Singapore-based e-commerce and ride-sharing company Grab ( GRAB) cut losses by nearly three-quarters in the quarter ending June and forecasts a lower loss for the year as cost-cutting measures paid off.

Points to remember

- Singapore-based e-commerce and ride-sharing company Grab cut losses by nearly three-quarters in the quarter to June.

- The company posted a net loss of $148 million in the second quarter. , down 74% from its year-ago quarter loss.

- Subscriptions to GrabUnlimited, the company's subscription program, were up 25% from the prior quarter and 43% year-on-year.

- Company updated full-year outlook and expects much tighter operating profit . loss of $30-40 million, compared to previous estimates of $195-235 million.

The company, one of the most Asia's biggest tech startups in recent years, posted a net loss of $148 million in the second quarter, 74% lower than its loss in the year-ago quarter. Revenue jumped 77% from a year ago to $567 million as revenue from deliveries more than doubled.

Subscriptions to GrabUnlimited, the program of subscription, increased 25% from the prior quarter and 43% from a year ago. GrabUnlimited subscribers had retention rates on average twice as high as those of non-subscribers and spent almost four times as much on food deliveries.

"More people are using Grab today& #39; today more than ever, as we have reached our highest number of monthly transacting users yet, & #34; said Anthony Tan, co-founder and CEO of Grab.

Delivery revenue more than doubled from the same quarter last year to $292 million, driven by higher gross merchandise value (GMV) and reduced incentives for drivers, who are actions that ride-sharing companies like Uber (UBER), Lyft (LYFT) or Take the Time to accommodate drivers who might prefer different routes or work schedules. Higher incentives tend to increase spending.

The incentive reduction is part of a broader cost reduction initiative that also includes cloud services cost reduction and workforce reduction. In June, the company laid off about 1,000 workers, or about 11% of its workforce, in positions ranging from technology and development to marketing and administration. As a result, variable expenses decreased by 31% compared to a year ago, while staff costs decreased by 6%.

Company updated its outlook for the year and now expects a much lower operating loss of between $30 million and $40 million, compared to previous estimates of $195 million to $235 million.

