First Solar (FSLR) shares jumped higher up 4% early Friday after the solar panel maker said it secured a five-year, $1 billion revolving credit facility.

Key Points to Remember

- First Solar secured a five-year, $1 billion revolving credit facility.

- CEO Mark Widmar said the deal will help with plans to business expansion.

- Shares of First Solar and other solar power providers rose in early trading Friday after the news.

The company said the facility includes up to $250 million available for issuance letters of credit.

CEO Mark Widmar said the deal will provide First Solar with “the financial headroom and flexibility we need, while balancing our ability to grow in response to demand for our technology.”

The company plans to commission a new 3.4 gigawatt (GWDC) manufacturing plant in India this year, will add a new 3.5 GWDC plant in Alabama next year and expand its existing facility in Ohio by 0.9 GWDC by 2026.

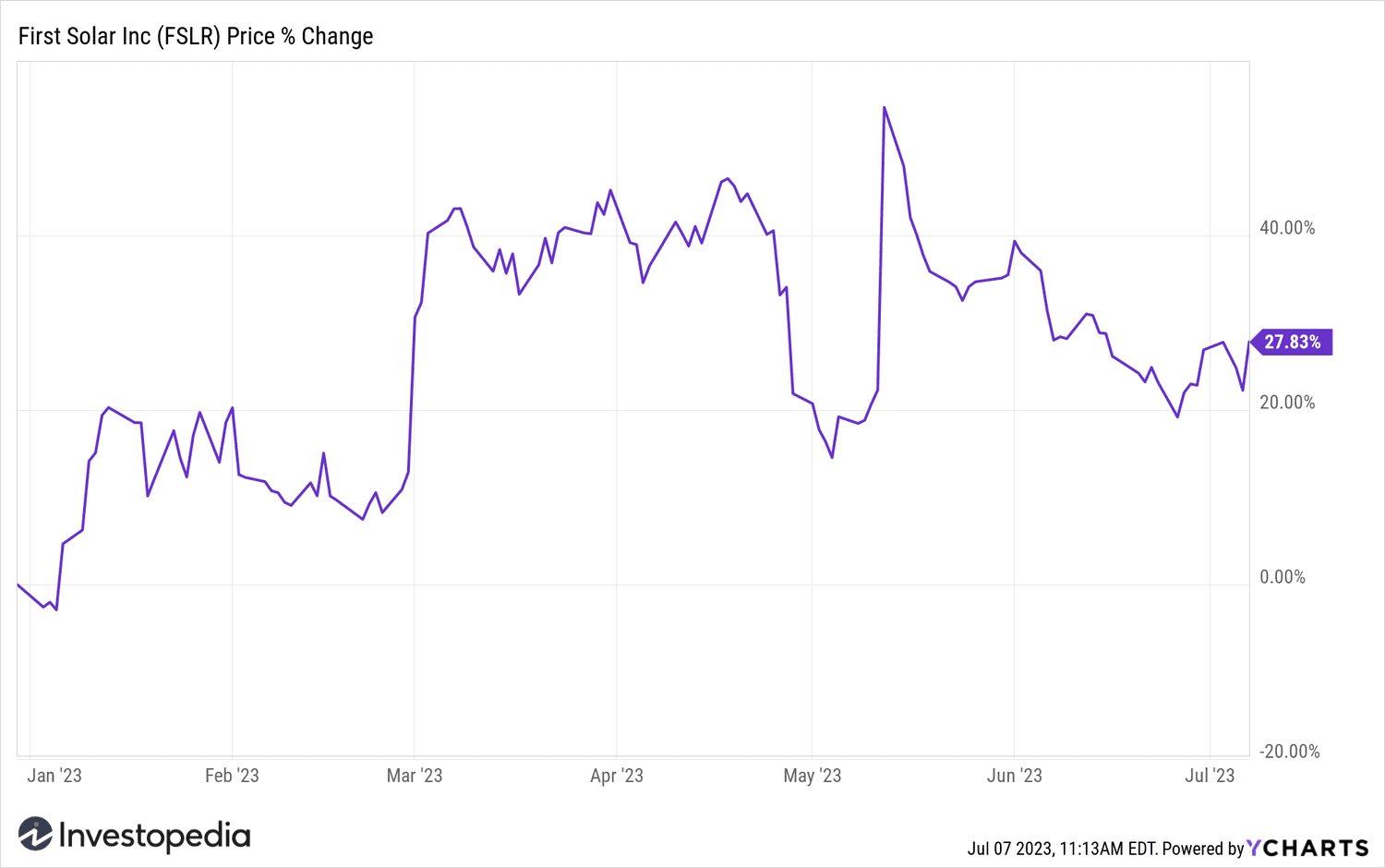

With Friday's gains, First Solar shares are up more than 27% year-to-date.

YCharts

Do you have any topical advice for Investopedia reporters? Please email us at tips@investopedia.com

Source: investopedia.com