Key Points

- FedEx sales fell as the pandemic boom in shipping demand slowed.

- The company will merge its Canadian Ground and Express networks beginning next April.

- CFO Mike Lenz will retire in July and an external search for a replacement is in progress.

FedEx (FDX) stock fell more than 1% in early trading on Wednesday after the shipping giant posted its third straight quarterly sales decline and gave lukewarm guidance as demand booms shipping during the pandemic was slowing down.

FedEx announced that fourth quarter revenue from fiscal 2023 were down 10.2% to $21.9 billion, below forecast. Earnings per share (EPS) fell 28% to $4.94, although that was better than expected.

The business has struggled as increased shipping demand during pandemic shutdowns has eased. In response, FedEx said it has begun a transformation process targeting savings of $4 billion over the next two years by merging its Ground and Express networks. He explained that as part of his transformation process, all FedEx Ground operations and staff in Canada will transition to Federal Express Canada starting next April.

CEO Raj Subramaniam said the “closing strong” in fiscal 2023 demonstrates the “significant progress” the company has made in advancing its plan, “while adapting to the dynamic demand environment.”

Even so, FedEx forecast fiscal year 2024 sales to be flat at low single digits. He expects EPS of $16.50 to $18.50, while analysts were looking for $18.30.

The company also announced that CFO Mike Lenz will retire next month and an external search for a replacement is underway.

