Takeaways

- Logitech reported better-than-expected results and raised its outlook as it cut costs.

- The computer accessories maker reported profit almost twice as much as analysts expected.

- li>

- Logitech also gave an update on its search for a new CEO.

Shares of Logitech International (LOGI) climbed after the PC equipment supplier reported higher profits and raised its forecast for lower spending.

The maker of keyboards and other computer peripherals reported second-quarter fiscal 2024 earnings per share (EPS) of $1.09, up 30% from almost a year ago double what analysts expected. Sales fell 8% to $1.06 billion, but remained above forecasts.

Demand for computer accessories has declined since the COVID-19 boom, when lockdowns forced people to work and school at home. However, interim CEO Guy Gecht noted that the company “has made great strides toward returning to growth and has exceeded our pre-pandemic profit levels.” CFO Chuck Boyton added that “Logitech’s focus on cost discipline with a customer-first mentality is paying off, with market share growth in key categories.”

The company now expects its Full-year revenue will be between $4 billion and $4.15 billion, up from its previous forecast of $3.80 billion to $4 billion. It expects operating profit of between $525 million and $575 million, compared to an earlier estimate of $400 million to $500 million.

Logitech noted that during the For four months, the board undertook a global search for a new CEO to replace Bracken Darrell, who left in June after 10 years at the helm of the company to “pursue a another opportunity. Logitech said it is “getting closer to finalizing a decision.”

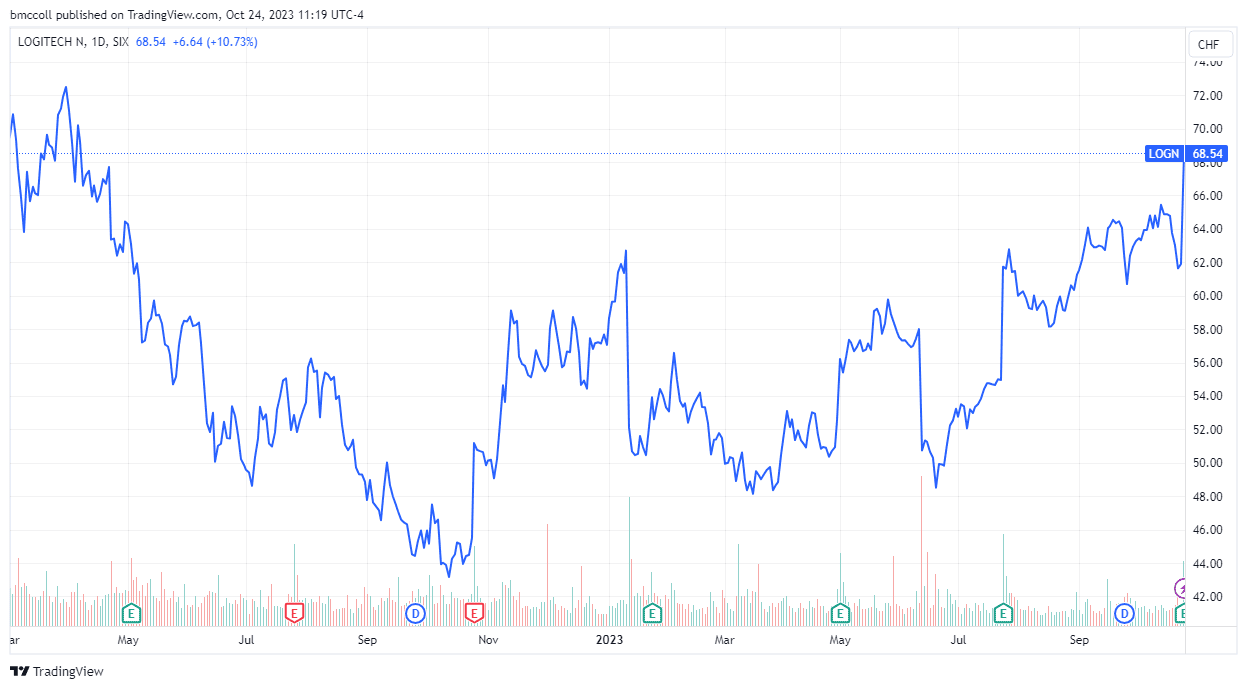

Logitech shares rose 10% at the start of the session on Tuesday, at their highest level in a year and a half after the news.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com