- Companies are issuing record debt amid low rates

- The Federal Reserve is buying corporate bonds to help stabilize markets

- Apple, Ford, and Boeing are among the biggest emitters

Days after Apple Inc. (AAPL) said it could not provide guidance for the next quarter, the company has raised $8.5 billion thanks to good market obligations with maturities ranging from three years to 30 years. He will use this money to fund share repurchases and for other general corporate purposes.

Apple is just one of many U.S. investment-grade, companies issuing bonds during the pandemic to take advantage of cheap borrowing costs. Starbucks (SBUX) and the $ 3 billion proposed new unsecured notes prompted the rating agency Fitch to downgrade to “BBB” from “BBB+” yesterday. Bank of America Global Research account $807.1 billion in new bonds so far this year as of last Friday. A dozen investment-grade, publicly traded companies offers yesterday, according to Bloomberg.

It seems to be extremely robust demand for bonds, even for struggling companies. Companies in the air transport industry sold $ 32 billion last week, including Boeing (BA) to a record $ 25 billion deal, which has allowed them to avoid giving in to the federal government of its request. Ford (F) sold junk bonds with a value of $ 8 billion last month despite the loss of its investment-grade status weeks earlier. The cruise line operator Carnival (CCL), would have seen the orders of the swelling to such an extent, it has increased its offering size to $ 4 billion from $3 billion in April. Also, yesterday, company of Avis car rental (CAR) said it plans to offer $ 400 million of senior secured notes.

You can thank the Fed for the bond bonanza, and his promise to buy corporate bonds, and corporate bonds Etf to support the economy. This includes some companies which have seen their debt recently downgraded to “junk” status, aka “fallen angels.” Fitch estimates the debt of a value of $101 billion, has poured into speculative grade territory in the first quarter.

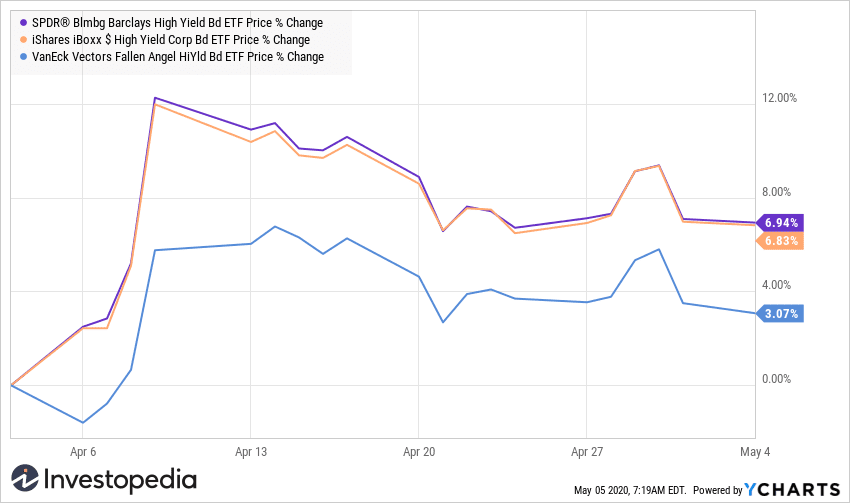

Courtesy YCharts.

A step like this by the central bank is unprecedented, and has been the target of criticism. It has been a blessing for the junk bond Etf well. The Fed has expanded its program to include the junk bonds, on the 9th of April. The SPDR Bloomberg, Barclays High Yield Bond ETF (JNK) saw the second largest weekly net inflows during the week ended April 15, according to Refinitiv Lipper. the iShares iBoxx $ High Yield Corporate Bond (HYG) had its fourth best of the week for collection. The high yield bond ETF universe also gained support at the end of March, when the $ 2.2 trillion of stimulus billed was passed,” said Pat Keon, senior research analyst at Refinitiv Lipper, The Wall Street Journal. The VanEck Vectors Fallen Angel High Yield Bond ETF (ENGL) has climbed nearly 20% since the 23rd of March.

Source: investopedia.com