Takeaways

- Jefferies has warned that sales at Nike and other retailers could be hurt by the end of the student loan repayment moratorium.

- A recent study by the company showed that A huge percentage of those with outstanding student debt worry about being able to pay their bills.

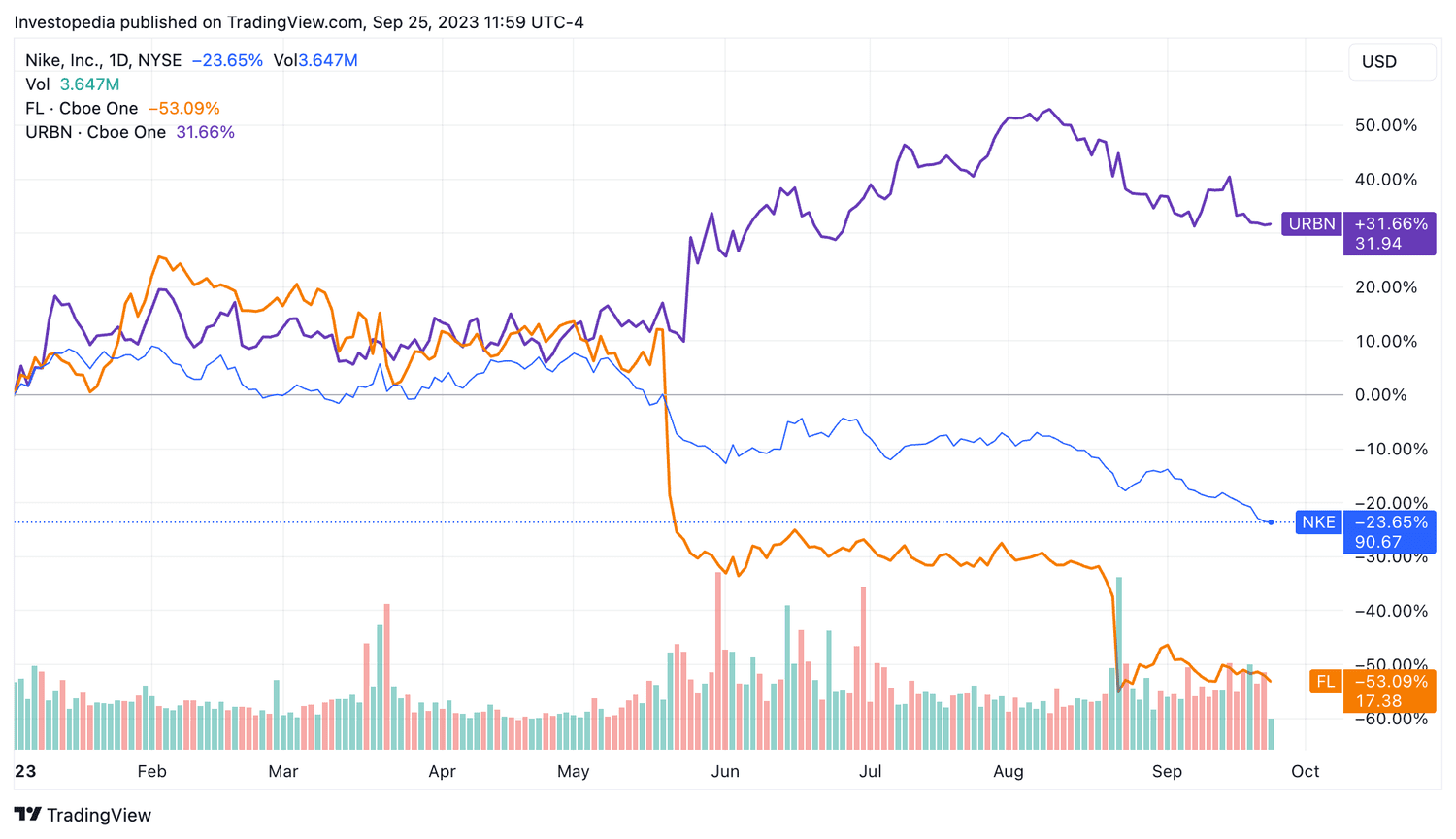

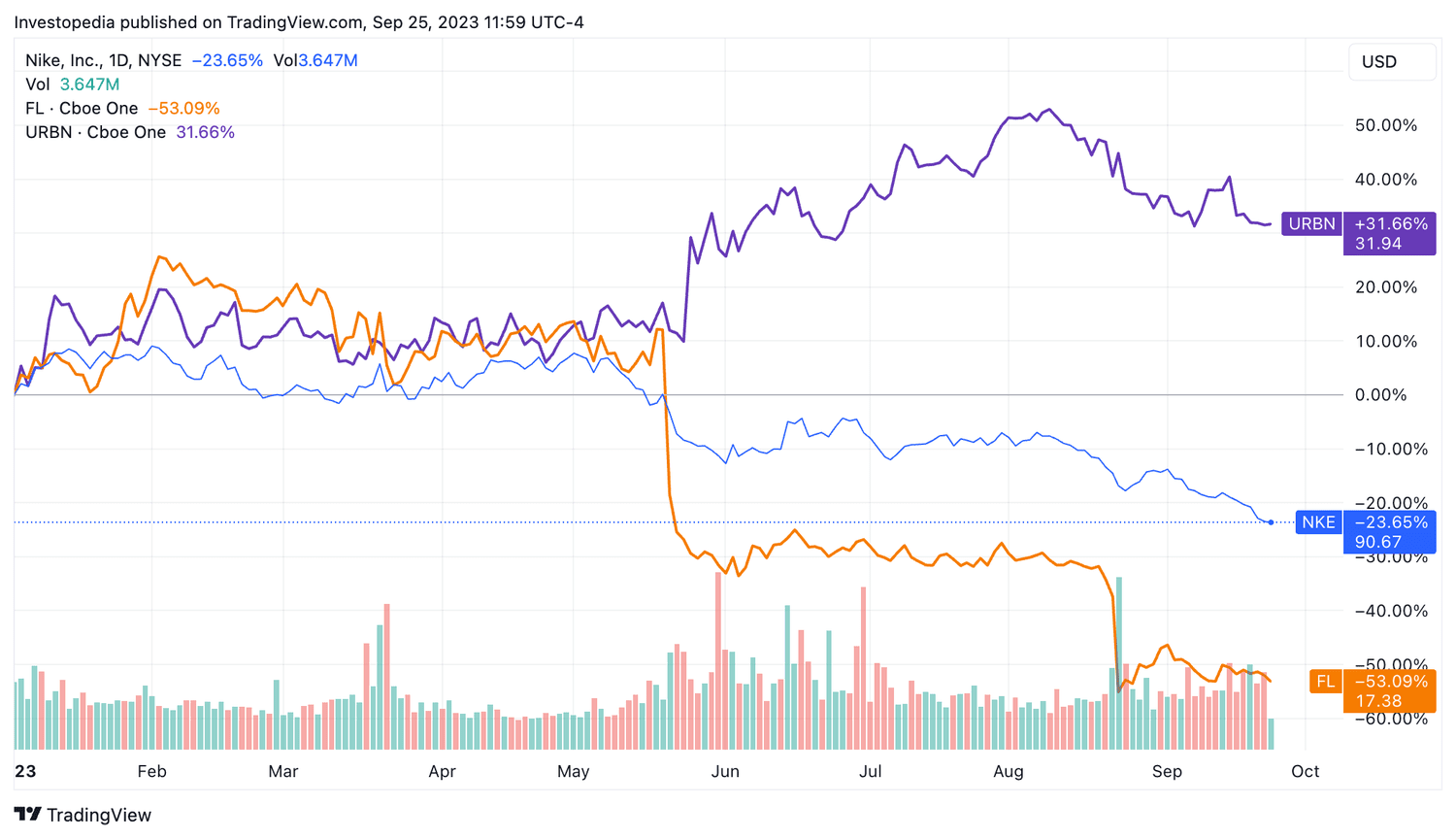

- Jefferies has downgraded Nike, as have rivals Foot Locker and Urban Outfitters.

Shares of Nike (NKE) were lower in early trading Monday after Jefferies indicated the sportswear retailer's sales could be affected by the end of student loan debt. moratorium on reimbursements reduces spending by young customers.

Analyst Randal Konick pointed to a survey showing nearly 90 percent of respondents with unpaid student debt were somewhat worried about being able to keep up with their monthly bills.

In April, Jefferies US economist Tom Simmons warned of a “student loan cliff,” leading to an $18 billion monthly reduction in consumer spending power. Simmons said restarting loan payments would result in a total drag of 0.9% on personal income this year.

The moratorium suspending payments and interest on most student loans was put in place in March 2020 as an emergency measure to stimulate the economy when the COVID-19 crisis hit. However, the Supreme Court ruled in June against President Joe Biden's plan to cancel student debt and triggered repayments to begin October 1.

Konick also suggested that in addition to pressure from debt repayments, Nike could face headwinds from China due to unstable sales trends in that region.

He downgraded Nike, as well than rival retailers Foot Locker (FL) and Urban Outfitters (URBN), to “hold” rather than “buy.”

Nike shares traded down over the previous six sessions and reached its lowest level since November. Shares of Foot Locker and Urban Outfitters also fell.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com