Tower Semiconductor (TSEM) shares fell further up 8% on Wednesday after Intel (INTC) called off a $5.4 billion deal to buy the Israeli chipmaker, saying it was unable to to obtain timely regulatory approval of the agreement by China. Intel shares were 1% lower.

Key Points to Remember

- Intel canceled a $5.4 billion deal to buy Tower Semiconductor after it was unable to secure regulatory approval for the China deal in time.

- Intel will have to pay $353 million to Tower in termination fees.

- Tensions between China and the United States have made it more difficult for some companies to obtain regulatory approval , especially in the semiconductor industry.

The cancellation of the agreement means that Intel will have to pay a termination fee of $353 million to Tower, in accordance with the merger agreement signed last year.

Intel had announced plans to acquire Tower, a premier analog semiconductor foundry, last February to expand its manufacturing capacity, global footprint and technology portfolio.

Although much smaller than& #39;Intel, Tower would have offered expertise in the mobile, automotive and energy segments, as well as geographic opportunities in Texas, Israel, Italy and Japan.

However, tensions between China and the States United States has made it more difficult to obtain regulatory approval for transactions requiring clearance from regulators in both countries for certain companies, particularly in the semiconductor industry, and Intel reportedly failed to get approval from Chinese regulators in time.

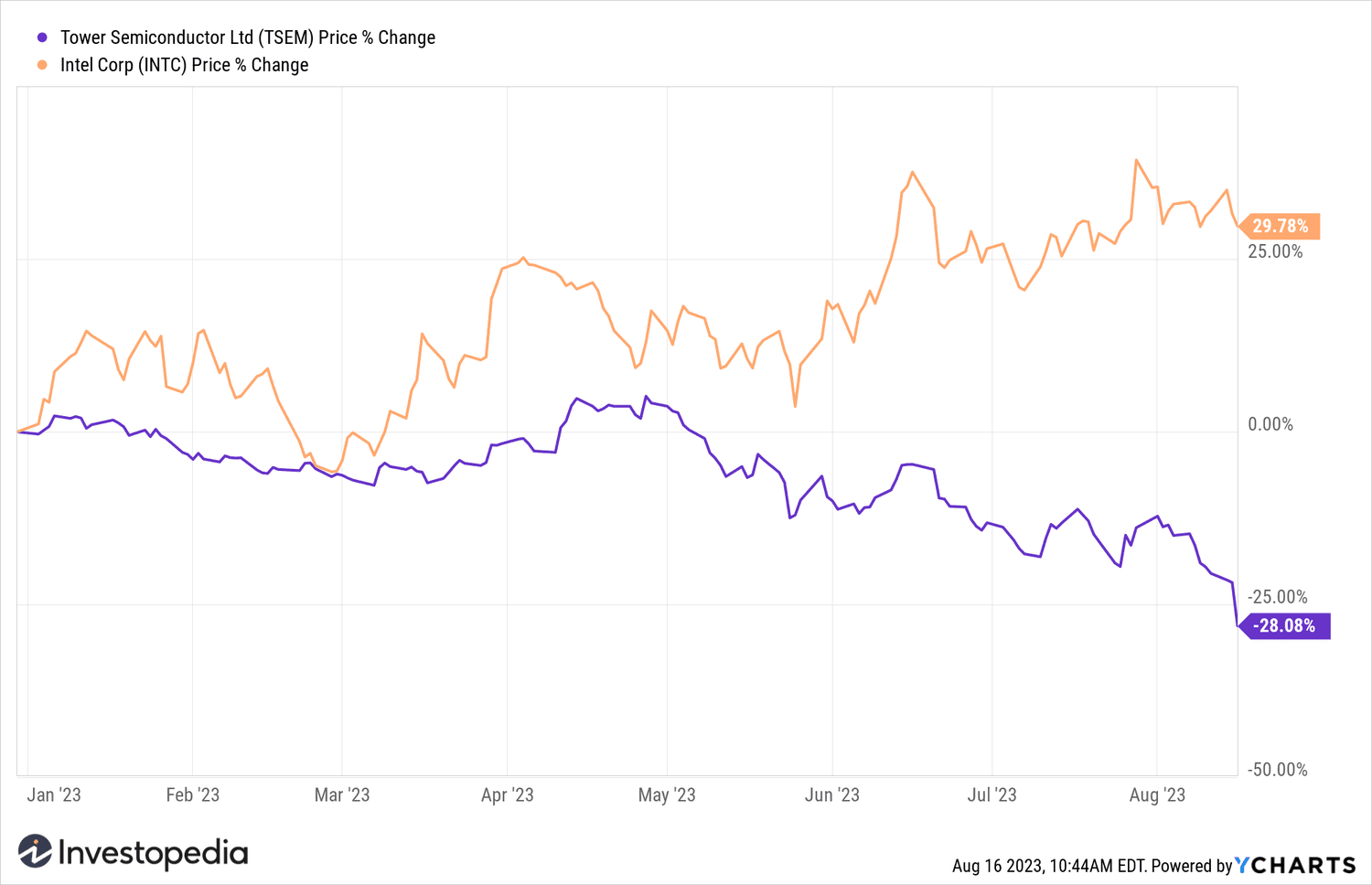

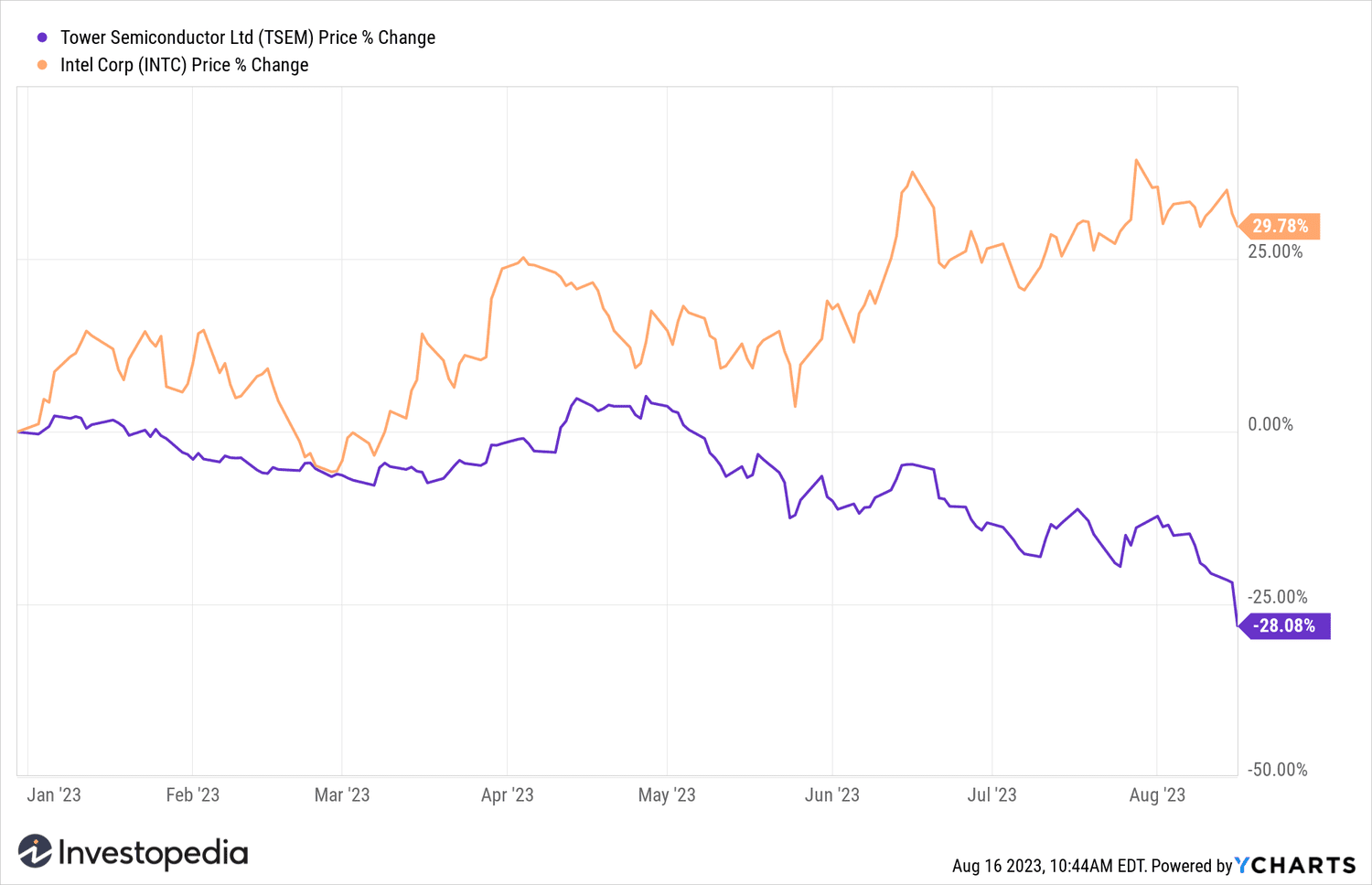

Despite Wednesday's losses, the Intel shares were still up 29% year-to-date, while Tower shares have lost 28% of their value this year.

YChar ts

Have Any Tip for Investopedia Journalists? Please email us at tips@investopedia.com

Source: investopedia.com