JD.com, Inc. (JD) shares rose more than 5% during Monday’s session after analysts reacted to Friday’s better-than-expected first-quarter results. China is the largest retailer in revenue, which increased by 20.7% to $ 20.6 billion and non-GAAP net income of 28 cents per share in the first quarter, beating consensus estimates by $ 1.35 billion and 19 cents per share, respectively. Management of the city COVID-19 relating to the demand for online shopping as a key element of the growth, with the active customer accounts, an increase of 25% to 387.4 million.

Analysts have reacted favourably to the strong financial results and the outlook for the next quarter. Reference Fawne Jiang reiterated the company’s Buy rating on JD stock and has raised its price target to $66 per share, saying that JD was still in the early stages of several years of above-average industry growth and margin expansion. Barclays Gregory Zhao has maintained the firm’s Overweight rating on JD shares and has raised its target price from 59, saying: ‘offline to online shift as the pandemic accelerated, could extend beyond the end of the pandemic period.

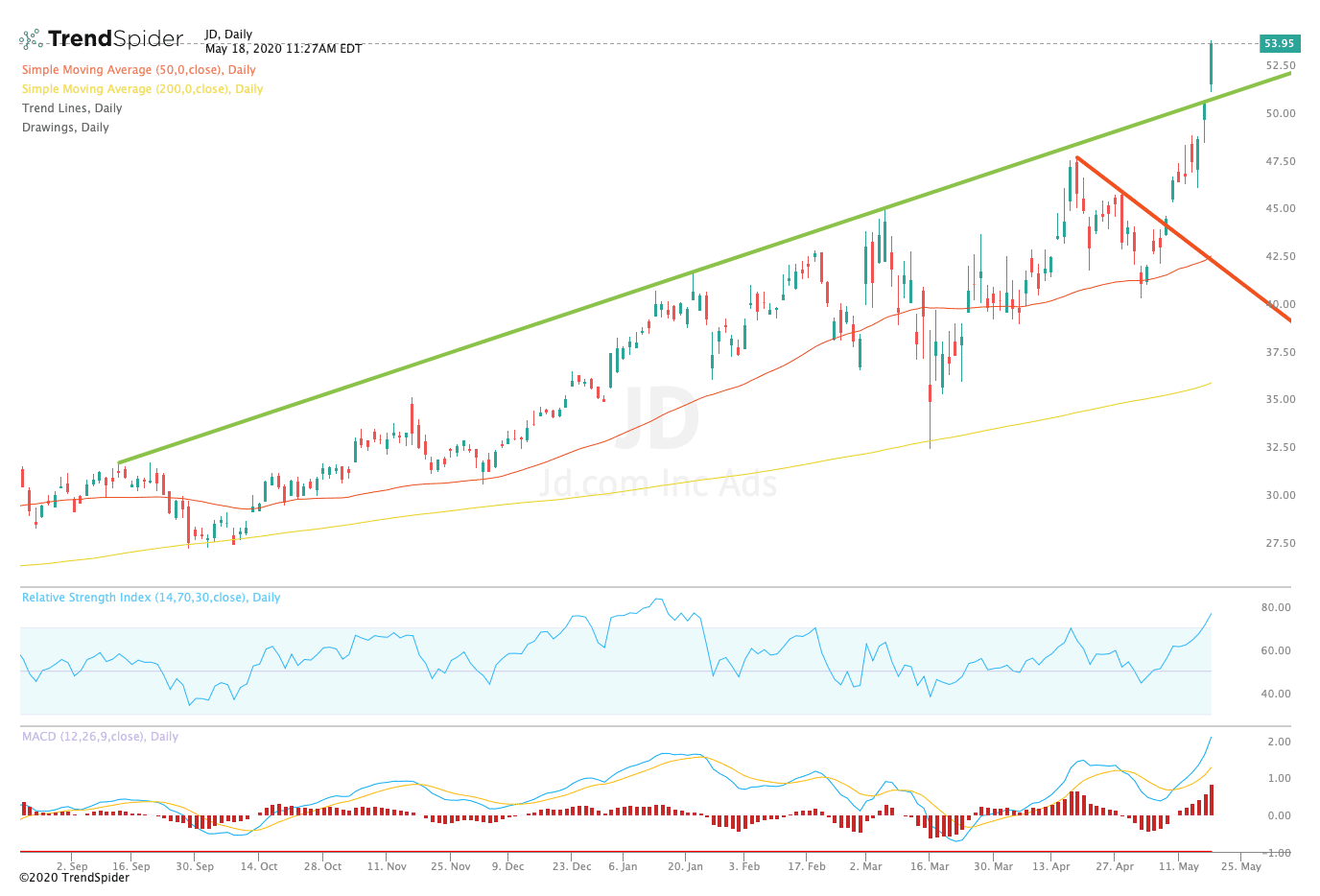

TrendSpider

From a technical point of view, the stock has broken out of a trendline resistance to new highs. The relative strength index (RSI) moved into overbought territory with a reading of 76.62, but the moving average convergence divergence (MACD) remains in a strong bullish recovery. These indicators suggest that the stock could see a period of consolidation, but in the medium term, the trend remains strongly bullish.

Traders should watch for a period of consolidation above trend line support levels in the coming sessions. If the stock breaks down from these levels, traders could see a return to the former price channel. If the stock continues its rebound, traders could see a move to new highs in the coming sessions.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com