Marathon Oil Corp. (MRO) will likely post net profit plunged and revenue fell for the second straight quarter in the first three months of the year as oil and natural gas prices slowed after a whirlwind in 2022. /p>

Key Points

- Marathon Oil is expected to post Q1 Adjusted EPS of $0.61 versus $1.78 in the prior year quarter.

- Revenue Could Fall For Second Consecutive Quarter At $1.7 billion.

- Marathon expected to have increased production, but gains likely offset by lower oil prices relative to 2022.

Marathon's net income could drop more than 70% to around $384 million, for adjusted earnings per share (EPS) of $0.61, from $1.3 billion, or $1.78 per share, in the prior year quarter, according to analyst estimates compiled by Visible Alpha. Revenue could fall nearly 5% year-over-year to $1.7 billion, its lowest point since mid-2021. Marathon reports results after markets close on Wednesday.

The big oil companies " annual profits doubled last year to $219 billion amid extreme price volatility and war in Ukraine. However, weaker fuel demand in Asia and Europe late in the year drove prices down, and oil and gas companies are entering 2023 under less favorable conditions.

Despite the difficult environment, Marathon is expected to have increased production in the last quarter. Analysts forecast total crude oil and condensate volume of more than 186 million barrels per day in the first quarter, up from 166 million a year earlier. Natural gas production is also expected to increase, from 626 million last year to more than 727 million cubic feet per day.

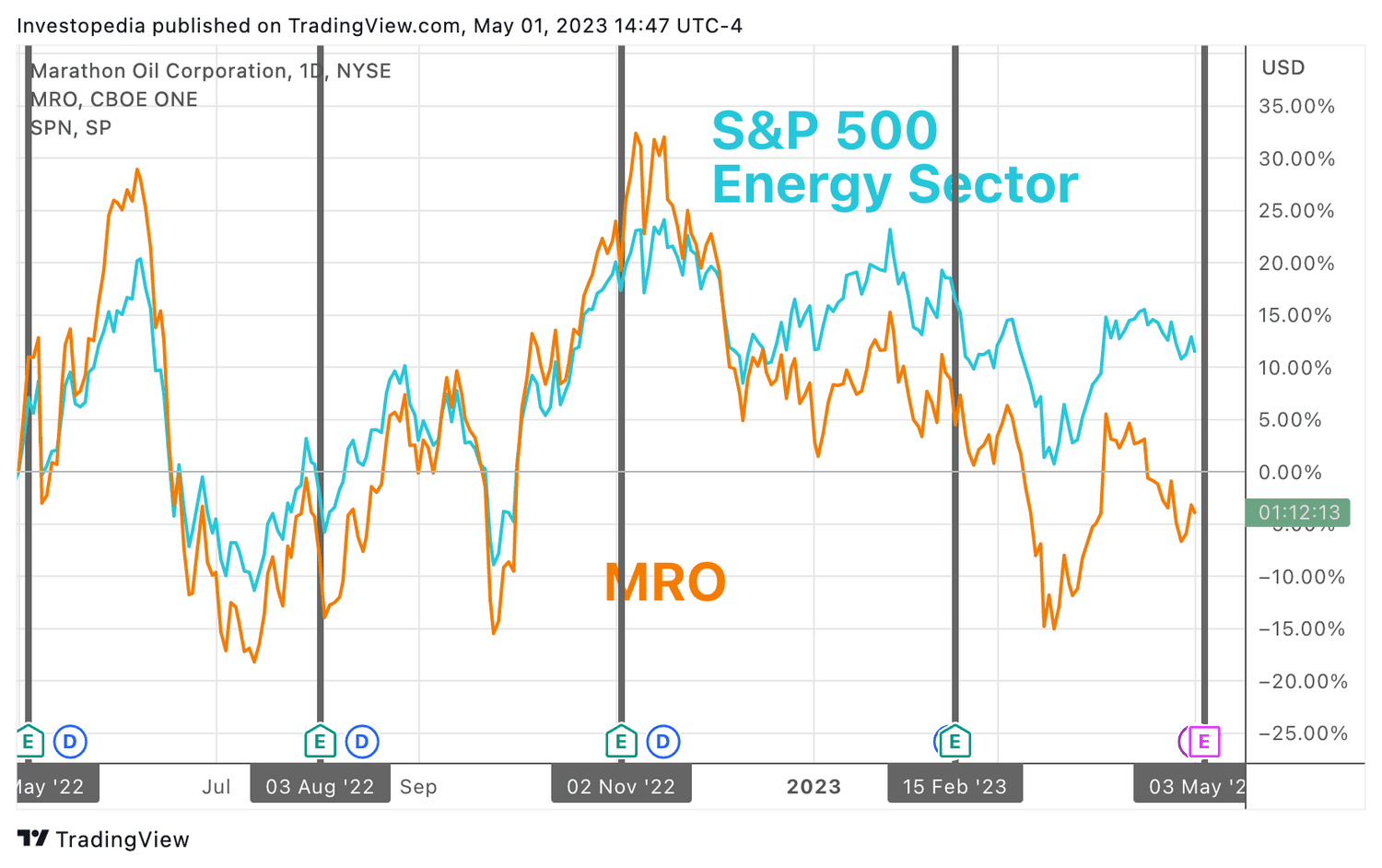

Marathon Oil shares are down about 4% in the past year, while the benchmark S&P 500 energy sector is up about 11%.

Source : TradingView. Marathon Oil Key Stats Estimate for the first quarter of fiscal 2023 Actual for the first quarter of fiscal 2022 Actual for the first quarter of fiscal 2021 Adjusted earnings per share ($) 0.61 1.78 0.12 Revenue (B$) 1.7 1.8 1.1

Source: Visible Alpha

Source: investopedia.com