Points to remember

- ICE has reached an $11.9 billion deal to buy Black Knight after meeting regulators' demands. concerns.

- The FTC dropped the lawsuit challenging the purchase after ICE agreed to divest certain Black Knight properties.

- The transaction adds value to Black Knight at $11.9 billion.

Intercontinental Exchange (ICE) has completed its $11.9 billion purchase of software, data, and analytics company Black Knight (BKI) after federal regulators dropped their opposition to the government. agreement.

The operator of the New York Stock Exchange (NYSE) and other exchanges said the agreement, first reached in May 2022 and revised last March, grants Black Knight investors 0.6577 ICE share for every Black Knight share they own, which equates to approximately $75.87. Black Knight shares, which closed Friday at $75.76.

The transaction was delayed after that the Federal Trade Commission (FTC) filed a lawsuit to stop it, arguing that the merger would give ICE too much control over the mortgage data market, which would cost consumers and stifle innovation.

Officials withdrew their lawsuit when ICE agreed to divest Black Knight's Optimal Blue and Empower loan origination system businesses to subsidiaries of Constellation Software of Canada.

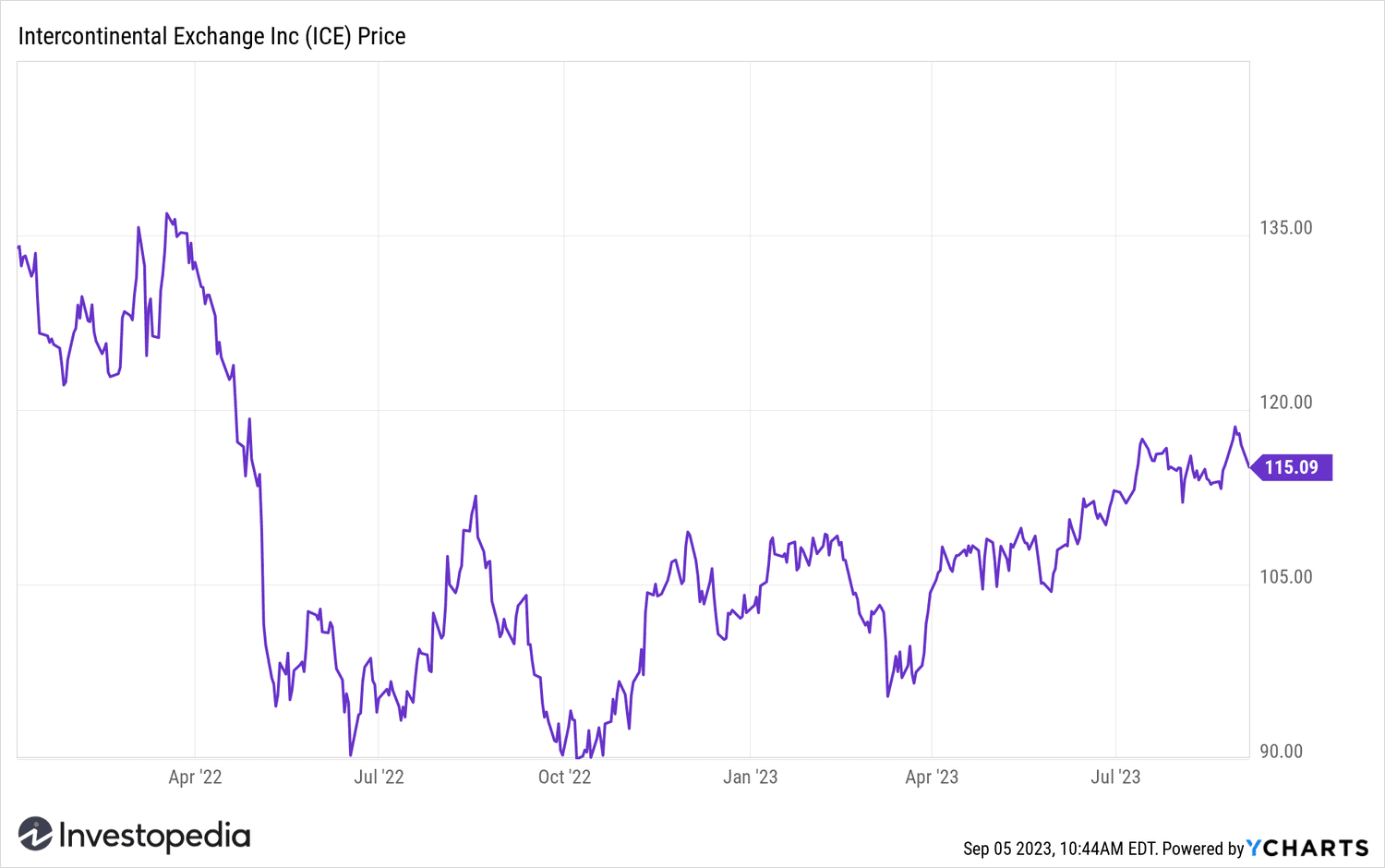

The actions of Intercontinental Exchange fell 1.7% in early trading Tuesday after the news, but remained more than 11% higher for the year so far. They had reached their highest level since April 2022 at the end of last month.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com