Farmer Brothers specialty roaster (FARM) does not The company fell short of its profit expectations for the quarter ended June 30, as slowing sales growth and persistently high coffee prices weighed on profitability amid an economic downturn. restructuring effort.

Takeaways

- The company reported a net loss of $79.18 million, or 84 cents per share, which beat projections of 61 cents per share.

- Slowing sales growth and persistently high coffee prices, which contribute to higher supply costs, have weighed on profitability over the past year.

- The company divested a coffee roasting facility and most of its direct delivery customers as part of a restructuring effort.

- Lower coffee prices could boost profitability by coming quarters by reducing the company's supply costs.

The company reported a net loss of $79.18 million, or 84 cents per share, which was higher than projections of 61 cents per share and well above a loss of $15.66 million. during the quarter of last year. Revenue rose 8% for the year to just under $340 million, but this was accompanied by a decline in gross margin, which is fell to 33.7% compared to 42.5% a year ago.

The last quarter ends a difficult year for the company , which is struggling with slowing sales growth due to a decline in discretionary spending, as well as persistently high coffee prices, which have led to higher supply costs. Even though prices per pound of coffee fell from their peak in early 2022, they were still 28% higher on average than their historical average last fiscal year.

Earlier this summer, Farmer Brothers sold its coffee roasting operations in Northlake, Texas, and the majority of its drop-shipping customers, as part of a restructuring effort to cut costs and pay down debt.

CEO Deverl Maserang has agreed to step down as part of a management shake-up, handing the reins to cafe director John Moore, who will become interim CEO on October 1. Executives are optimistic about the future of the coffee roaster and are confident. the last quarter marked a budgetary turning point.

“The company enters fiscal 2024 with our complete focus on a revitalized direct store delivery (DSD) business, a stronger balance sheet and a favorable coffee pricing environment,” said the outgoing CEO in a press release.

The company is also investing in artificial intelligence (AI) capabilities. Its AI-driven pricing engine, which uses data from 40,000 customers, has enabled the company to develop a streamlined pricing model and improve margins.

Farmer Brothers could also benefit from lower coffee prices in the coming quarters. Coffee futures have fallen more than 40% from their highs early last year and last traded at $1.59 a pound, down from to the peak of nearly $2.60 reached in February 2022. However, this compares to prices below $1 per pound in June 2020.

Coffee beans are the company's basic raw material used for roasting coffee. When their prices increase, this increases supply costs, and vice versa.

