Air taxi company Joby Aviation (JOBY) announced Monday that it was building a new manufacturing plant in Dayton, Ohio, that will be capable of delivering up to 500 planes a year and generating about 2,000 jobs.

Takaways Keys

- Air taxi company Joby Aviation is building a new facility in Dayton, Ohio, that could deliver 500 planes a year and generate up to 2,000 jobs.

- Construction is expected to begin next year and be completed by 2025.

- Construction is expected to begin next year and be completed by #39;by 2025.

- li>

- Starting in 2025, Joby plans to operate its aircraft as part of aerial ride-sharing networks in cities around the world.

The new facility will be built at Dayton International Airport and will cover 140 acres. Construction is expected to begin next year and be completed by 2025.

Joby's decision to build in Dayton is important for historical reasons. The city is the birthplace of aviation and is home to inventors Orville and Wilbur Wright who created and flew the world's first airplane. The Wright brothers developed and perfected their invention over years of work in their Dayton workshop.

Ohio Gov. Mike DeWine hailed Joby's decision as the start of a “new era in aircraft manufacturing and air mobility in Dayton,” he said. and said the company's air taxis will “redefine urban transportation and contribute to a fundamental change in the way people and goods travel.”

Joby Aviation is a California-based aviation company that manufactures electric vertical takeoff and landing (eVTOL) aircraft for use as an air taxi service. The company's aircraft are designed to carry four passengers and a pilot at speeds of up to 200 miles per hour for a distance of up to 100 miles. Starting in 2025, Joby plans to operate the aircraft as part of air ride-sharing networks in cities around the world, building on its existing partnerships with Delta Air Lines (DAL) and Uber (UBER).

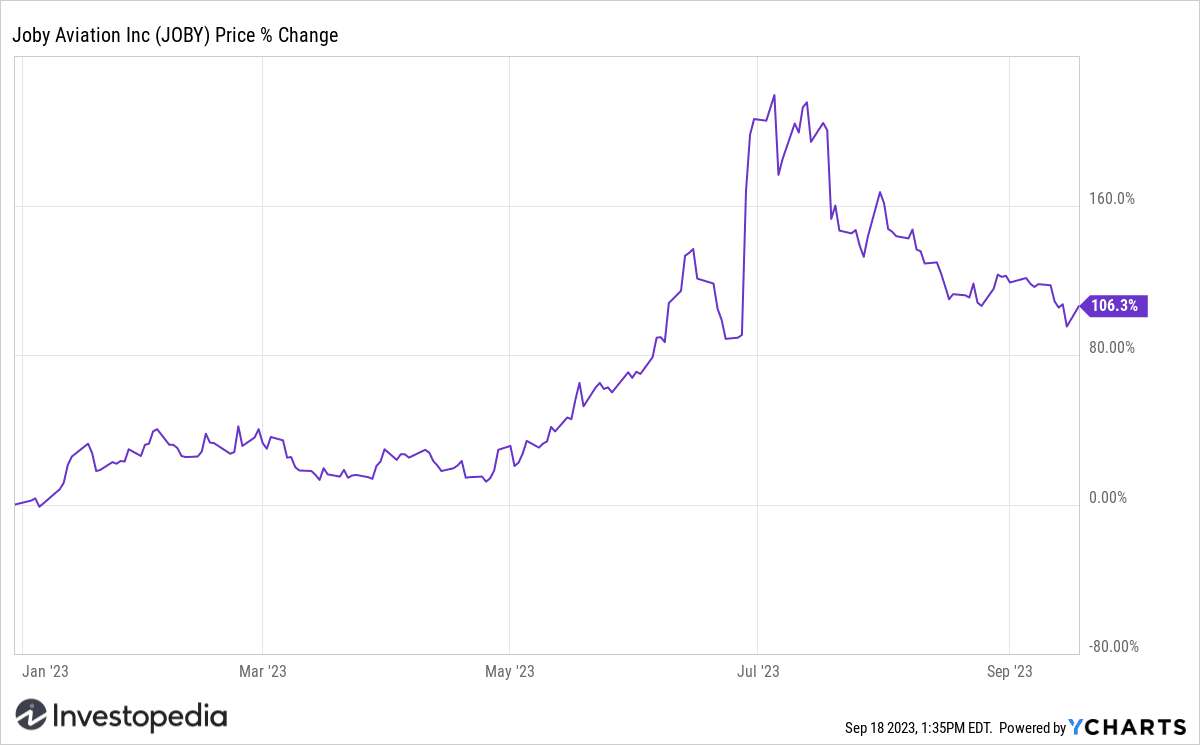

Joby shares are ;were trading 5% higher as of 3:00 p.m. ET Monday, and have more than doubled so far this year. However, they are worth about a third less than their IPO closing price of around $11 per share in August 2021.

YCharts

Do you have any advice news for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com