Takeaways

- Buffett's Warren Berkshire Hathaway sold 4.5% of his stake in HP.

- Berkshire Hathaway made an initial investment in the PC and printer maker in April 2022.

- HP reduced its capital. full year forecast last month, warning of market weakness.

Shares of HP Inc. (HPQ) were down more than 2% as of midday Thursday after Warren Buffett's Berkshire Hathaway (BRK.A) revealed it had reduced its stakes in the PC sector and printers. manufacturer by 4.5% this week.

Berkshire Hathaway announced in a regulatory filing to have been sold 5.5 million HP shares in the last three days. She now owns 115.5 million shares.

Berkshire's stake is valued at 3.27 billion based on Wednesday's closing price of $28.33 per share. Buffett's company is estimated to own 11.7% of HP shares. In April 2022, Berkshire Hathaway initially purchased 109.8 million shares of HP worth $4.2 billion, then made three additional purchases.

Berkshire's latest initiatives come about two weeks later HP cut its full-year profit forecast, warning that demand for PCs and printers had slowed.

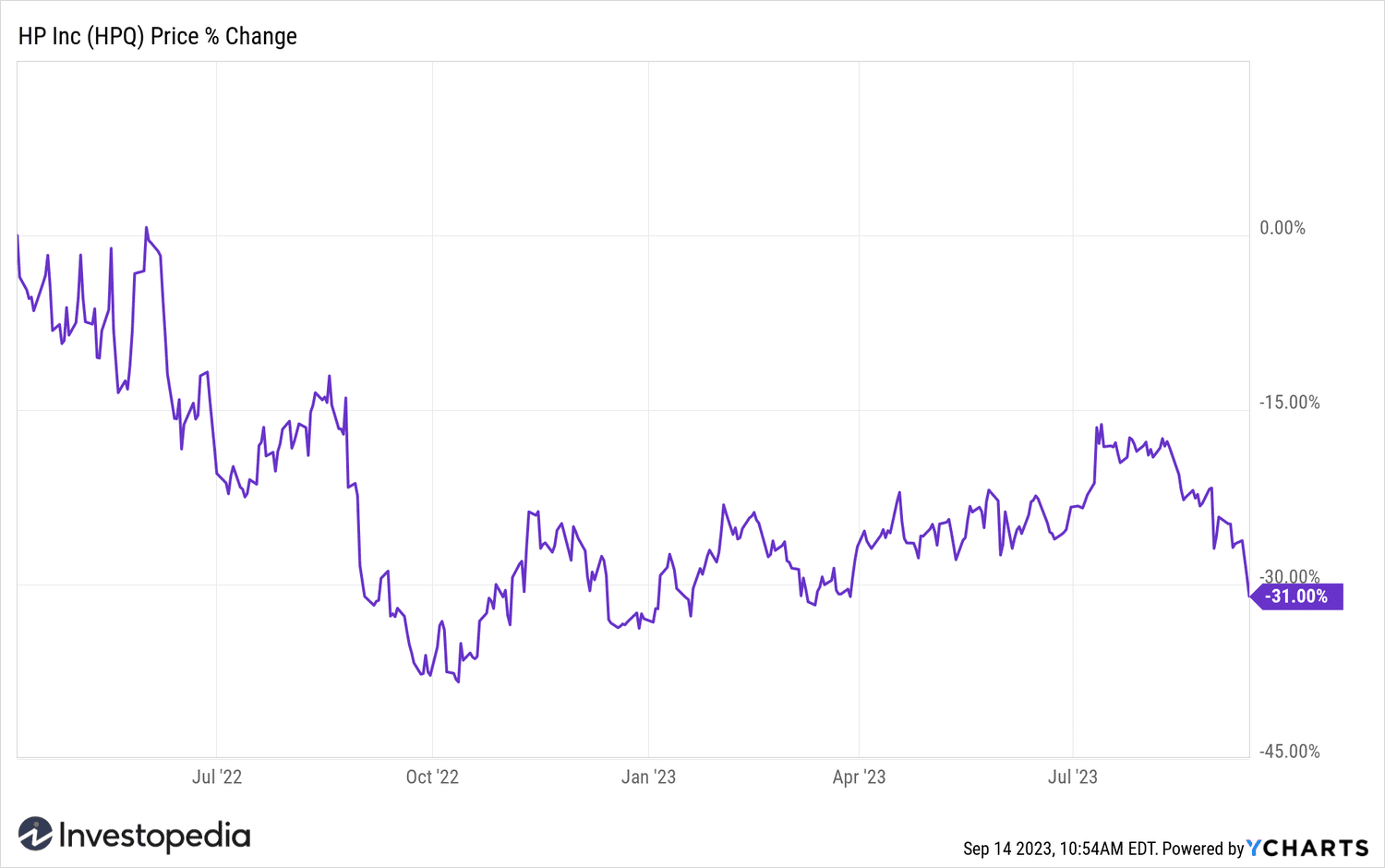

HP shares climbed following the news of this first Berkshire Hathaway investment, but have since lost almost a third of their value. They had reached an 11-month high in July before falling, and are up about 3% for 2023.

YCharts

Do you have a news tip for journalists from Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com