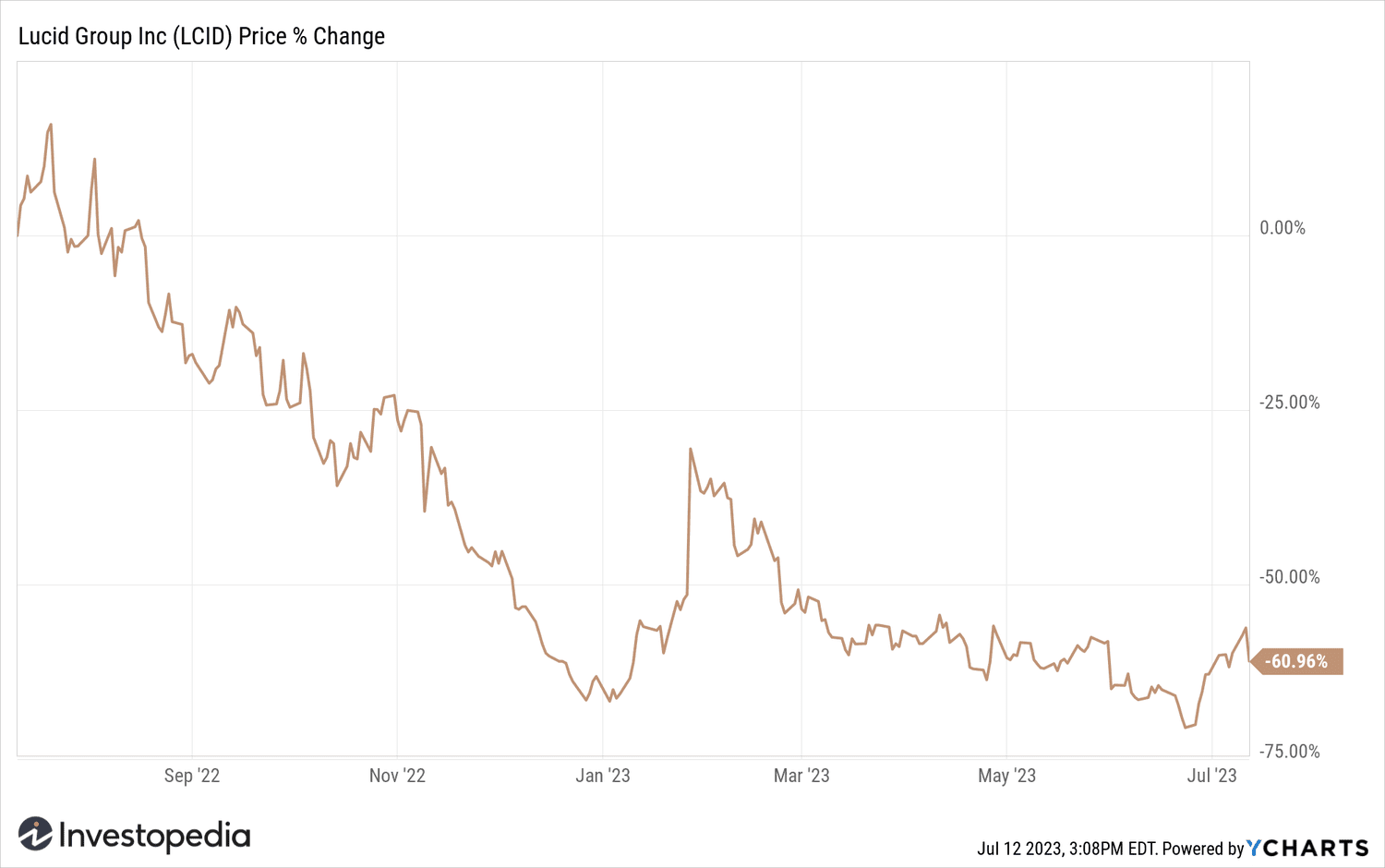

- Lucid shares fell 12% on Wednesday following the news. They have lost nearly two-thirds of their value over the past year.

The Air sedan maker said on Wednesday it had delivered 1,404 cars from April to June, almost the same number as in the first quarter (1,406), and well below the 2,000 cars expected by analysts.

Additionally, the company produced just 2,173 vehicles at its plant in Arizona, a 6% drop from the prior quarter. In February, Lucid said he expected to build 10,000 to 14,000 cars this year, although he said he had over 28,000 reservations.

Lucid's business has been hampered by security issues supply chain and pricing for its Air model, which starts at $138,000 before incentives.

The automaker also noted that; he had “started material shipments” to Saudi Arabia. The Saudi Public Investment Fund (PIF) is Lucid's largest shareholder, and in May the company announced it was raising $3 billion in a public sale of shares and thanks to an additional investment from PIF.

With Loss Wednesdays, Lucid Group shares have lost about two-thirds of their value over the past year.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com