Key takeaways

- Gap posted a surprise profit as turnaround efforts and lower costs improved margins.

- The retailer benefited from lower airfreight costs.

- Promotions have helped Gap reduce its inventory volume.

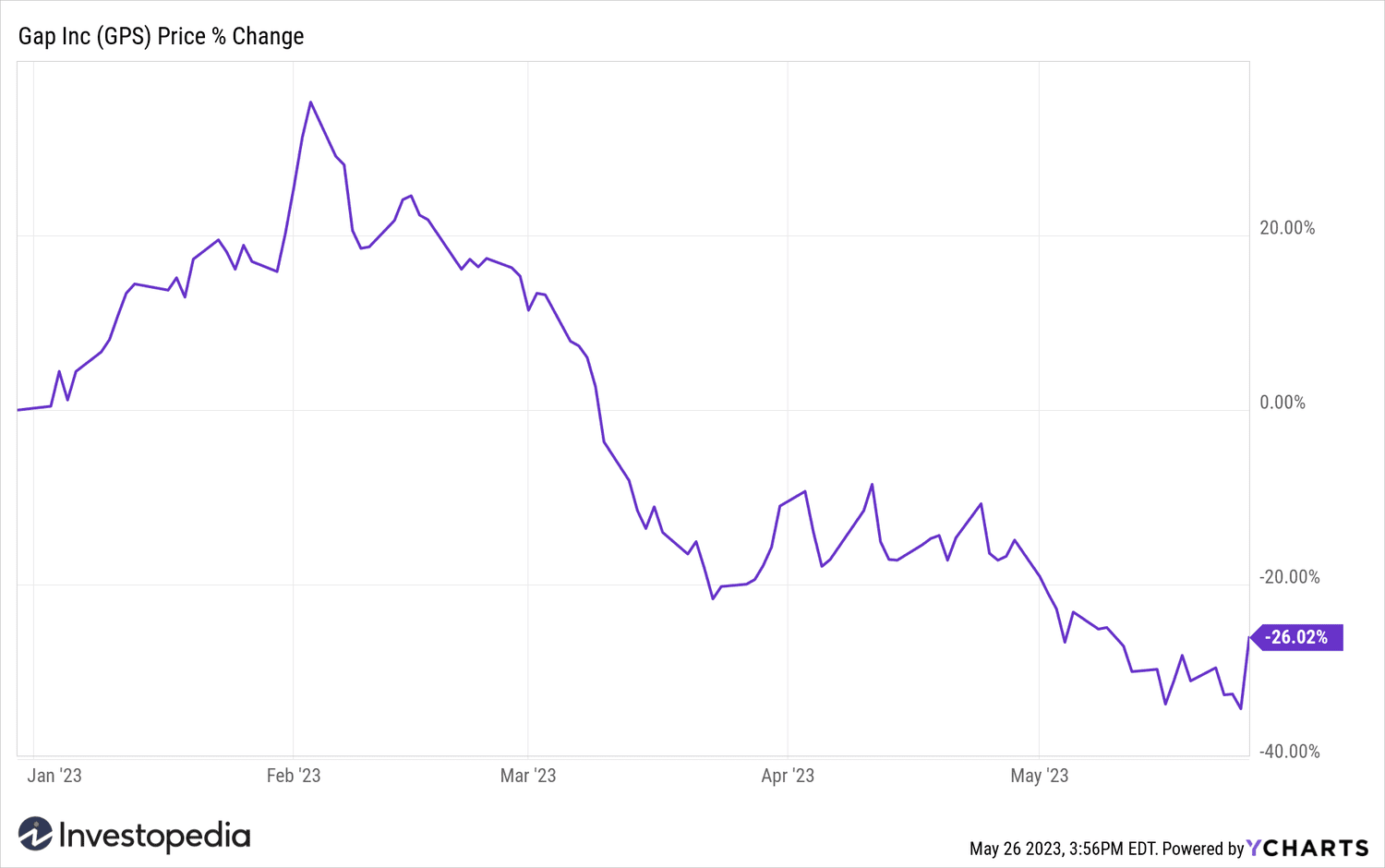

Spread Shares (GPS) jumped 12.5% on Friday as the clothing retailer posted an unexpected profit and said its margins improved due to its restructuring efforts and lower transportation costs.

The operator of Gap, Old Navy, Banana Republic and Athleta stores reported earnings of $0.01 per share in the first quarter of fiscal 2023. Analysts had expected a loss of $0.16. Revenue fell 5.8% to $3.28 billion, just below forecasts. Same store sales were down 3%.

CEO Bob Martin said the company continues to “take the necessary steps to drive critical change at Gap Inc., ultimately putting us back on the path to delivering consistent long-term results.”

He noted that Gap's adjusted operating margin jumped 610 basis points (bps) from a year ago, driven by “significantly improved gross margin” thanks to lower freight costs. airline and promotional activities, as well as sales, general and administrative (SG&A) discounts.

Added CFO Katrina O'Connell that Gap has reduced inventory volumes by 27% from 2022 and will have closed approximately 350 underperforming Gap and Banana Republic locations by the end of the year. #39;year. Additionally, she explained that the company plans to open fewer stores this year than expected.

Gap reaffirmed its annual performance net sales forecast of a decline in the low to mid-single digit percentage range.

Y-Graphs

Source: investopedia.com