Foot Locker (FL) shares fell more #39; a third of their value in early trading Wednesday after the sportswear retailer said sales had slumped as inflation-weary shoppers spent less on sportswear and footwear ;business.

Points to remember

- Foot Locker shares fell as much as 35% early Wednesday after reporting lower sales.

- Comparable store sales fell 9.4% as shoppers tired of inflation having reduced their spending on company clothing and footwear.

- The company recorded a net loss of $5 million, or about 5 cents per share. compared to a profit of $99 million in the same quarter last year.

The company reported a net loss of $5 million, or about 5 cents per share, compared with a profit of $99 million in the same quarter last year. On an adjusted basis, the company posted a profit of $4 million, down more than 96% from $105 million in the year-ago quarter. Sales of $1.86 billion were down nearly double digits from last year's $2.06 billion and underperformed estimates by $1.88 billion.

Same-store sales fell 9.4%, which the company attributed to “consumer weakness” and a shift in supplier mix as consumers cut spending amid inflation still elevated and broader economic uncertainty. Foot Locker said it used promotions and discounts to boost sales, which fell by double digits in the first quarter.

Mary, President and CEO of Foot Locker Dillon acknowledged a challenging consumer backdrop and said the company is “adjusting its outlook for 2023 to enable it to be more competitive for price-sensitive consumers.”

Foot Locker has lowered its full-year outlook for the second time in just five months. The company now expects sales to fall between 8% and 9% this year, more than a previous estimate of 6.5% to 8%. Same-store sales are expected to fall 9-10% from an earlier forecast of 7.5-9%.

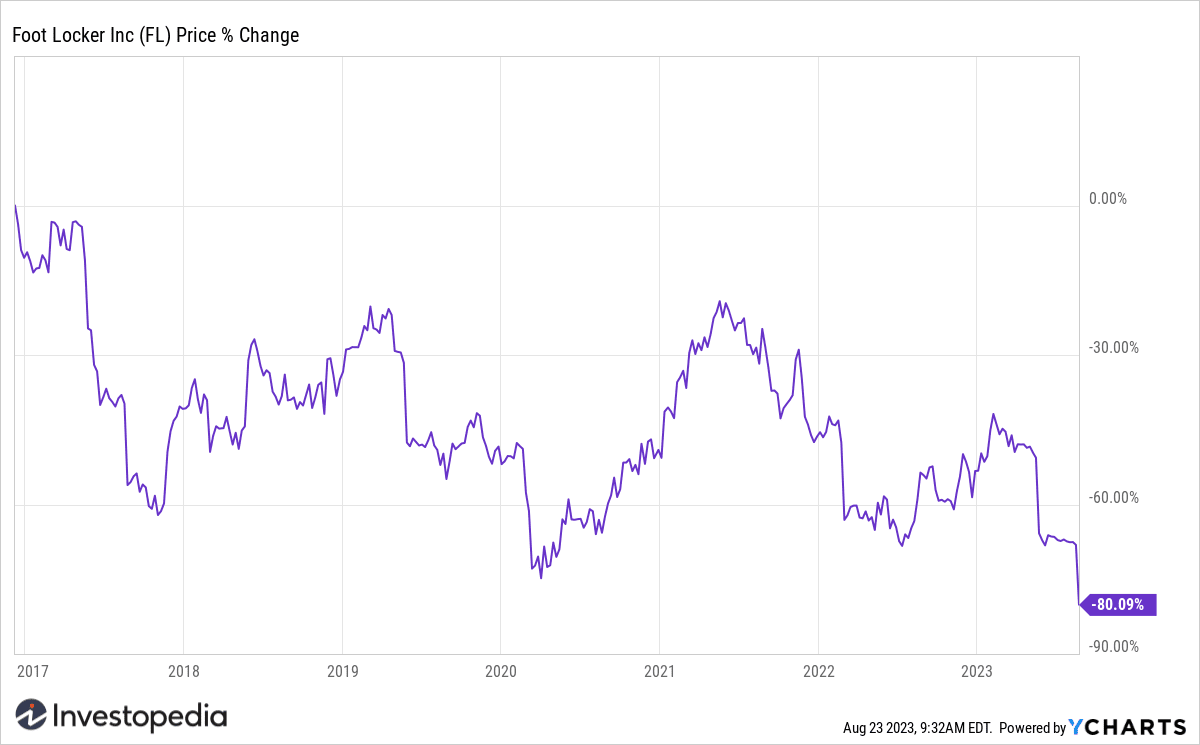

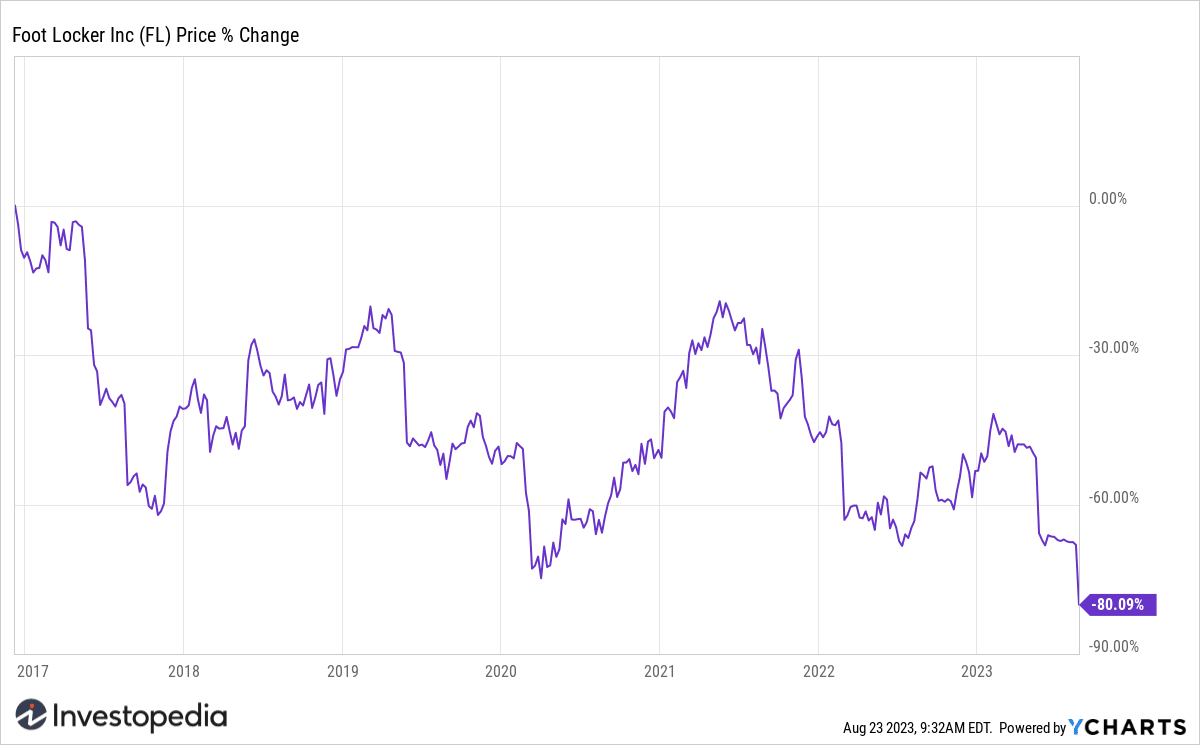

Foot Locker actions have have fallen 58% so far this year, and are down 80% from the all-time high of $80 per share in late 2016. They have significantly underperformed the benchmark S&P Consumer Discretionary sector 500, which is up 30% this year.

YCharts

Do you have any news tip for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com