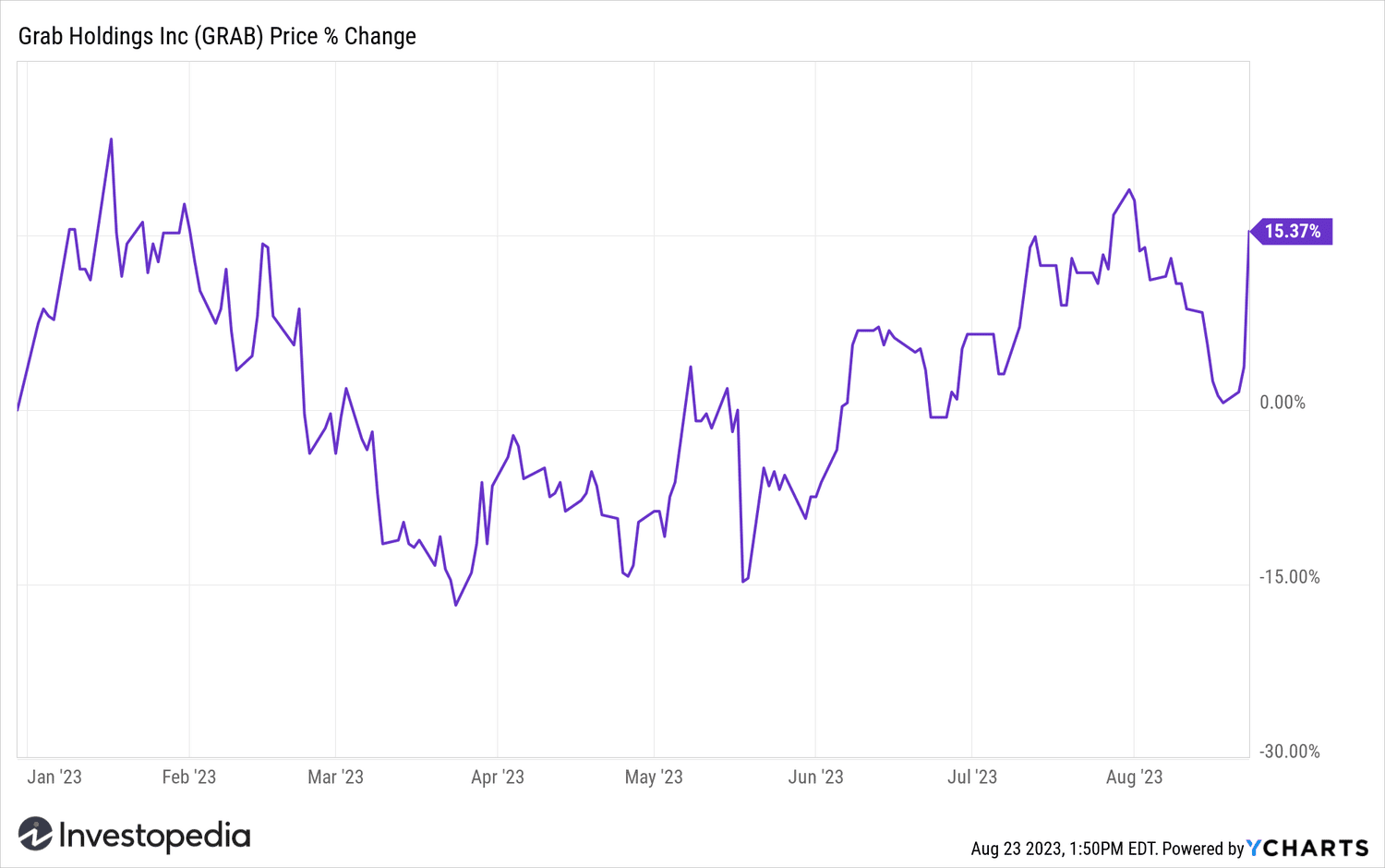

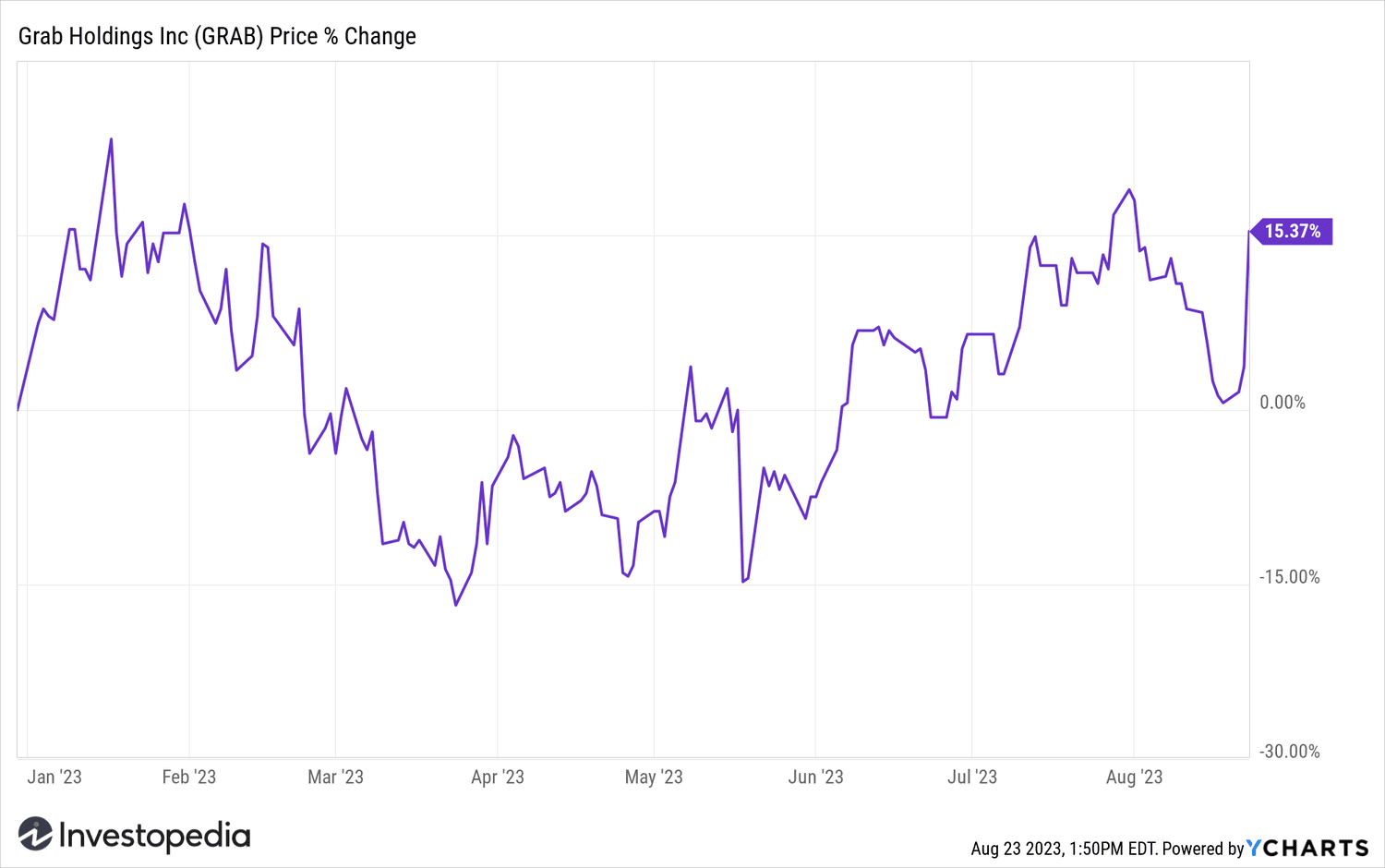

Grab shares were higher 10% higher at 1:45 p.m. ET Wednesday. They are up 15% so far this year.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com