L Brands, Inc. (LB) shares rose over 1% during Tuesday’s session after BMO Capital upgraded the stock to Outperform with a price target of $17.00 per share, which represents a significant premium of approximately 40% compared to yesterday’s closing price.

Analyst Simeon Siegel believes that the noise will dissipate and it will be more difficult to ignore the underlying fundamental value of the owner of victoria’s Secret and Bath & Body Works. Siegel believes that the stock could have 50% to 70% of potential upside that the company is working to resolve it-even in the midst of the hustle and bustle of the market.

The analyst the upgrade comes a day after Sycamore Partners, the investment projects in Victoria’s Secret has been cancelled. Despite the agreement falling through, The Brands management and board remain committed to the establishment of Bath & Body Works as a pure-play and take action to prepare victoria’s Secret to run as an independent director of the company.

Analyst of Wedbush Jen Redding has also warned that The Marks of the debt, the capital ratio of 1.37 x creates a lot of uncertainty about its ability to stay afloat in the medium-term and long-term, although the April 24 amendment to its revolving credit facility serves as a relief in the short-term liquidity risks.

TrendSpider

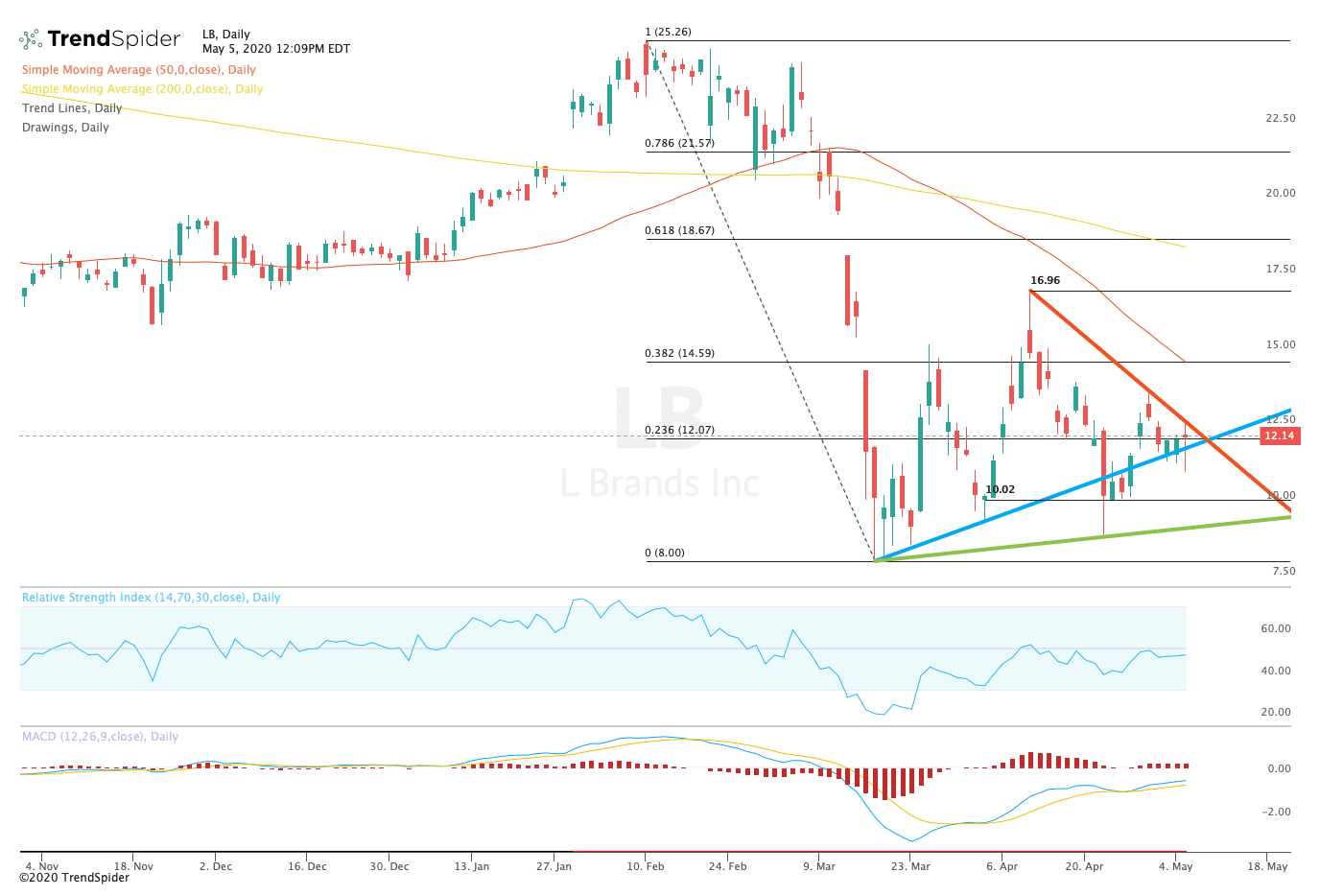

From a technical point of view, the stock has been trading in an increasingly narrow price range since mid-March. The relative strength index (RSI) remains neutral with a reading of 46.68, but the moving average convergence divergence (MACD) remains in a bullish trend in the direction of the zero line. These indicators suggest that the stock could have more room to run.

Traders should watch for a breakout from the consolidation pattern of the reaction of the vertices of $17.00 or the 200-day moving average at around $18.00. If the stock breaks down, traders could see a movement to test again the support at $10.00 or higher of the order of $8.00 in the coming sessions. The news from Sycamore Partners, and BMO Capital creates some uncertainty as to the direction.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com