Johnson & Johnson (JNJ) will sell at least 80.1% of its shares in consumer healthcare company Kenvue (KVUE) through an exchange offer, the company announced on Monday.

J&J shareholders will have the option of exchanging all, some or none of their common stock for Kenvue stock at a 7% discount.

KEY POINTS

- Johnson & amp; Johnson is offering shareholders the option to exchange shares for Kenvue at a 7% discount.

- Consumer healthcare company Kenvue has spun off from Johnson & Johnson in May.

- J&J and Kenvue both reported better-than-expected second quarter results on resilient demand for their products.

Johnson & amp; Johnson owned approximately 90% of Kenvue shares before initiating the exchange offer. Kenvue was Johnson & Johnson's Consumer Health business before it was separated by an initial public offering (IPO) in May as part of a strategic move to make both companies more agile and create long-term value for their respective shareholders.

In the IPO filing, J&J had agreed not to distribute shares for 180 days after the April prospectus filing without the consent of lead underwriters Goldman Sachs and JPMorgan Securities.

J&J and Kenvue both reported better-than-expected second-quarter results as demand for J&J's medical technology products increased and consumer spending on Kenvue's brands such as Band-Aid and Tylenol held up. For Kenvue, this was the first quarterly earnings report since its IPO.

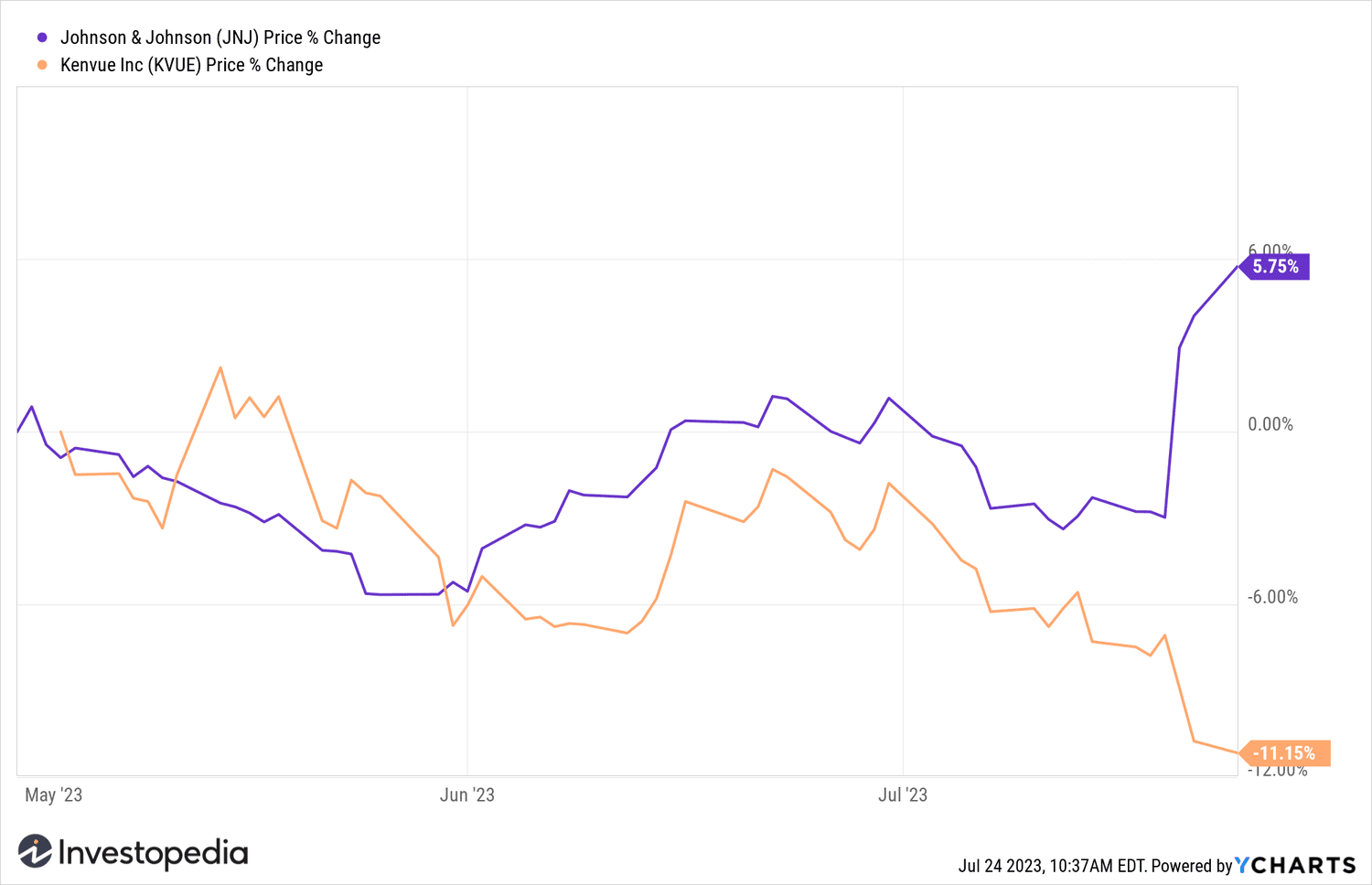

Kenvue shares fell about 0.3% in early trading Monday after the announcement and are down about 11% year-to-date, while Johnson & Johnson shares are up around 1.7% and 5.8% for the year so far.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com