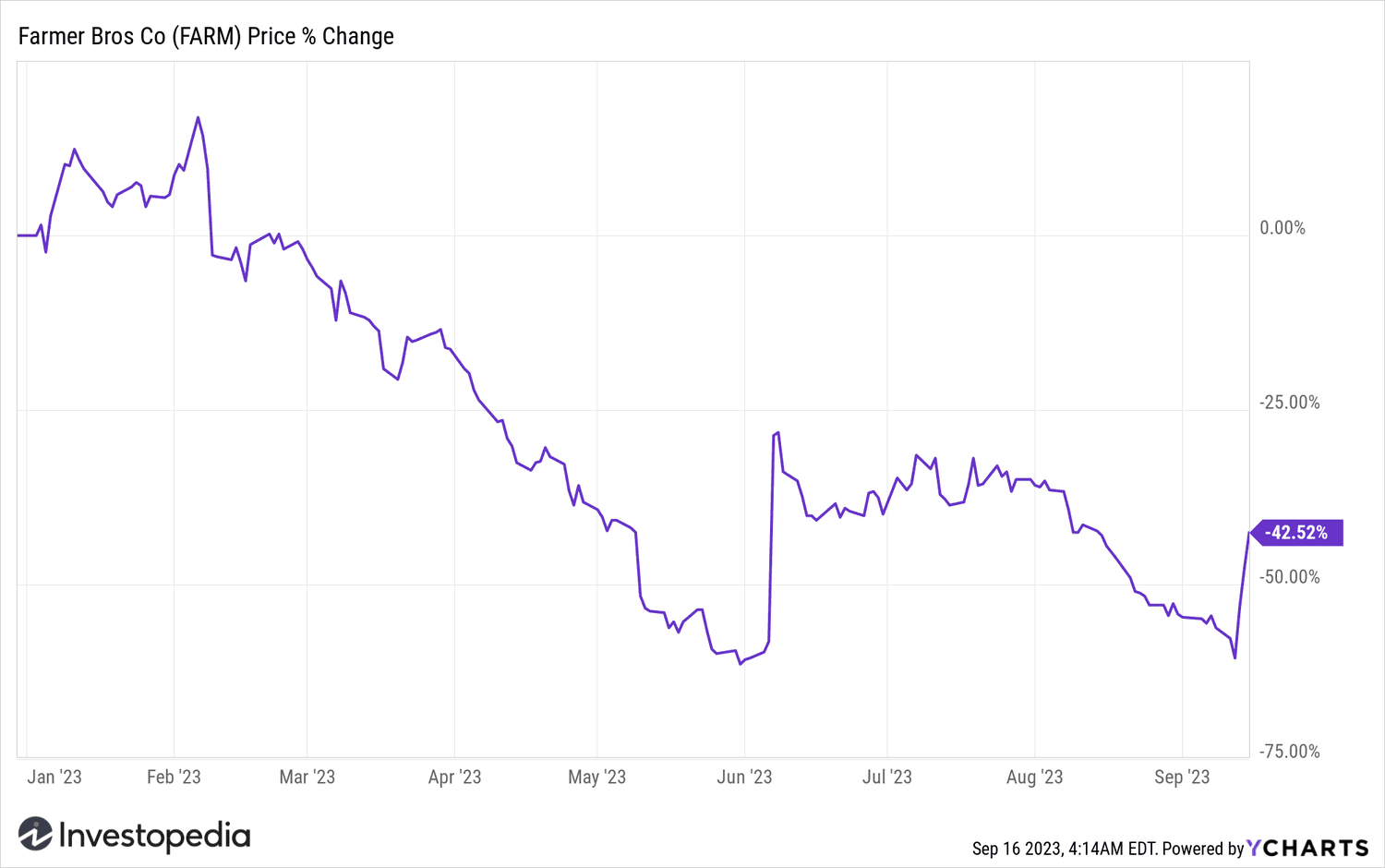

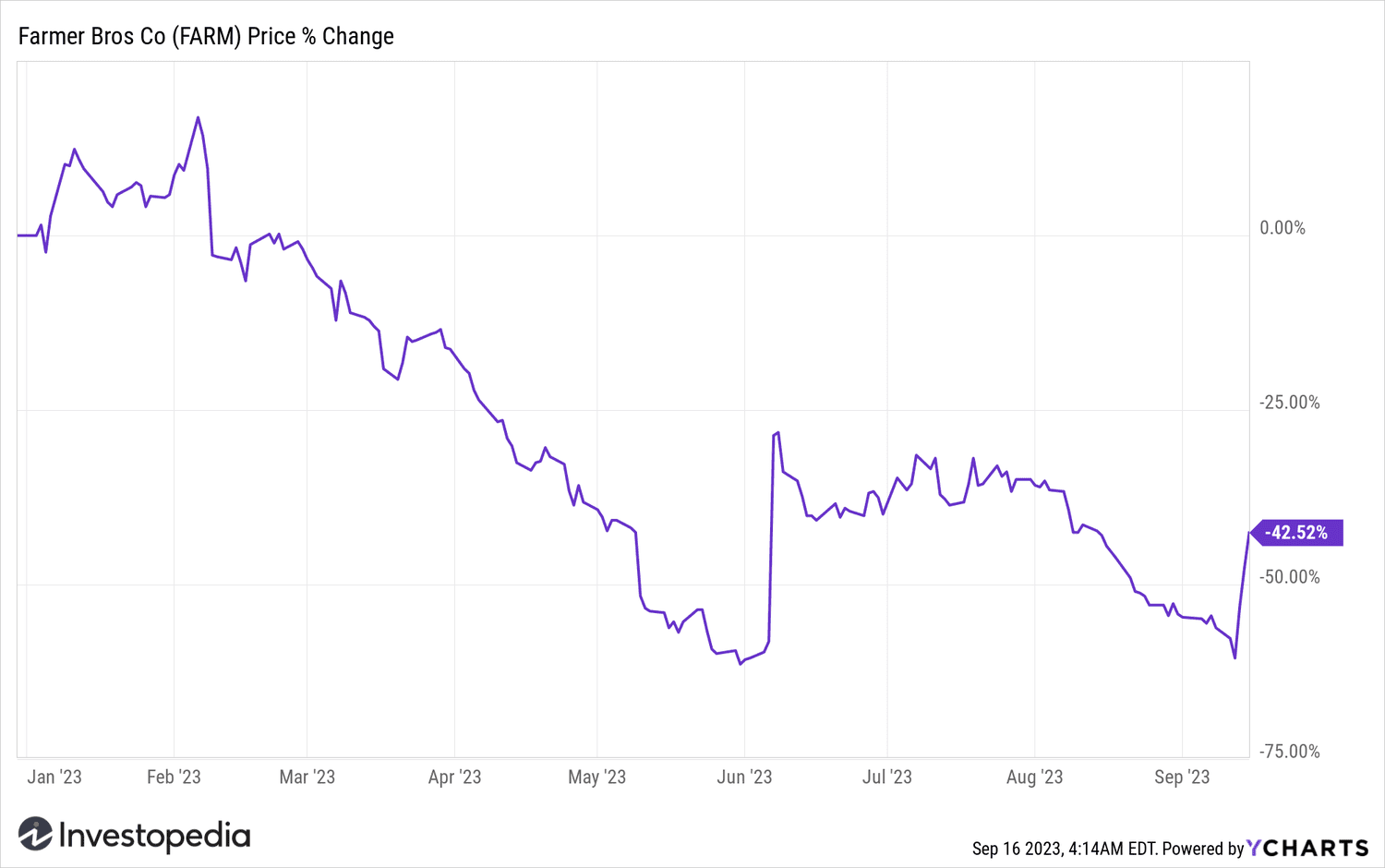

Farmer Brothers shares have jumped more than 12% on Thursday and is up more than 30% since Monday. However, they have lost almost half their value this year.

YCharts

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com