Key Points

- JPMorgan Chase (JPM) posted record first-quarter 2023 revenue, pushing its shares higher on Friday.

- The largest bank in the United States by assets said a net income of $12.62 billion in the first quarter, compared to $8.28 billion a year ago.

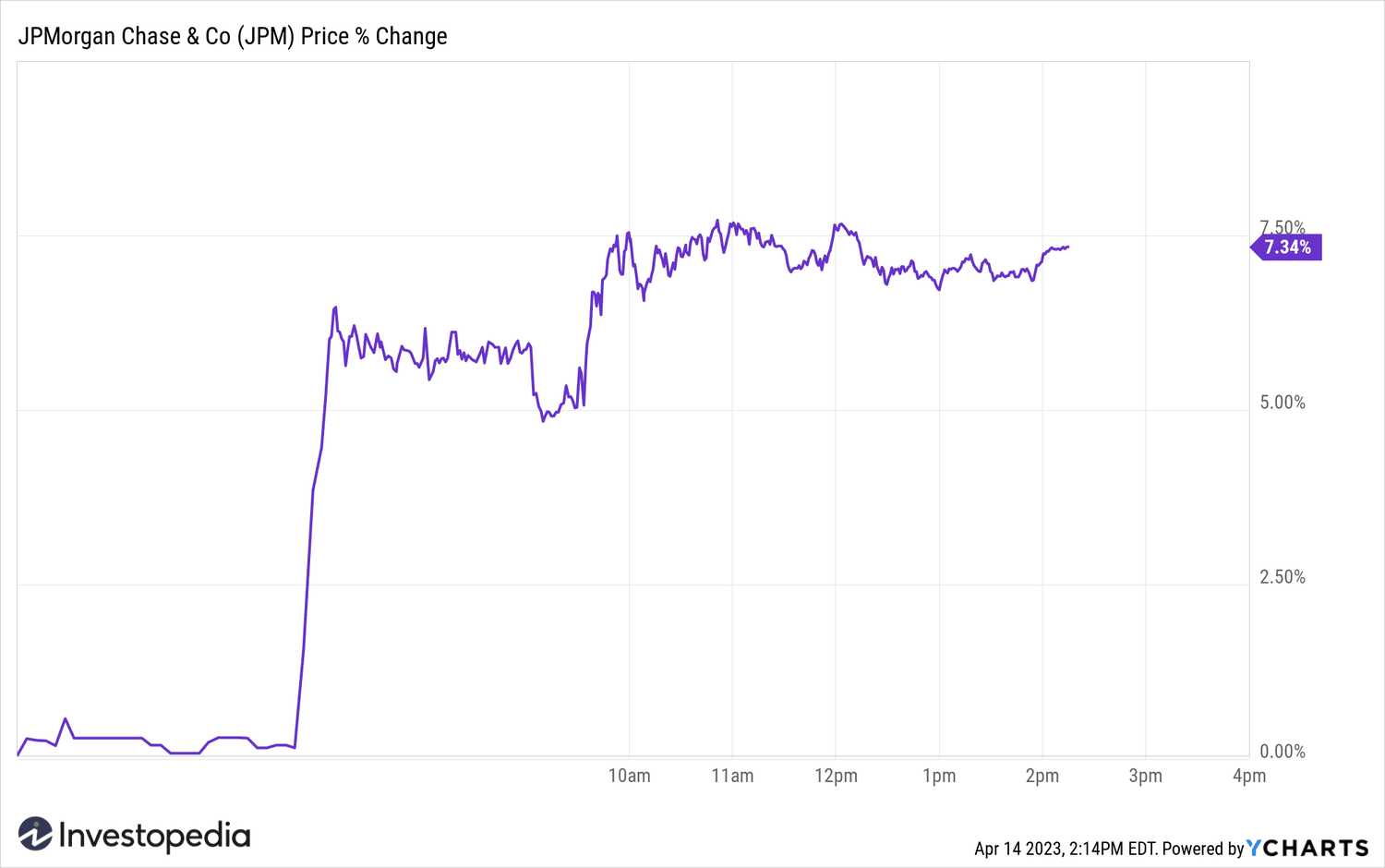

- JPMorgan shares gained more than 7% following the ;announcement at the start of trading on Friday.

Other banks reporting in the coming weeks may find it difficult to keep pace with JPMorgan Chase (JPM), which reported record first-quarter 2023 revenue on Friday, sending stocks soaring .

JPMorgan blew by the estimates analysts, propelled by earnings from higher interest rates. The largest bank in the United States by assets reported net income of $12.62 billion in the first quarter, compared with $8.28 billion a year ago.

Earnings per share hit $4.10 , a 56% jump from a year ago. Earnings were well above analysts' projections, which said the bank posted earnings per share of $3.43.

JPMorgan results were aided by the Federal Reserve's interest rate hike campaign to curb inflation, which helped the bank increase its net interest income by 49%.

JPMorgan shares surged up more than 7% on the news in early trading Friday.

Y-Graphics

Y-Graphics

Source: investopedia.com