Key Takeaways

- Analysts estimate EPS of $1.08 vs. $2.82 in Q2 2019.

- The net interest margin is expected to fall year-on-year.

- Revenue seen rising in Q2, but the decrease for the full YEAR 2020 in the middle of COVID-19 spin-offs.

JP Morgan Chase & Co. (JPM), by far the largest U. S bank with a $ 290 billion market value, is considered a barometer of the financial services industry and the economy in general. The bank’s outlook has weakened significantly this year. JPMorgan stock is down more than 30% by 2020, higher than the spread COVID-19 crisis has shut down large parts of the AMERICAN economy, badly hurt JPMorgan and the whole of the banking industry. In an unusually grim forecast, JPMorgan in April, said that the GDP could drop by 40% in Q2.

Investors will closely monitor how these changes affect JPMorgan when the bank reports earnings on the 14th July for the 2nd quarter of the FISCAL year 2020. For the quarter, analysts expect an earnings per share (EPS) to dive for the second straight quarter, even as revenue rises compared to the same quarter a year ago.

Another objective of the investors will JPMorgan’s net interest margin, which measures the difference between the net interest income of the bank JP Morgan wins on its loans and the outgoing interest it pays to customers for cash, including savings account holders. This margin is expected to fall to 2.18% from 2.49% in Q2 of FISCAL year 2019.

