Takeaways

- Fastenal shares jumped after the maker of fasteners and other construction and hardware equipment beat profit forecasts.

- The company attributed the strong sales results at its sites to site, particularly those activated and implemented in 2022 and 2023.

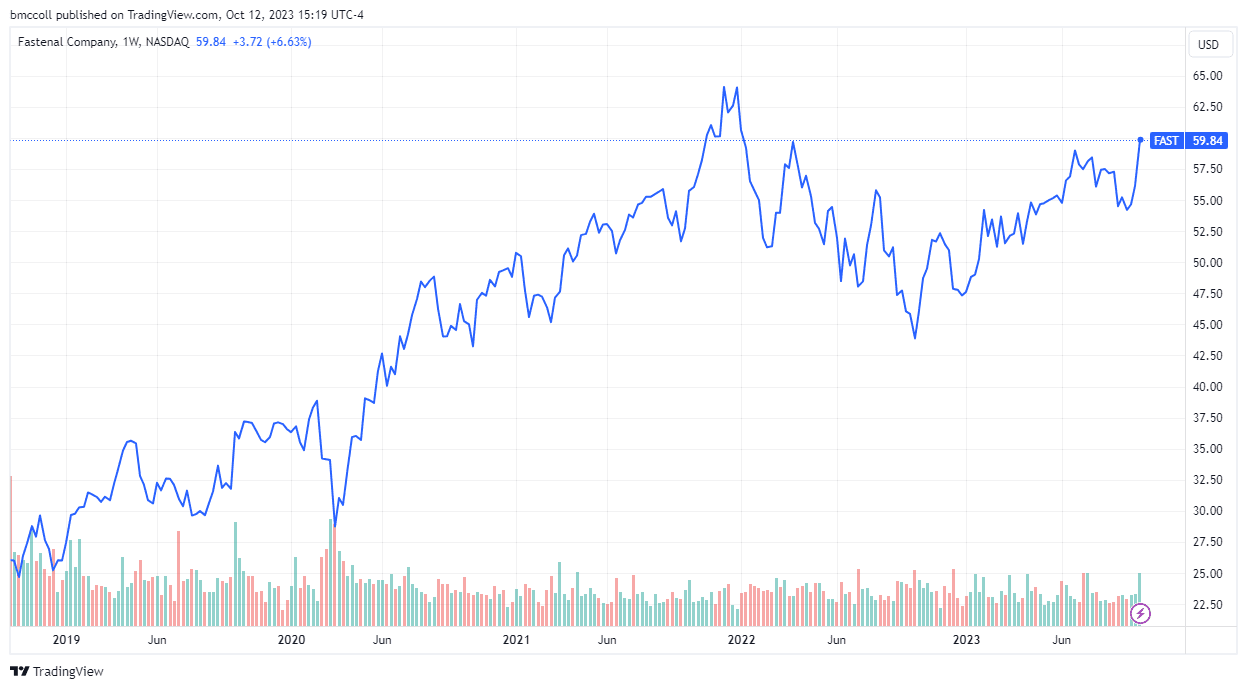

- The news propelled Fastenal shares to their highest level in 21 months.

Fastenal (FAST) was the best-performing stock in the S&P 500 on Thursday, as shares jumped more than 7% after the construction equipment and hardware maker beat profit estimates on the back of sales. #39;higher units on its sites.

Fastenal reported its third quarter of fiscal 2023 earnings per share (EPS) of $0.52, beating forecasts. Revenue rose 2.4% to $1.85 billion, in line with expectations.

The company reported that on-premises sales grew by a double-digit percentage, primarily from those enabled and implemented last year and this year. Fastenal also noted that the impact of rising prices for its products was “slightly positive” on revenue.

CEO Daniel Florness said Despite economic conditions remaining difficult, September was the first month in the company's history to generate $30 million in daily sales. Florness added that Fastenal benefited from lower transportation costs.

The news sent shares of Fastenal at their highest level since January 2022.

TradingView.

TradingView.

Source: investopedia.com