Key takeaways

- Levi Strauss missed its quarterly sales forecast and cut its full-year forecast as uncertain macroeconomic conditions weighed on consumer demand.

- Sales declined in North America and Europe, while strong growth in China boosted revenue in Asia.

- The company said economic pressures on consumers, as well as hot summer weather hurt sales.

Levi Strass & Co. (LEVI) missed its quarterly revenue estimates and cut its forecast as economic conditions weighed on consumer demand, sending shares lower in early trading Friday.

The manufacturer of its namesake jeans has published its results financials for the third quarter 2023 revenue of $1.51 billion, which was little changed from 2022. Analysts expected $1.54 billion. Earnings per share (EPS) of $0.28 was $0.01 higher than forecast.

Turnover fell by 5% in North America and 2% in Europe. It increased by 12% in Asia, with strong growth in China. Revenues from other brands increased 12%, with Dockers sales increasing 9% and Beyond Yoga sales increasing 25%. Direct-to-consumer sales rose 14%, but wholesale revenue fell 8%.

CEO Chip Bergh explained that consumers “ being under pressure” from an uncertain macroeconomic environment, as well as hot summer weather, had a negative impact on results.

Harmit Singh, Chief Financial and Growth Officer, added that “given the continued uncertainty in the macroeconomic environment, we are taking a cautious approach to our outlook for the fourth quarter.”

Levi now plans a full year revenue is expected to increase 1%, compared to an earlier forecast of 1.5% to 2.5% growth. It also said EPS is expected to be at the lower end of its forecast range of $1.10 to $1.20.

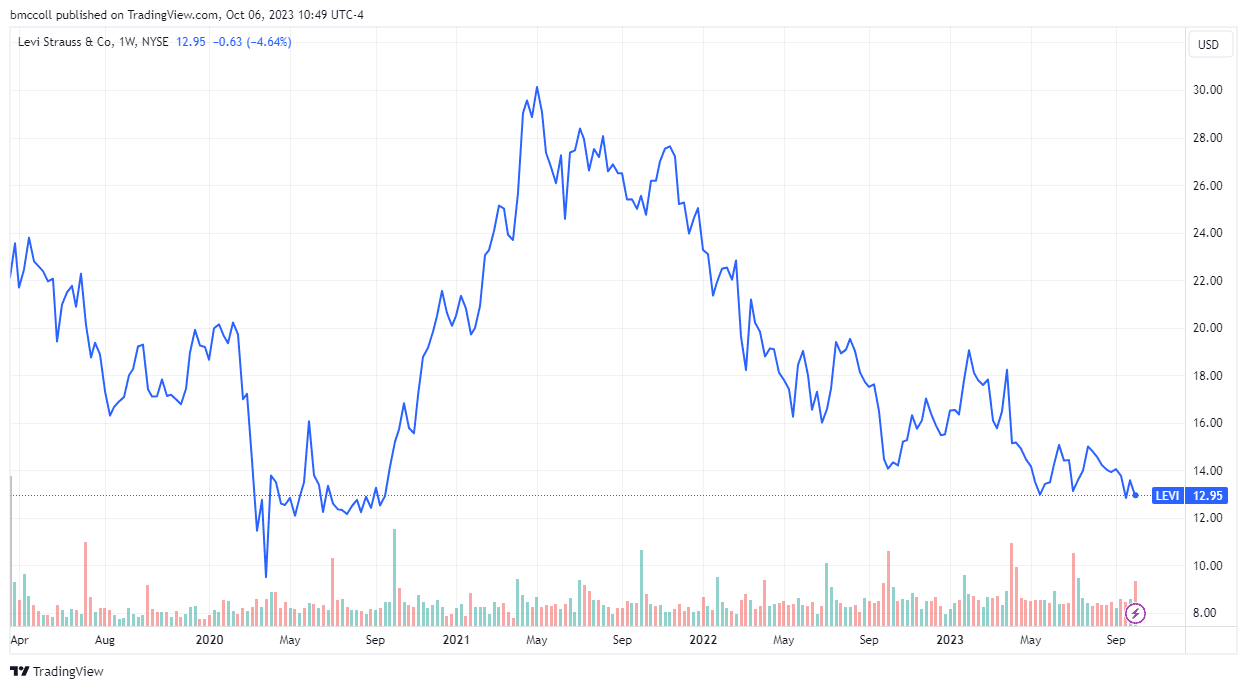

Levi Strauss shares traded near their three-year low reached last month after the news.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com