Investors in Kohl (KSS) had a pleasant surprise while the department store chain posted an unexpected quarterly profit.

The retailer posted first-quarter earnings per share (EPS) of 13 cents, as analysts had expected a loss of 42 cents. Revenue fell 3.3% to $3.36 billion, which was slightly better than expected. Same-store sales were down 4.3%, also slightly better than forecast.

CEO Tom Kingsbury attributed the results to a 6% reduction in inventory, improved store productivity and continued sales momentum at his Sephora stores inside Kohl locations. He said the gains “represented a first step as we strive to drive long-term sales and earnings performance.”

Recovery plan

Kingsbury officially took over as CEO in February 2023 and introduced a turnaround plan for the company, which had been plagued by falling sales and falling share prices. Kohls had been under pressure from activist investors Ancora Holdings and Macellum Capital to boost the retailer's fortunes, including calling for the ousting of Kingsbury's predecessor Michelle Gass. She left in December 2022 to direct Levi Strauss (LEVI). The retailer also had discussions last year with the owner of Vitamin Shoppe Franchise Group (FRG) about selling the business, but ultimately ended the offer.

Kingsbury added that &# 34; there is still work to be done," and the macro environment “remains difficult”. He explained that this is why Kohl's reaffirms its full year sales guidance down 2% to 4%, with EPS between $2.10 and $2.70. .

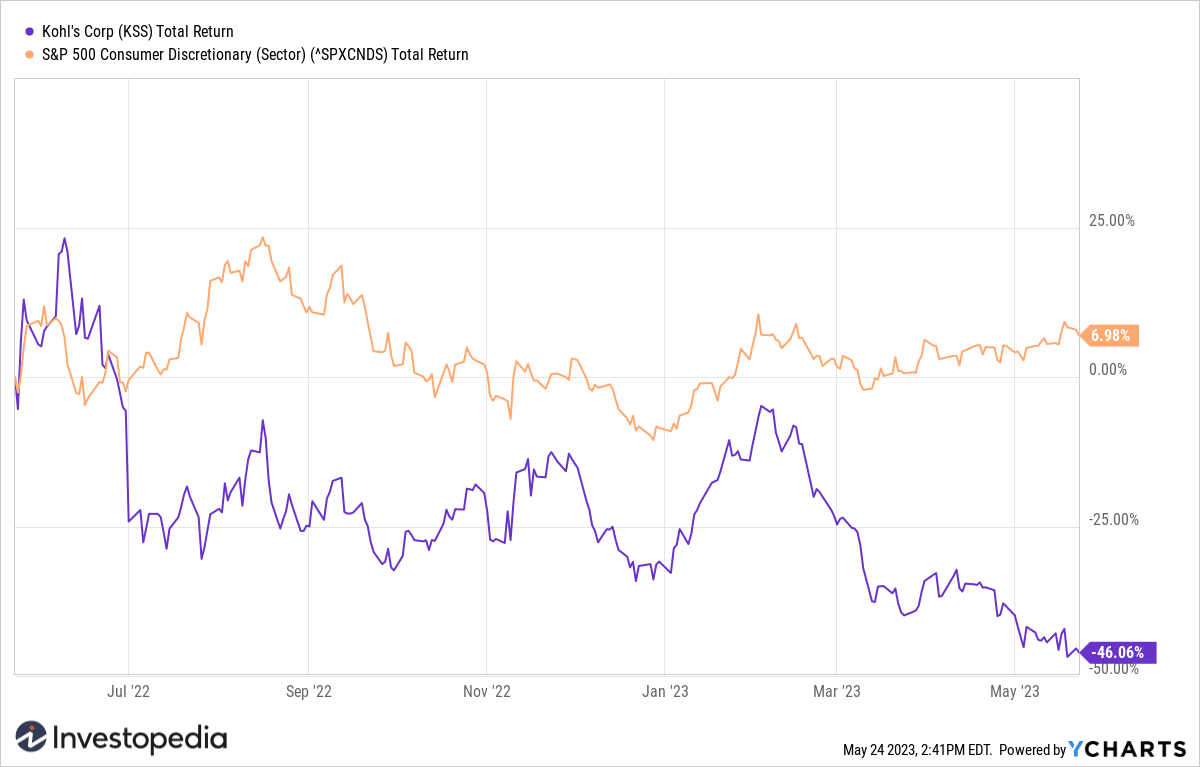

Kohl's shares rose 6% starting at 2:30 p.m. Eastern Time Wednesday. However, they have lost 46% of their value over the past year, far underperforming the broader consumer discretionary sector, which has risen 7% over the same period.

YCharts

Source: investopedia.com