Key Points

- ICE and Black Knight are selling Black Knight's Optimal Blue business.

- Toronto-based Constellation Software will pay $700 million for Optimal Blue.

- The move is designed to comply with regulations concerns over ICE's purchase of Black Knight.

Intercontinental Exchange (ICE) and Black Knight (BKI) said they agreed to sell Optimal Blue in order to comply with regulatory requirements for ICE to proceed with the #39;expected purchase of Black Knight.

The companies said the buyer is a subsidiary of Toronto-based Constellation Software, which will pay $700 million for Optimal Blue. The deal called for Constellation to deliver $200 million upfront, with a $500 million promissory note issued to Black Knight upon closing of the ICE transaction. ICE and Black Knight noted that the sale included the stipulation that its merger and Constellation's prior agreement to buy Black Knight's Empower loan origination system business is terminated.

Optimal Blue offers data and technology for mortgage pricing and transactions.

Exchange operator ICE announced in May 2022 that it would acquire software and data provider Black Knight for $13.1 billion. However, the U.S. Federal Trade Commission (FTC) said in March it would block the combination after some members of Congress complained that the pricing power ICE would gain in the mortgage data market could result in increased costs for consumers.

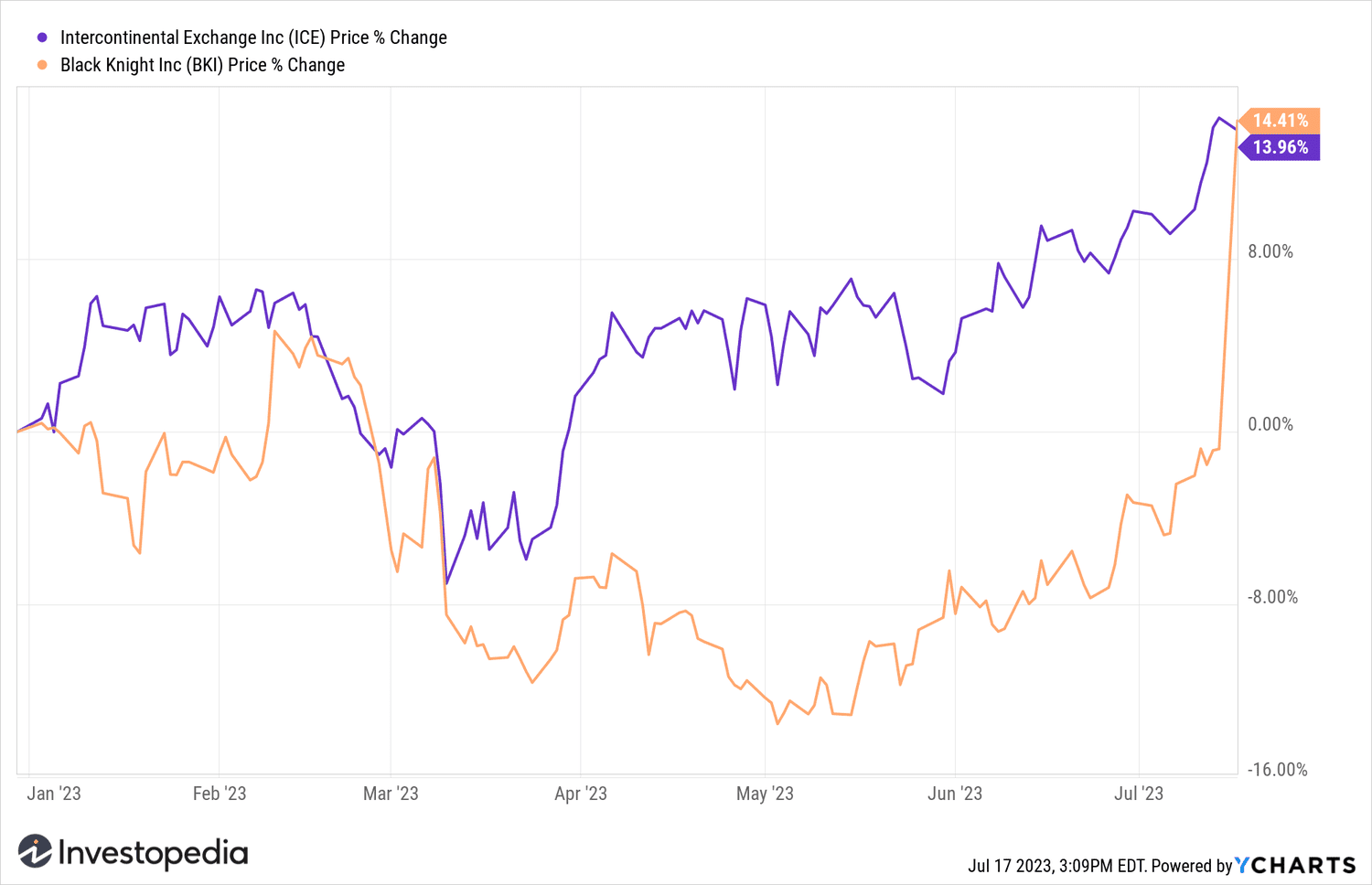

Black Knight's actions have skyrocketed 15% on Monday after the news. Intercontinental Exchange shares fell.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com