Icahn Enterprises LP stock price ( IEP) fell about 15% in intraday trading after the holding company owned by activist investor Carl Icahn was accused of having “ponzi-like” dividend payments by Hindenburg Research.

Key Takeaway

- Hindenburg questioned the IEP valuation with a 218% premium to NAV.

- The company had a negative free cash flow of 4.9 billion since 2014, but has paid out $1.8 billion in dividends.

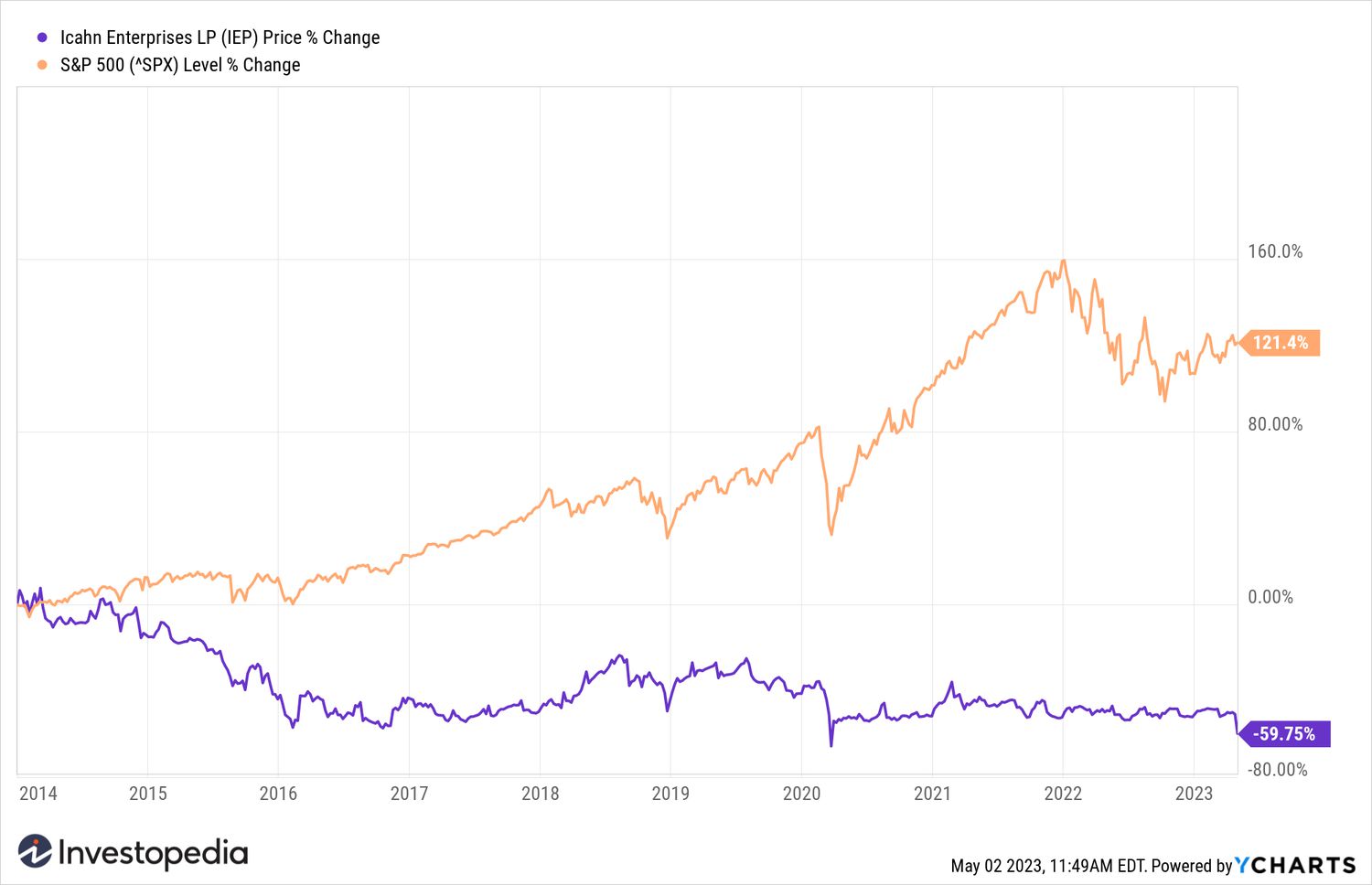

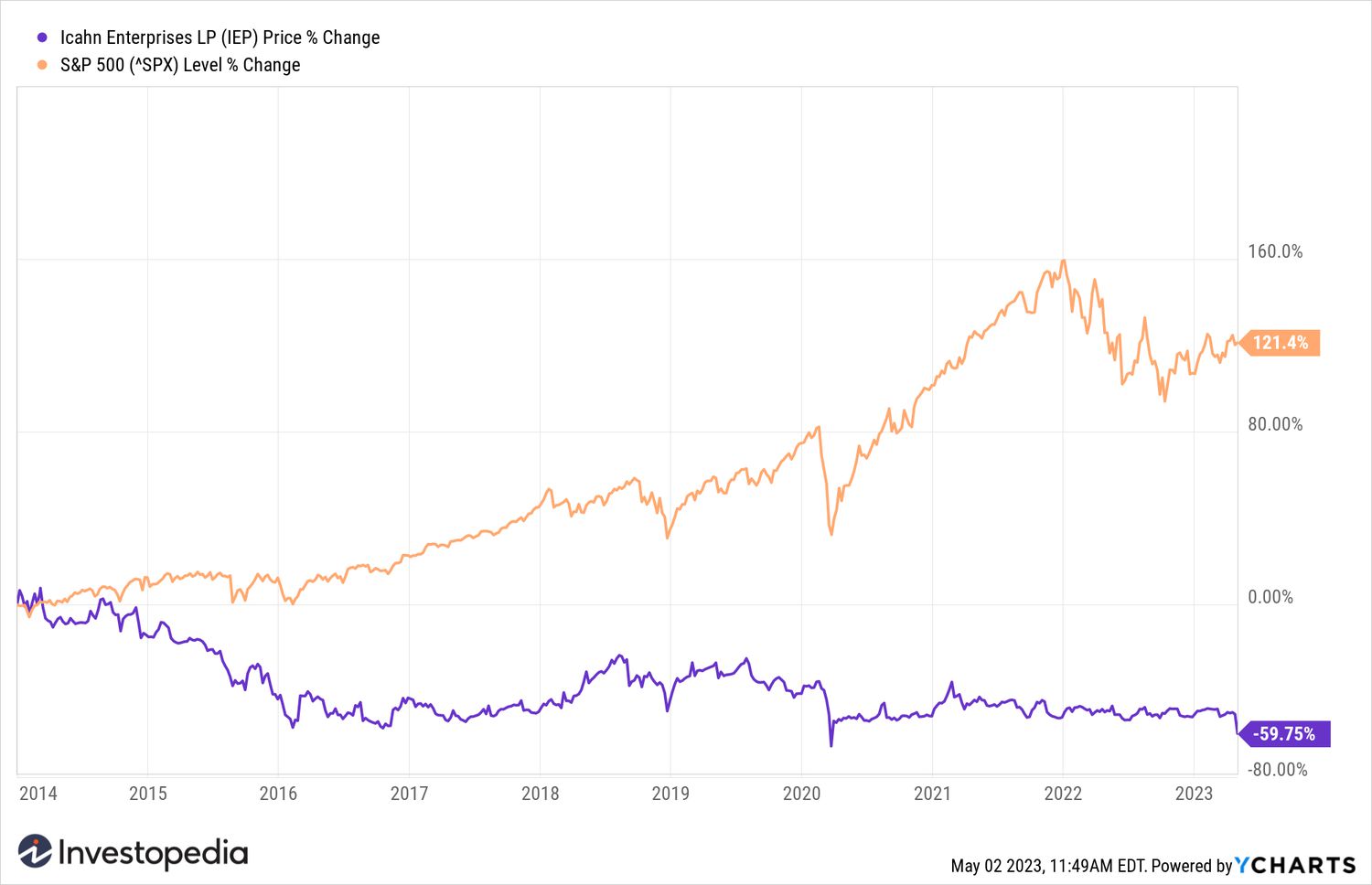

- The investment portfolio has lost 53% since 2014, while the S&P500 is up 147 .%.

Hindenburg based his brief appeal around the valuation of the company, which it says is inflated by 75%, with the company trading at 218% of its net asset value (NAV).

The short seller's report highlighted that activist funds held by Dan Loeb and Bill Ackman were trading at a discount of -14% and -35% respectively. The company also turned to Icahn for the company's “Ponzi-like” dividend, which the short seller said was not supported by the company's cash flow and performance. IEP investment.

Icahn and his son own 85% of IEP, which is about 85% of the eldest's net worth. Hindenburg said the closed-end fund is also highly leveraged with $5.3 billion in debt, with more than $1 billion due each year from 2024 through 2026. 39;Icahn have been pledged for personal loans on margin, which can lead to margin calls if the unit price drops, Hindenburg added.

Digging deeper into the holdings, the short appeal also called into question the value of some of Icahn's holdings. Icahn's investment portfolio has lost 53% since 2014, compared to a 147% return for the S&P500 over the same period. During the same period, $1.5 billion in dividends were paid despite negative free cash flow of $4.9 billion.

YCharts

Hindenburg noted the poor performance of large holdings such as CVR Energy (CVI) and the company's Icahn Automotive Group. “Suspicious marks” were also noted for a meatpacking business and IEP real estate.

Hindenburg Research s' attack on another titan earlier this year after it published a report on the empire of India's richest man, Gautam Adani. Hindenburg accused the firm of being involved in a “brazen set-up of stock manipulation and accounting fraud”. Adani's company has refuted the allegations, but the company's shares are down about 50% year-to-date.

Source: investopedia.com