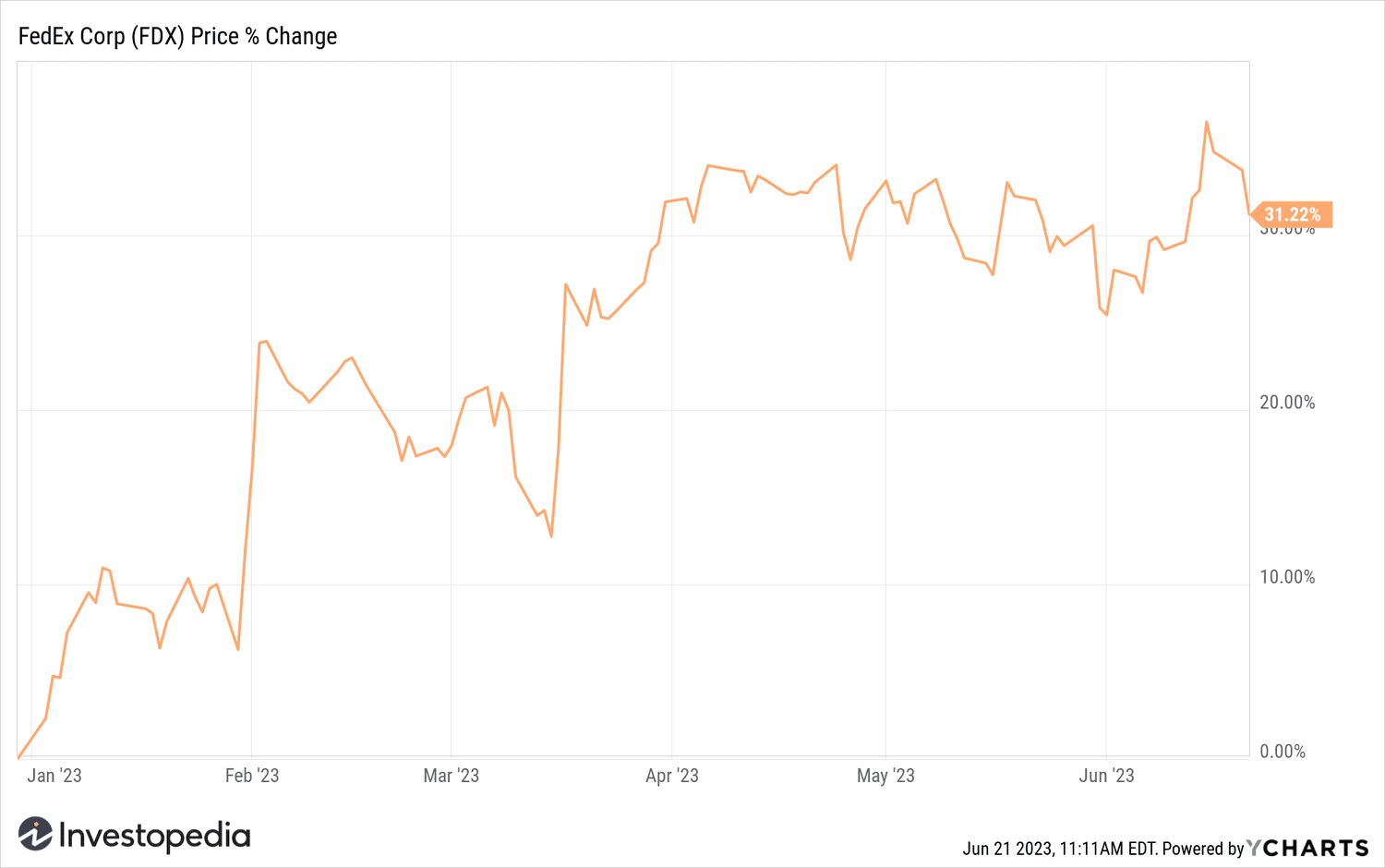

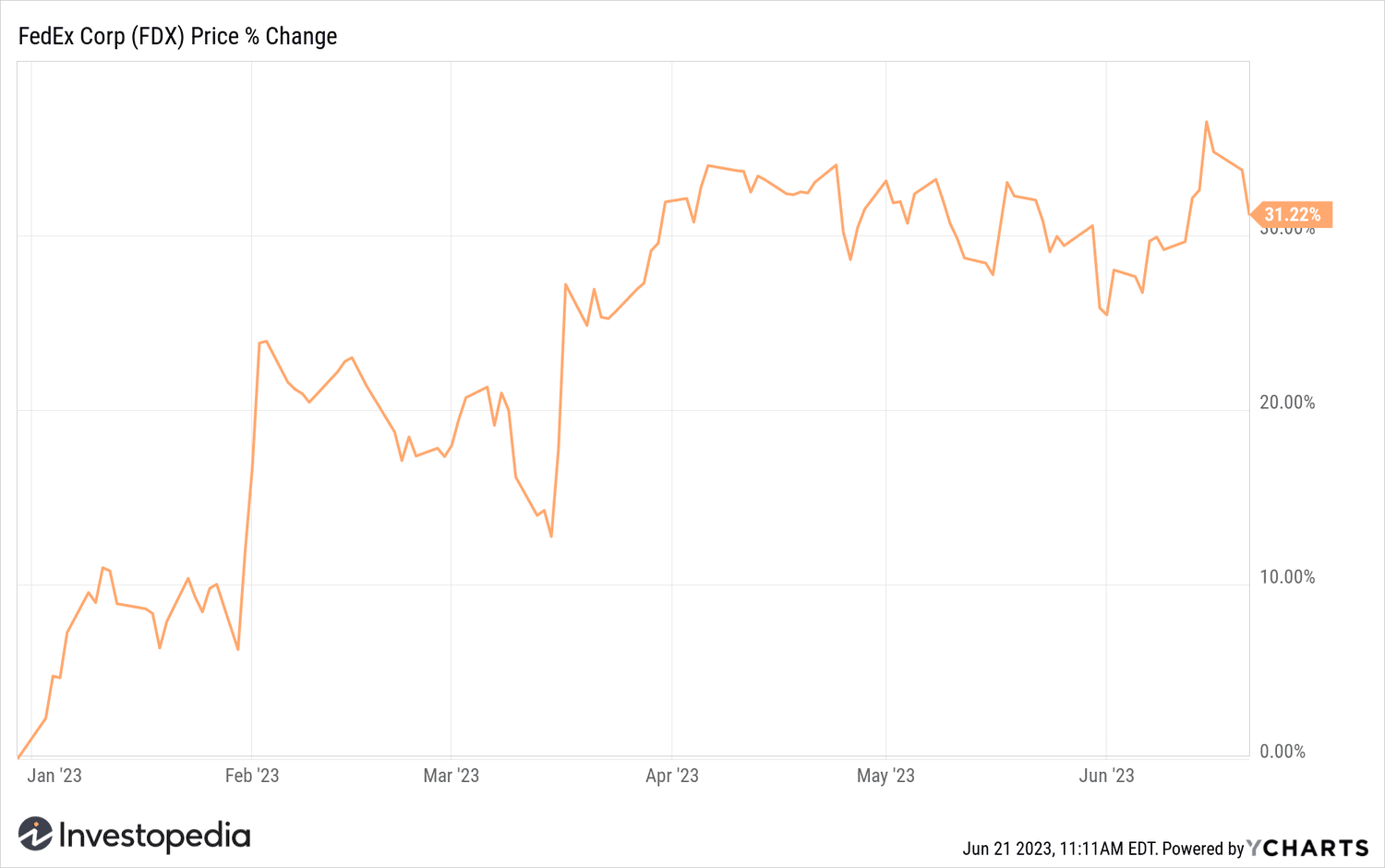

Despite Wednesday morning' s decline, FedEx shares were still up more than 30% year-to-date.

YCharts

Do you have any news tip for news reporters? #39;Investopedia? Please email us at tips@investopedia.com

Source: investopedia.com