Takeaways

- J.B. Hunt missed its earnings and sales estimates due to lower prices for freight services.

- The company's Intermodal and Truckload segments saw lower revenues. revenue per load.

- J.B. Hunt said his customers' inventory clearance was reducing shipping demand.

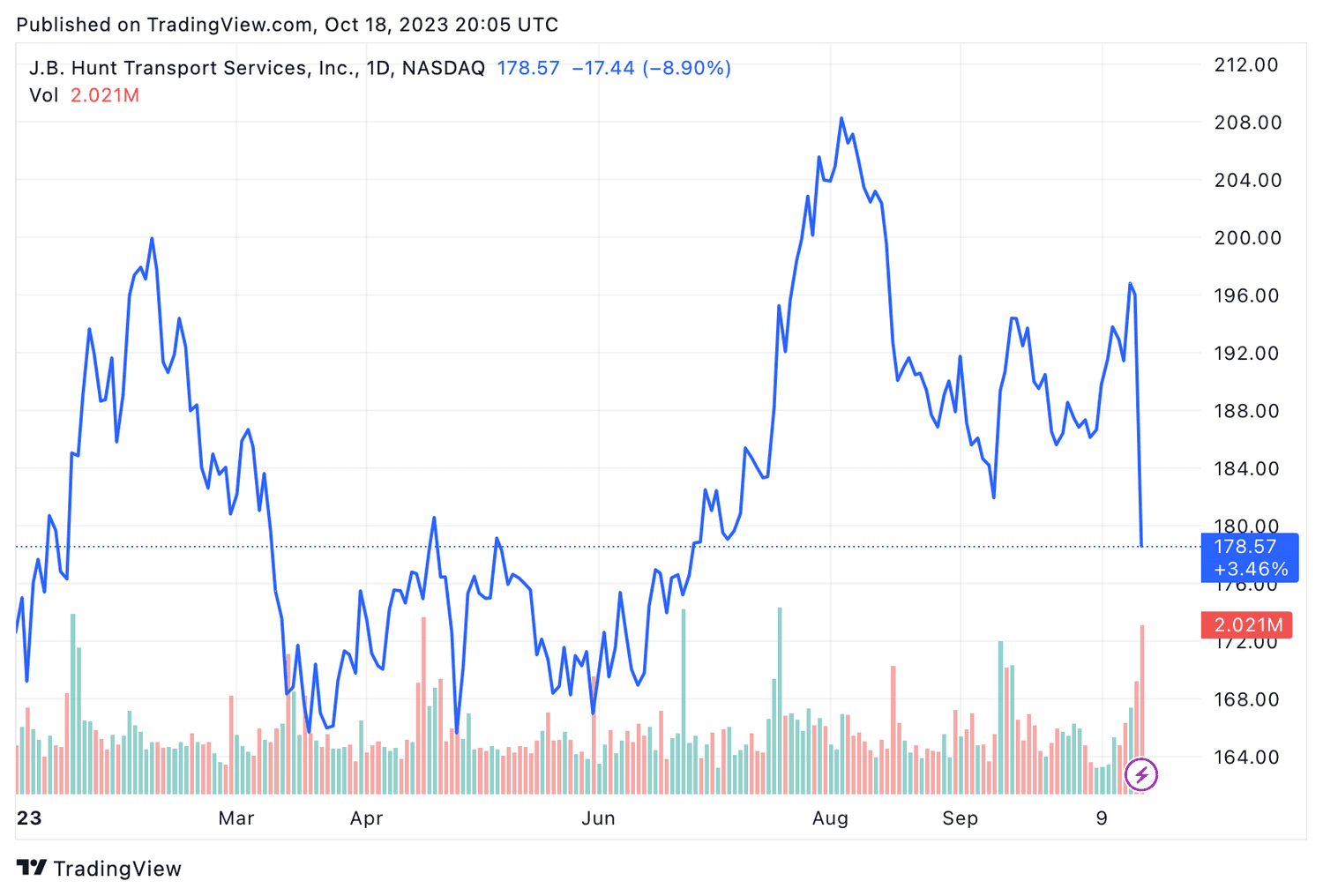

Shares of J.B. Hunt Transport Services (JBHT) fell more than 8% on Wednesday after the shipping giant reported worse-than-expected results due to falling freight prices.

J.B. Hunt reported that third-quarter fiscal 2023 earnings fell 30.4% from last year to $187.4 million, or $1.80 per share. Revenue fell 17.6% to 3.16 billion reais. Both were lower than expected.

The company said revenue per load at its Intermodal – truck and rail shipments – and Truckload divisions fell 14% and 22%, respectively. It also saw a 38% drop in volume in its Integrated Capacity Solutions group, a 20% drop in stops for its Final Mile Services division and a 1% drop in average revenue-generating truck revenue. for its Dedicated Contract Services segment.

Fuel surcharge revenue fell 30% to $472 million and represented 14.9% of total revenue. A year ago, it was 17.6%.

The company blamed the results Disappointing on customer inventory clearance which reduced shipping demand, but indicated that this process began to moderate in June.

Despite that of Wednesday After a sell-off, J.B. Hunt shares remained in positive territory for the year.

TradingView

Do you have a news tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com