IMAX Corporation (IMAX) shares rose more than 16% after Goldman Sachs initiated coverage on the stock with a Buy rating and $14 price target. Analyst Michael Ng believes that the company focuses on the films success could position itself for a recovery in moviegoing since most of the films should be less affected than small and mid-budget films that are in competition with other distribution platforms.

During the first quarter, IMAX reported revenues that fell by 56.5% to $ 34.9 million, missing consensus estimates by $8.33 million, and non-GAAP net loss of 48 cents per share, missing consensus estimates of 34 cents per share. Despite these mediocre results, Ng notes that IMAX has “enough liquidity” for what could be a rough recovery, and a solid list of films to 2021.

A COVID-19 vaccine could help to 2021 to become a year of strong growth for the businesses of entertainment, but the image is still a little more cloudy. For example, in California, the new stops have led to a significant decline in the shares of AMC Entertainment Holdings, Inc. (AMC), Cinemark Holdings, Inc. (NKCC), IMAX, and other companies.

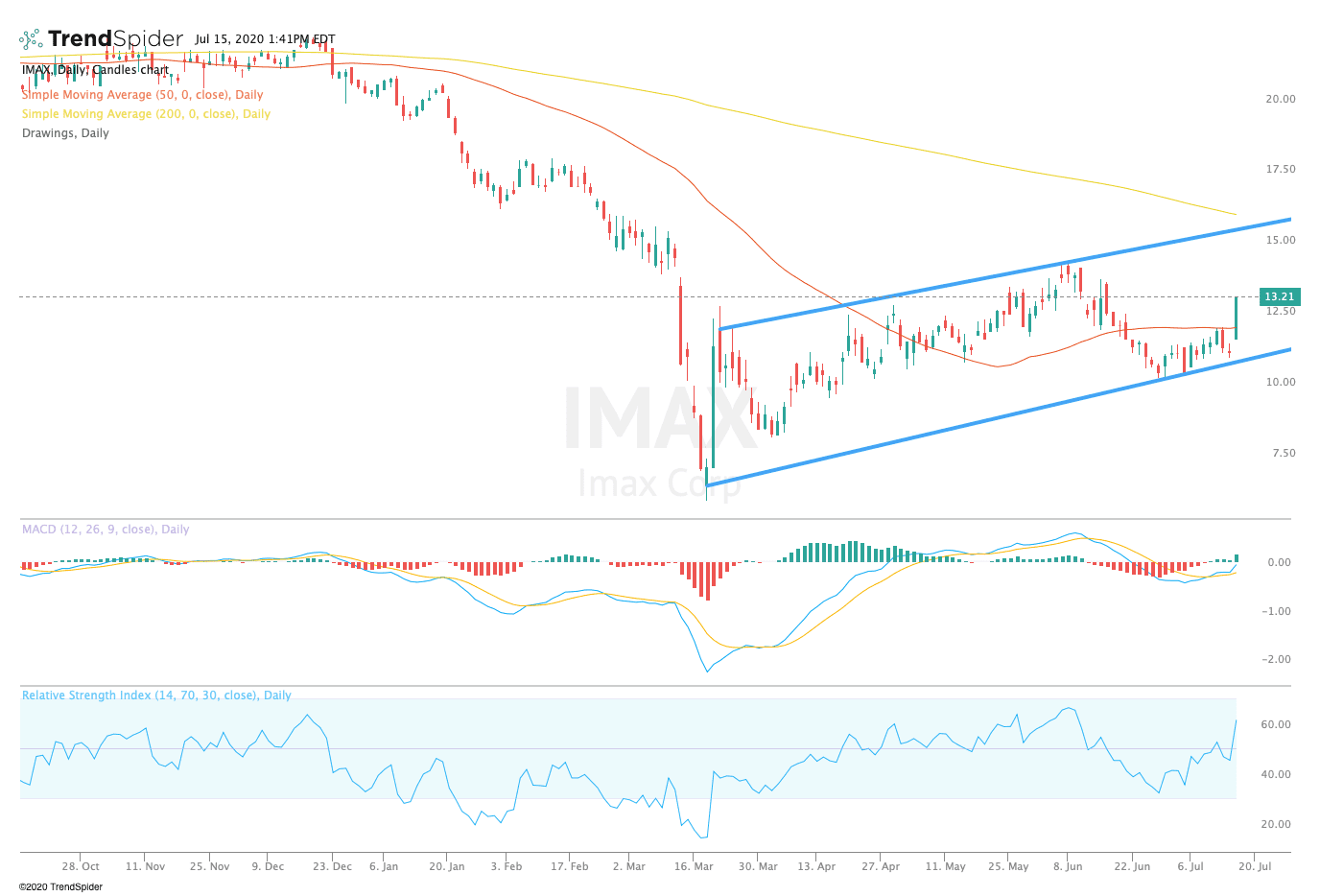

TrendSpider

From a technical point of view, IMAX stock has bounced from the trendline support of the 50-day moving average at $12.11. The relative strength index (RSI) has risen to levels that are overbought with a reading of 61.56, but the moving average convergence divergence (MACD) in histogram MACD experienced a bullish cross. These indicators suggest that the stock has a little more space to run, before undergoing the consolidation.

Traders should watch for a move towards the upper trendline resistance at around $15.50, or the 200-day moving average at $16.11 in the coming sessions. A break of these levels could lead to a tendency to the reaction of the vertices of $18.00 over the medium term. If the stock breaks down, traders should look to switch to a trendline support at around $11.00.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com