More than a month after the first signs of danger, First The Republic Bank (FRC) was seized by the Federal Deposit Insurance Corporation (FDIC) and sold to JPMorgan Chase.

Key Points to Remember

- First Republic Bank was seized over the weekend and sold to JPMorgan Chase.

- Depositors will have full access to all their deposits as all 84 branches in eight states reopen as branches of JPMorgan Chase.

- The San Francisco-based company has been faltering since the collapse of Silicon Valley Bank and had already received billions in deposits from other institutions in hopes of stabilization.

Government officials intervened early Monday after efforts by bank executives failed to yield a deal. The FDIC then sold all of the bank's deposits and most of its assets. According to regulators, First Republic Bank's 84 branches in eight states will reopen as branches of JPMorgan Chase. Depositors will have full access to all their deposits on Monday, May 1, 2023.

The San Francisco-based bank has been at the center of the regional banking crisis since the collapse of Silicon Valley Bank in early March. The company was bailed out, with 11 of the largest US banks depositing a total of $30 billion in the business. Deposits fell more than 40% in the first quarter, even with money from other institutions.

D' other banks had been reluctant to enter into a deal because their bailout deposits were uninsured. The FDIC's involvement likely made them more willing to engage in talks.

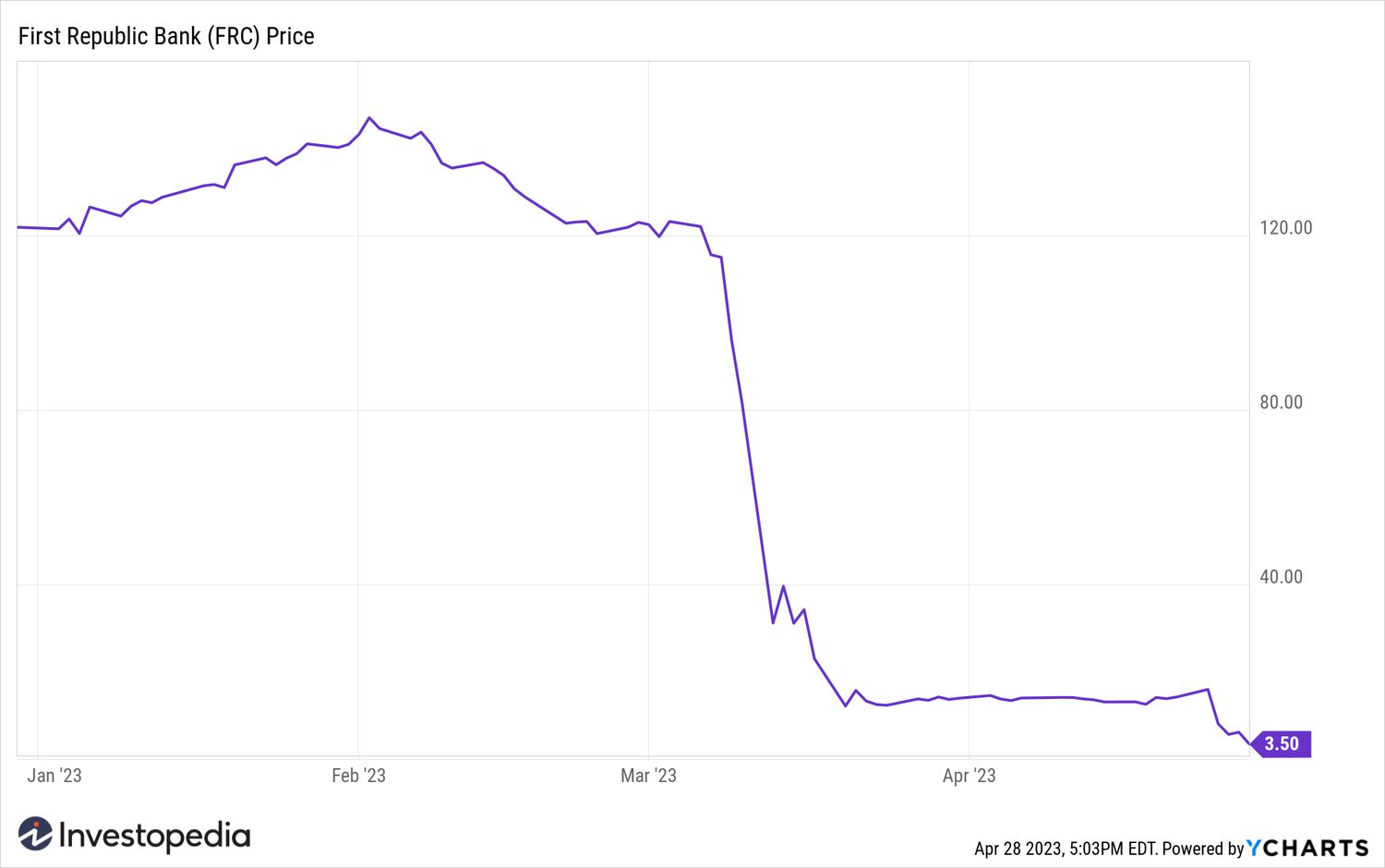

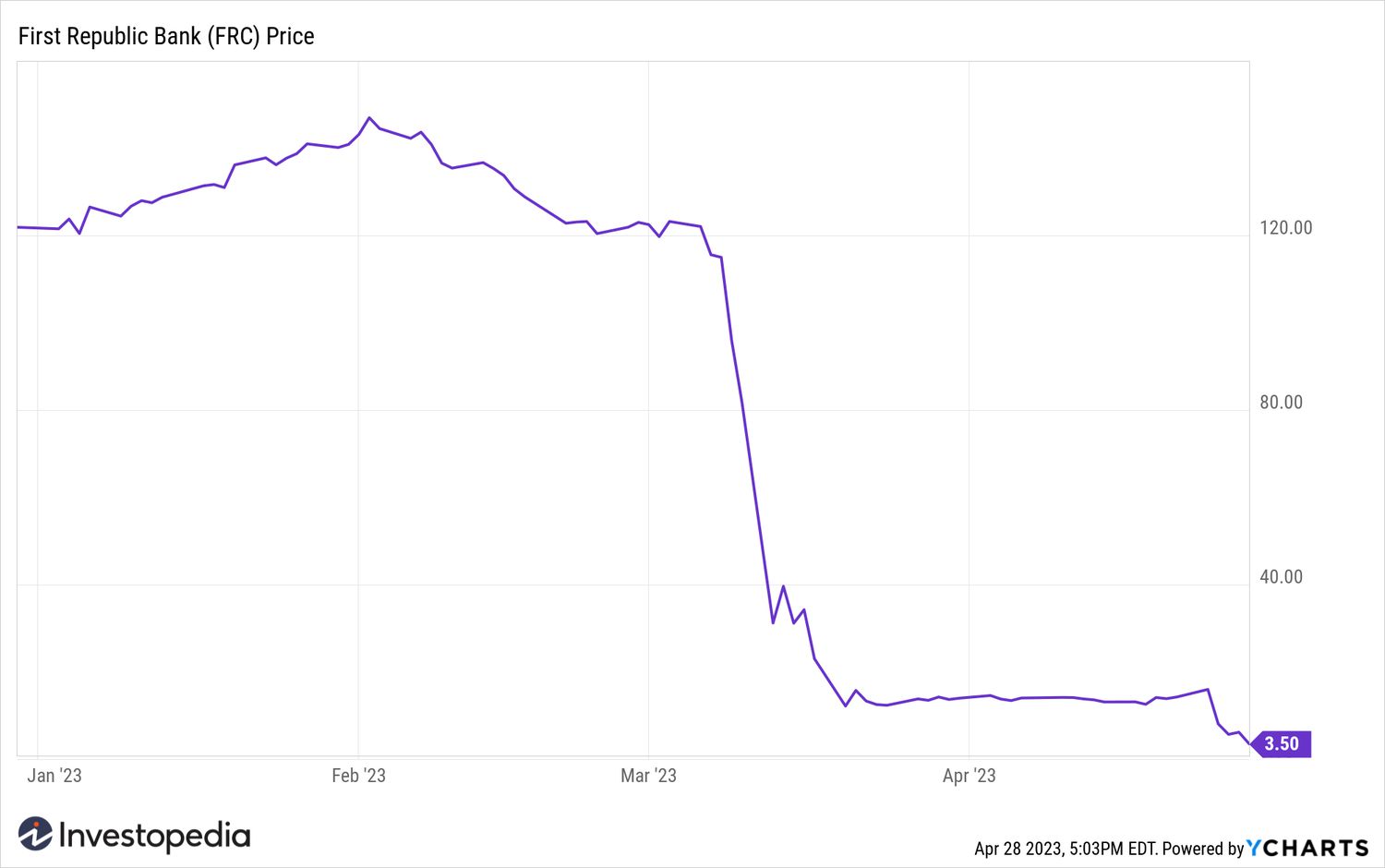

It had already been a tumultuous week for the company's stock price, which was down more than 75% at Friday's close. Trading had been halted several times during the day, as had been the case for a few days during the week. First Republic shares have lost about 98% of their value since the start of the year.

YCharts

Over the last month, short selling of First Republic shares rose 19.2%, with 9.26 million shares worth $53 million sold short, according to research by S3 Partners. Those who wanted to bet against the company were struggling to find shares to sell, Bloomberg reported.

Source: investopedia.com