Key takeaways

- Intuit missed revenue estimates for key fiscal season.

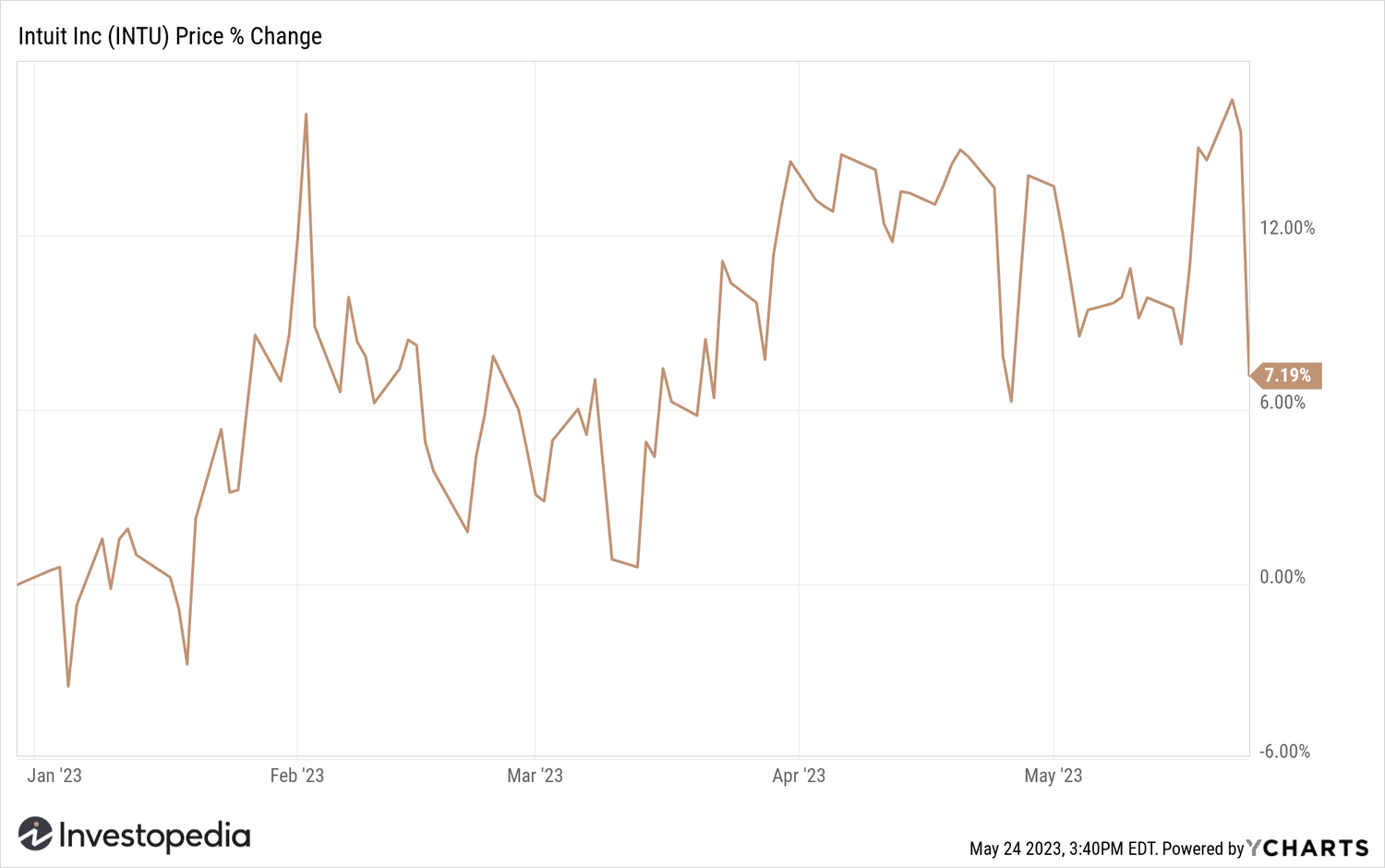

- Intuit shares fell 7.5% on Wednesday after the news.

- CEO Sasan Goodarzi has warned of the possibility that the IRS will allow Americans to directly file taxes for free electronically, without the need for a third-party provider such as Intuit.

Intuit (INTU) fell 7.5% on Wednesday after tax-filing software maker TurboTax fell short of expectations during key tax-filing season.

Intuit reported its fiscal third quarter 2023 revenue rose 6.9% to $6.02 billion, below analysts' forecasts. Earnings of $8.92 per share beat estimates.

The company noted that the results reflect its outlook for the full year. It predicts a 2% decline in total Internal Revenue Service (IRS) returns and the DIY share will be down 0.75%. Intuit explained that it believes the reason for this is that those who filed taxes in order to receive stimulus money and tax credits in the age of the pandemic at the recent years have not filed this season.

Even so, Intuit CEO Sasan Goodarzi explained that Intuit is increasing its revenue, operating income and earnings per share (EPS) guidance for 2023.

Goodarzi also warned against the possibility of the Internal Revenue Service (IRS) allowing Americans to directly file their taxes for free electronically, without the need for a third-party provider such as Intuit. Goodarzi argued that such a move would “cost taxpayers billions of dollars.” The idea was part of $80 billion in IRS upgrades included in last year's Inflation Reduction Act. Last week, Treasury Secretary Janet Yellen asked the IRS to move forward with testing a prototype system.

investopedia.com