GoPro, Inc. (GPRO) shares rose more than 4% during Friday’s session after the company announced a record e-commerce sales over Memorial Day weekend. The growth in revenues is explained mainly by its flagship HERO8 Black product, although GoPro has also debuted the $69.99 Zeus Mini mounting of the light.

The movement highlights a trend towards the company’s direct-to-consumer approach, which offers higher gross margins and a lower threshold to reach profitability. The management expects sell-through of 600 000 to 650 000 units during the second quarter of 2020 while the global demand continues to increase.

Last quarter, the company said half of the revenue that it generated a year ago. The EBITDA loss amounted to 41 million during the quarter, compared to $ 1 million a year ago, with gross margin, which settled at approximately 34.2% of sales. The good news is that subscribers grew 14% quarter-on-quarter and 69% year on year in the first quarter of the year 2020.

The management believes that the GoPro.com will represent the majority of its turnover next year, with goals for gross margins between 38% and 40%. Last year, GoPro.com generated only about 10% of the turnover, but the management expects that the share of income to move to 45% this year.

TrendSpider

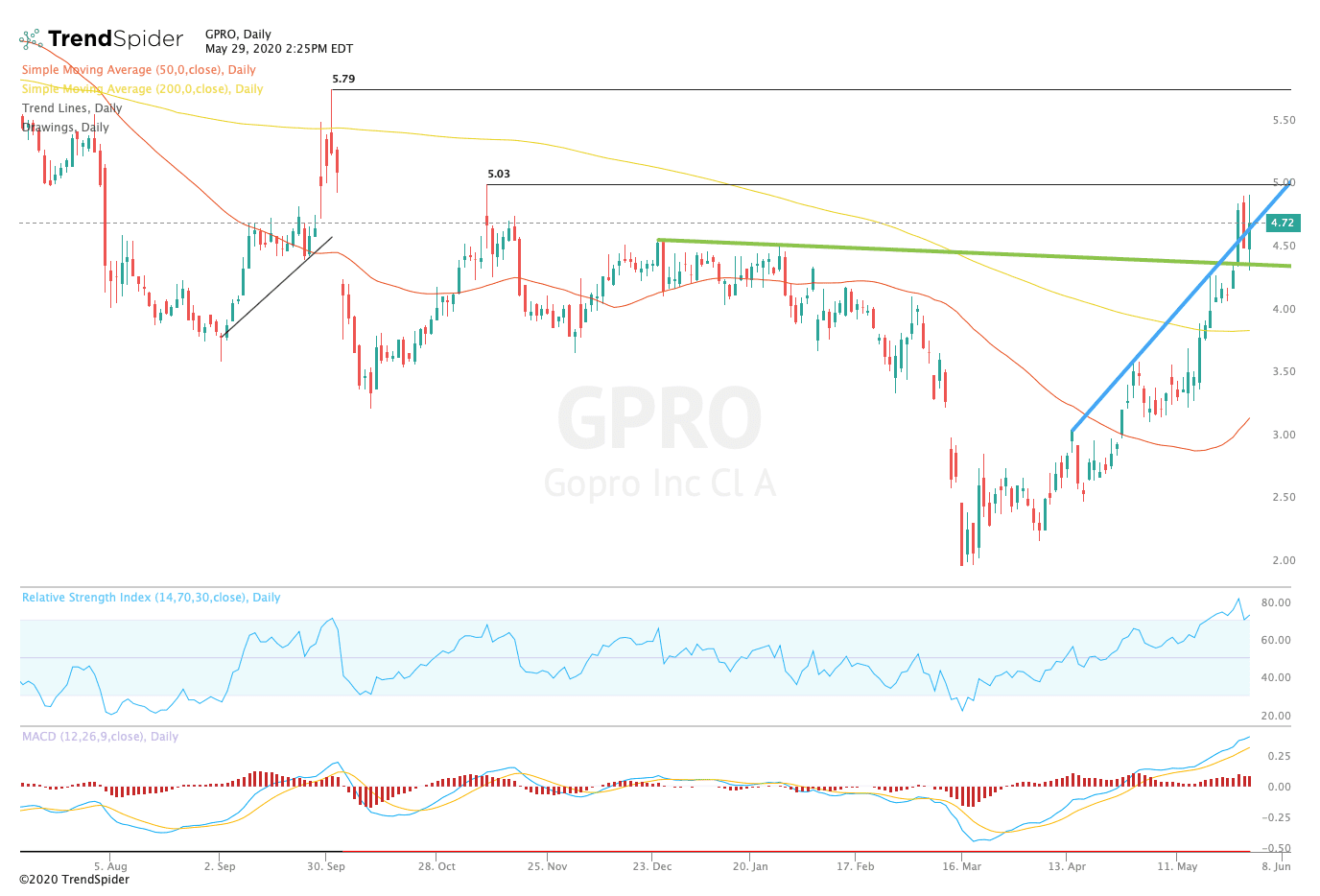

From a technical point of view, the stock moved up to test the reaction of the highlights during Thursday’s session. The relative strength index (RSI) is in overbought territory with a reading of 72.46, but the moving average convergence divergence remains in an uptrend. These indicators suggest that the stock could see a consolidation before a move higher.

Traders should watch for a period of consolidation above trend line support at $4.40 in the coming sessions. If the stock moves higher, traders should watch for a new test of the prior highs of around $5.00. If the stock moves lower, traders could see a movement lower towards the 200-day moving average near $3.87, while the general trend remains higher.

The author holds no position in the stock(s) mentioned except through the passive management of index funds.

Source: investopedia.com