Points to remember

- Hormel It missed its earnings and revenue estimates and lowered its forecast for lower meat prices and lower sales in China.

- All segments of the business saw a decline in sales, with international revenue falling 6%.

- Hormel expects consumers and operators to remain “highly intentional”; in their expenses.

Falling meat prices and slowing demand in China have undermined profits and sales at Hormel Foods (HRL), the maker of Spam, Skippy Peanut Butter and other foods , which cut its forecast for the full year.

Hormel reported earnings per share (EPS) by $0.40 for the third quarter of fiscal 2023, with revenue down 2.3% to $2.96 billion. Both fell short of analysts' estimates. block-html”>Retail segment sales fell 2% and foodservice unit sales fell 3% due to lower prices for certain items, including bacon. International Division sales fell 6%, dragged down by “unfavorable pork and turkey commodity markets, continued weakness in China and lower brand export demand “, the company said in a statement.

The operating environment, both domestically and overseas, “continues to be dynamic, and we expect consumers and operators to remain very intentional in their spending,” said CEO Jim Snee in the release.

Hormel now forecasts 2023 EPS in the range of $1.61 to $1.67, down from its previous forecast of $1.70 to $1.82. He predicts that sales will remain stable, even down 4%, after having anticipated a gain of 1 to 3%.

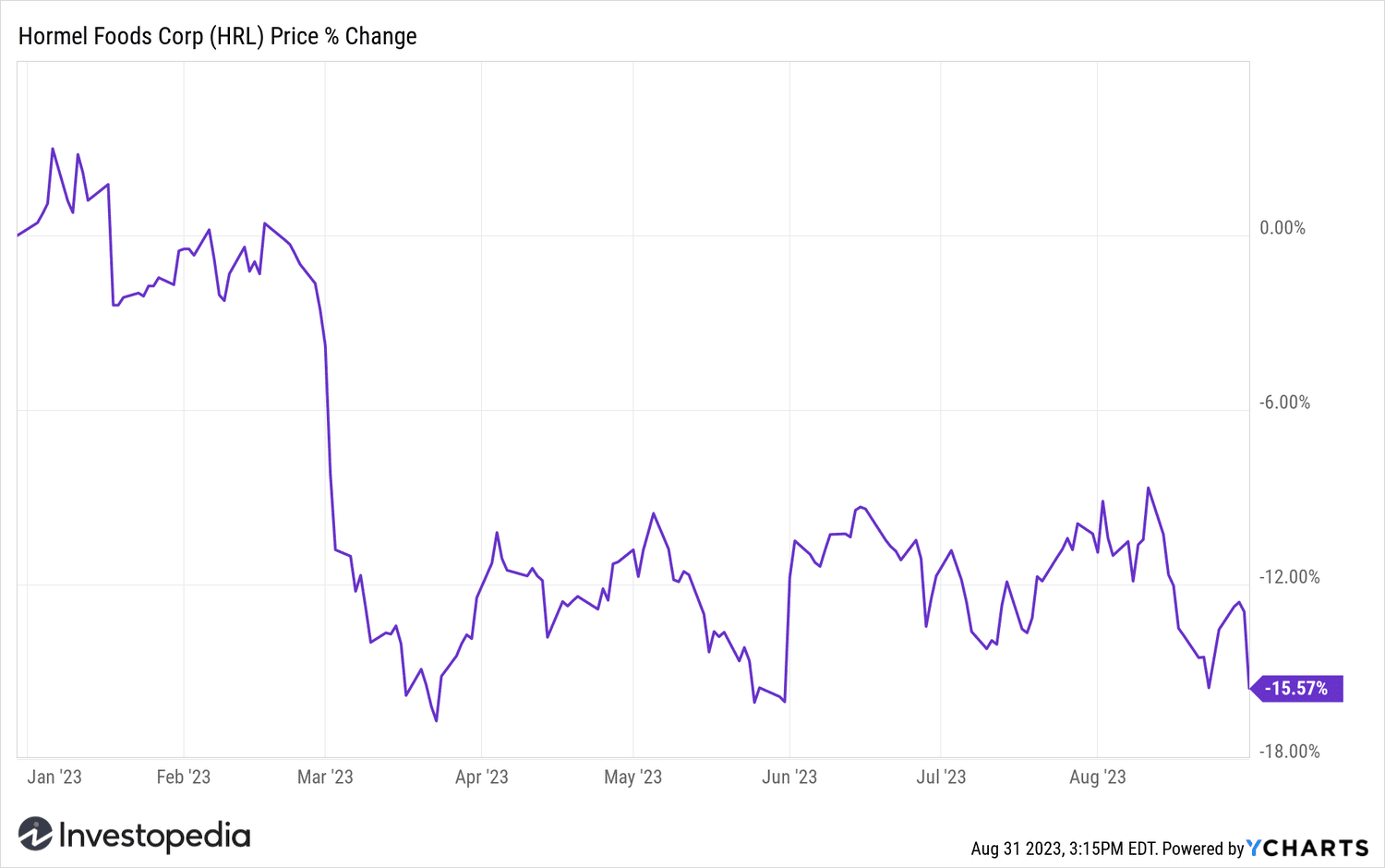

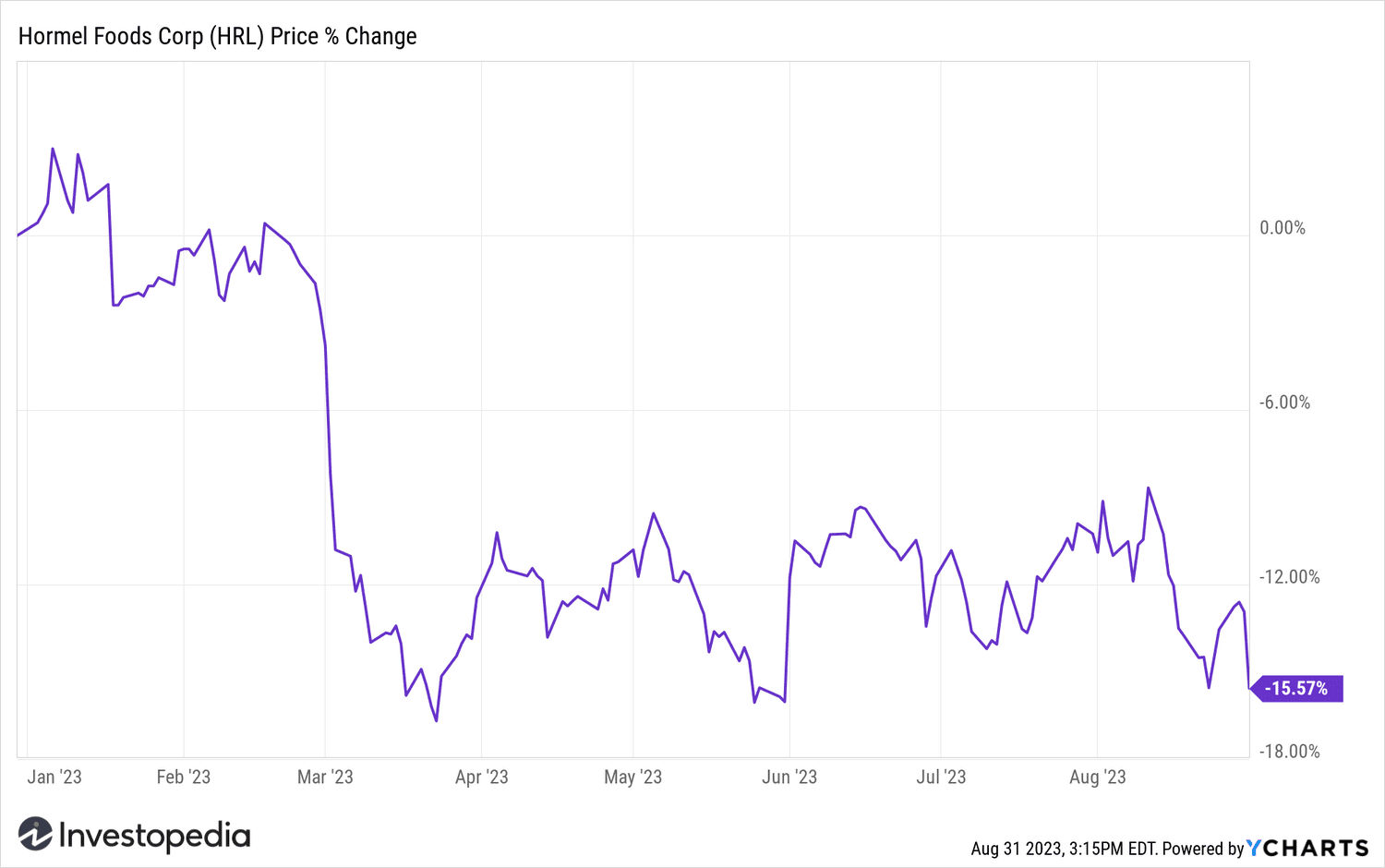

Hormel Foods shares have lost ground on the news, closing down 2.7%, and traded in negative territory for most of 2023.

YCharts

Source: investopedia.com