Takeaways

- Hormel Foods Corp. stock was the S&P 500's biggest loser on Thursday after the company provided an update on its strategy and reached a new contract with union workers.

- Hormel said it aims to increase operating profit by more than $250 million by 2026.

- Hormel shares fell nearly 10% Thursday to a record low level in almost six years.

Hormel Foods (HRL) Corp. was the worst-performing stock in the S&P 500 on Thursday, as the maker of Spam, Skippy peanut butter and other foods released an updated strategic plan and reached a new contract with its union members. br>

Hormel told shareholders at its investor day it aims to increase its operating profit by more than $250 million in 2026. That includes 5% to 7% growth in its current business. It also expects additional operating income of more than $25 million from the transformation of its Jennie-O Turkey Store business and mergers and acquisition (M&A) synergies.

Additionally, the company said it expects to save at least $200 million through cost-cutting efforts and standardization of its supply chain after recent logistics disruptions. .

The agreement approved by members of the United Food and Commercial Workers union will give workers raises of $3 to $6 an hour and other benefits.

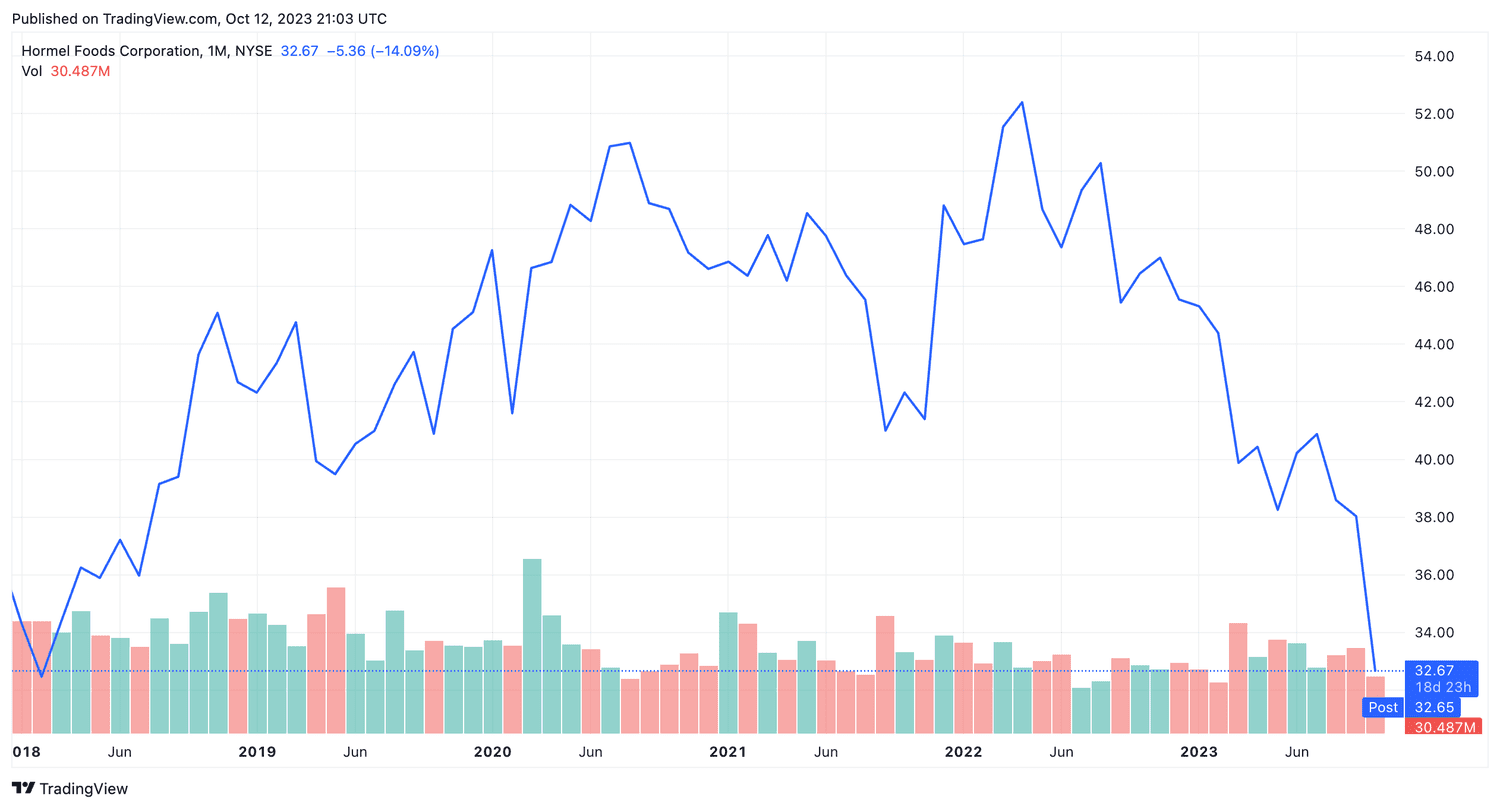

Shares of Hormel Foods nearly fell 10% from where they were on Thursday lowest closing price since early 2018.

TradingView

Do you have a tip for Investopedia journalists? Please email us at tips@investopedia.com

Source: investopedia.com