Key Takeaways

- Analysts estimate adjusted EPS of $2.09 vs. $3.17 Q2 2019

- Global Technology Services revenue is expected to fall year-on-year.

- COVID-19 is scheduled to hit revenues hard.

International Business Machines Corp (IBM) just completed its first quarter under the leadership of recently appointed chief executive officer Arvind Krishna. It was not an easy quarter to navigate, as the global economy has retreated from the coronavirus pandemic. Krishna, chief architect of IBM’s $ 34 billion acquisition of open source and the cloud software company Red Hat in 2019, seeks to transform IBM into a major player in the field of cloud computing. But one of his main concerns in recent months has been trying to overcome the economic impact of the pandemic. IBM Q2 2020 earnings report, which will be released on July 20, 2020, will see how it does.

A key metric to keep an eye on the revenues of IBM’s largest segment, Global Technology Services (GTS). Analysts expect IBM’s adjusted earnings per share (EPS) a sharp decline in Q2 2020, while the total receipts and GTS revenues are expected to decline less strongly.

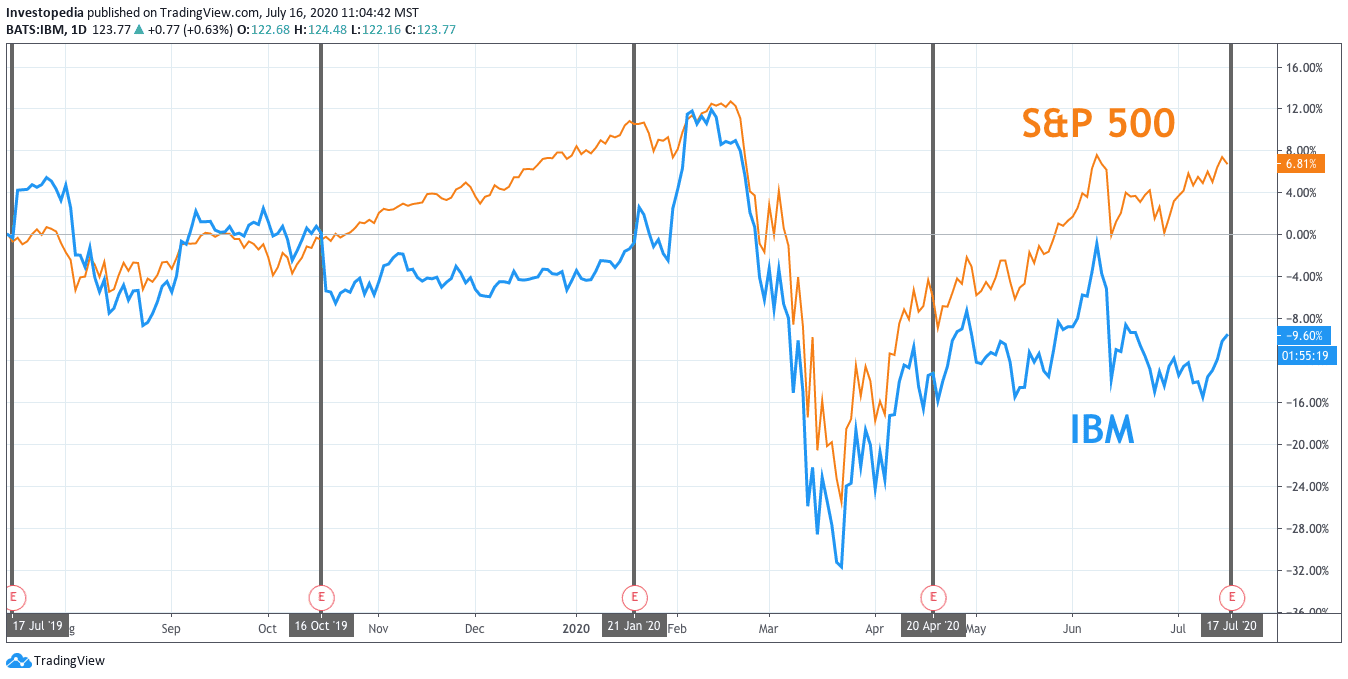

In the last 12 months, IBM has underperformed the market in general. The S&P 500 has recovered better than IBM in the wake of the pandemic induced market collapse that began in mid-February, and bottomed in mid-March. The company’s shares posted a total return of -9.6% compared to the S&P 500 is 6.8%. All figures are as of July 16, 2020.

Source: TradingView.

IBM shares initially fell after reporting revenue that met analysts ‘ expectations for Q1 2020, but then continued to trend upward over the next few days. IBM has published a 18.0% decline in adjusted EPS for the quarter, marking the third consecutive quarter of earnings declines. The profit has taken a hit of approximately $ 0.9 billion of restructuring charges related to the GTS segment. Decrease in turnover by a more modest 3.4%, but it was the sixth year-on-year (yoy) decline in seven quarters. IBM has also removed full-year forecasts because of the COVID-19 crisis.

But even before the pandemic, IBM had difficulty making it through both the top and bottom lines. The adjusted EPS has decreased from 3.4% in the 4th quarter of 2019, the second consecutive quarter of decline and the fourth decline in five quarters. Revenues have increased at a meager 0.1% in the 4th quarter, marking the first quarter year-over-year revenue growth since the 2nd quarter of 2018. Nevertheless, the company’s shares got a boost, and, at the beginning of February, seemed ready to begin to outperform the market in general. Then the markets crashed due to the pandemic.

While the market has recovered and is ready to hit previous highs, IBM’s shares have mostly moved sideways in recent months. Analysts expect declines in both adjusted EPS and revenues, including the size of the company has not seen in at least 14 quarters. The adjusted EPS is expected in the fall of 34.0%, while the revenue is expected to fall 7.9%.

IBM Key measures

Estimate of the Q2 2020 (AF)

Q2 2019 (AF)

Q2 2018 (AF)

Adjusted Earnings Per Share ($)

2.09

3.17

3.08

Revenue ($B)

17.6

19.2

20.0

Global Technology Services Revenue ($B)

6.3

6.8

7.3

Source: Visible Alpha

As mentioned previously, a key measure of concentrating our efforts on the revenue growth of IBM Global Technology Services (GTS) unit. GTS IBM information technology (IT) infrastructure and platform services business, and is its largest segment, which represents approximately 35% of total sales in 2019. The company has been a major hindrance to the company, recognition of sales decreased in 13 of the last 17 quarters.

However, the share of income has been falling. GTS composed of approximately 37% of IBM’s total consolidated revenue in 2018. The segment posted year-over-year revenue declines of 5.9% and 4.8% in Q1 2020, and Q4 2019, respectively. Analysts expect a further decline of 7.8% in the Q2 of 2020.

One of the main reasons IBM’s overall revenues have not declined as sharply because of the strong growth of the company in the Cloud and Cognitive Software segment, which grew 5.5% in Q1 2020. This segment contains the Red Hat, a company specialized in open source software and cloud computing. While the income attributable to, Red Hat has increased by 18% in Q1 2020, its relative size means that the growth has not offset declines in IBM GTS segment. Therefore, the acquisition of Red Hat is not enough to stop overall sales decline of less than IBM manages to halt the decline of the GTS of revenue or cloud revenue up much faster than anticipated.

Source: investopedia.com