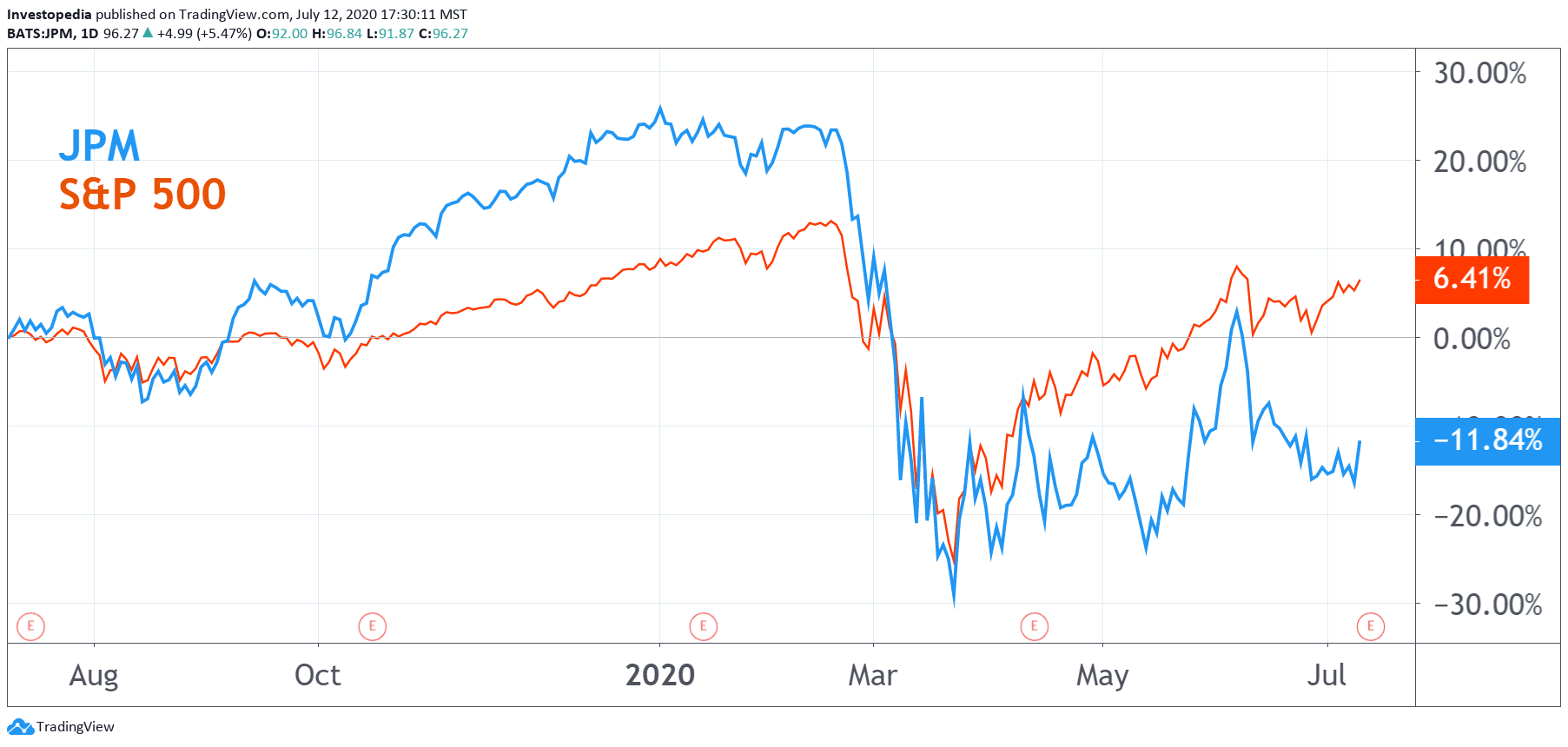

These trends have had a major impact on JPMorgan’s stock performance. While the stock has risen sharply in the second half of 2019 in the middle of a robust economy, it has plunged this year. As a result, the stock has greatly underperformed the broader stock market, posting a total return of -11.8% compared to 6.4% for the S&P 500.

Source: TradingView.

On 14 April, JP Morgan reported earnings per share for the Q1 of the YEAR 2020 has fallen to 70.4%, the first EPS decline in nine quarters. EPS significantly missed analyst estimates. Revenues were also down 3% year on year (yoy). The biggest news of the Q1 for the publication of the results has been the decision of the bank to add $ 6.8 billion of its reserves for losses on loans. CEO Jamie Dimon said the additions to the reserves for losses were needed to pay for a potentially expensive default throughout its vast portfolio of loans.

Looking at JPMorgan’s Q2 performance in recent years, EPS growth has been very strong. The growth in EPS is increased by 17.9% in FISCAL 2017 Q2 22.9% growth in the 2nd quarter of 2019. On the other hand, in the Q2 of the YEAR 2020 analysts expect EPS to decline from 61.7%, while income increases of 3.5% compared to a year ago.

JPMorgan Chase Key Actions

Estimate of the Q2 2020

Q2 2019

Q2 2018

Earnings Per Share ($)

1.08

2.82

2.29

Revenue ($B)

29.8

28.8

27.8

The Net Interest Margin (%)

2.18

2.49

2.48

One of the most important measures for investors to look at when evaluating JP Morgan’s earnings is its net interest margin. In order to be profitable, banks must ensure that they are constantly lending money at rates higher than what they pay for their own source of funding. The net interest margin is a key element of the gauge that indicates how much a bank can profit and prosper in the long term, and allows investors to determine whether the company’s own shares. In 2020, the banks net interest margins have been under enormous pressure from the Federal Reserve and central banks around the world have cut rates in an attempt to support the economy. However, the weakness of the economy is to strengthen the loss of jobs, making it more difficult for banks to charge higher interest rates on certain products.

In the midst of a strong economy, JPMorgan’s net interest margin has increased from 2.33% in Q1 of FISCAL 2017, to reach a peak of 2.57% in Q1 of FISCAL 2019. But in the three quarters of Q3 2019 Q1 FY2020, net interest margins have decreased year-on-year.

Analysts expect performance to get worse in Q2 of FISCAL year 2020. If the analysts are correct in their consensus estimate of a 2.18% net interest margin in Q2 of FISCAL year 2020, which would be the lowest margin posted by JP Morgan in at least 14 quarters.

Source: investopedia.com