Key takeaways

- Pied Locker missed its earnings and sales guidance and lowered its full-year guidance.

- Lower consumer tax refunds and theft had a negative impact. impact on results.

- Sales “diminished significantly”; since launching a new strategy in March.

Foot Locker (FL) shares tumbled on Friday after the shoe retailer reported earnings and revenue well below forecasts and cut its outlook.

The company recorded a profit of 0.70 $ per share in the first quarter, 14% lower than estimates. Sales fell 11.4% to $1.93 billion. Same-store sales fell 9.1%.

Foot Locker pointed to lower tax refunds, as well as changing supplier mix and the repositioning of its subsidiary Champs Sports for lower sales. Additionally, he said operating margins fell 400 basis points (bps) due to higher markdowns, lower store occupancy and theft.

Foot Locker CEO Mary Dillon said the retailer is making progress in building a solid foundation for growth beyond this year after launching its Lace Up strategy in March. However, she said that “sales have since declined significantly given the difficult macroeconomic backdrop.” She added that this has led the retailer to lower its guidance for 2023, “as we take on more aggressive markdowns to both drive demand and manage inventory.”

Foot Locker now expects full-annual sales drop from 6.5% to 8%, down from the previous decline of 3.5% to 5.5%. Same-store sales are expected to fall 7.5% to 9%, compared to the previous decline of 3.5% to 5%. Earnings per share (EPS) is expected to be between $2 and $2.25, down from $3.35 to $3.65 previously.

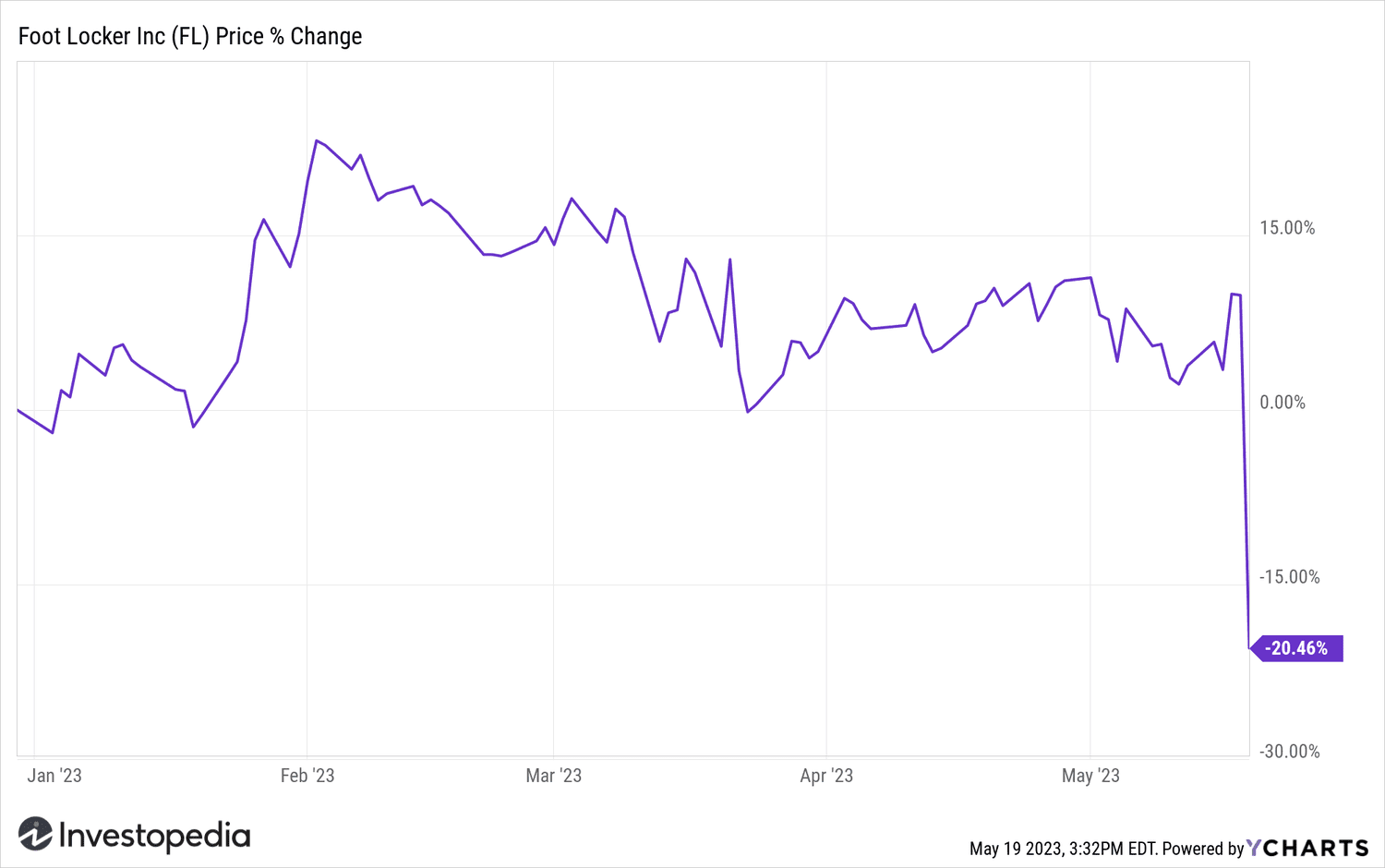

Foot Locker actions have fell a further 27% on Friday in the biggest daily decline since 2018. The losses sent shares of Foot Locker into negative territory for the year, with shares down about 20% since the start of the year.

Y-Graphs

Source: investopedia.com